View this edition in our enhanced digital edition format with supporting visual insight and information.

Thank you to this week’s contributor, Gibb Dyer, for sharing insights he’s acquired during his thirty-five years as a family business consultant. We hope you enjoy this week’s FFI Practitioner in which the authors identifies five factors that assist family enterprises to grow and transfer their family capital to the next generation.

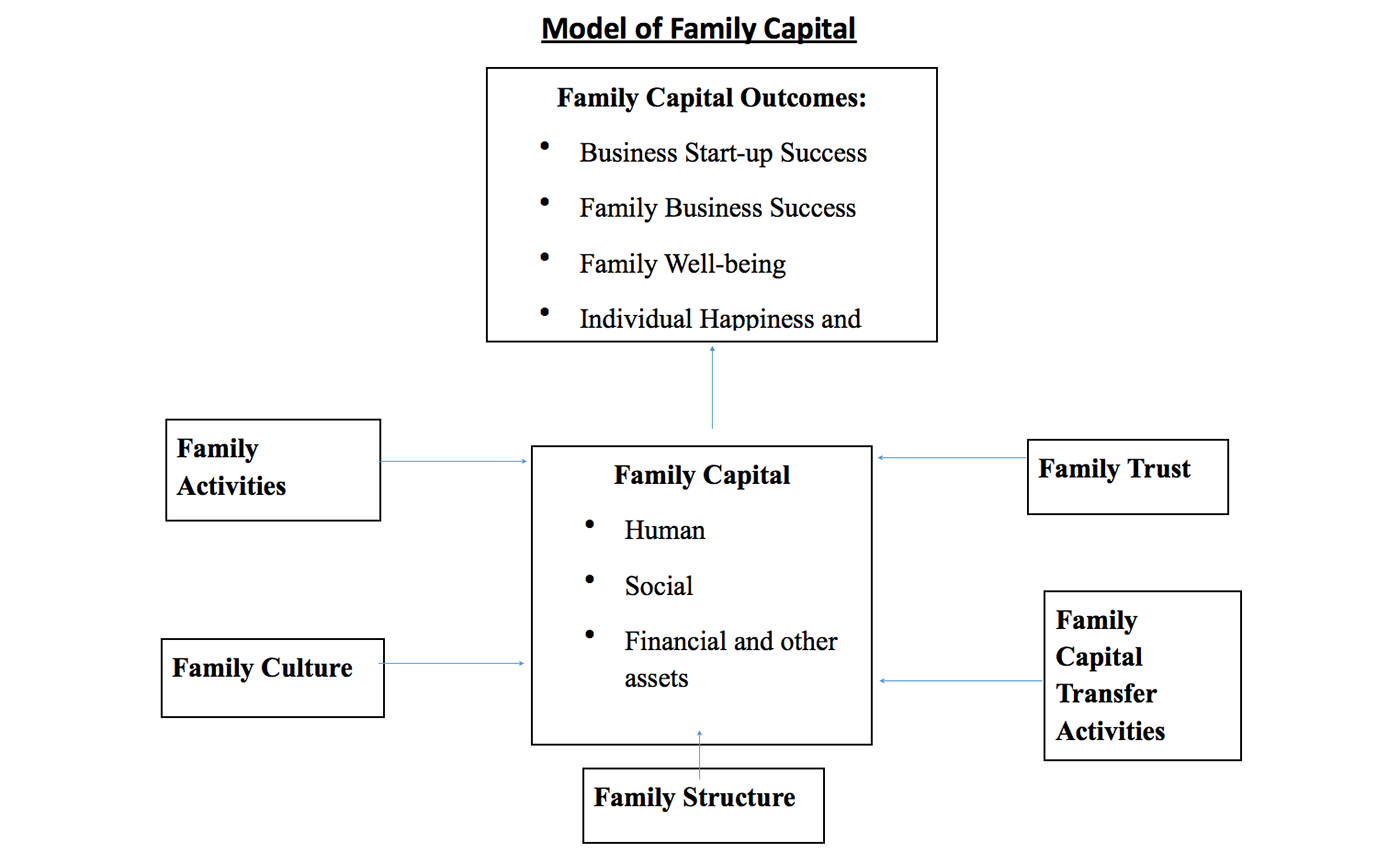

As someone who has consulted with families and family businesses for the past 35 years and believes that families play a significant role in our happiness and in the economic success of society, I have come to one inescapable conclusion: we’re in trouble! For the past several decades we have experienced a precipitous decline in what I call “family capital”—the human, social, and financial resources provided by families to help family members lead happy and productive lives. This decline also has dire economic consequences, since family capital is positively correlated with: 1) business start-up success and 2) family business success. Today, fewer families are being formed and the ones that are being created are less stable and smaller than in the past—all leading to a dearth of family capital. This has led to what I call a “family capital crisis.” In my role as a family business consultant, I have come to realize that my primary role is to help a family create, preserve, and transfer family capital to the next generation.

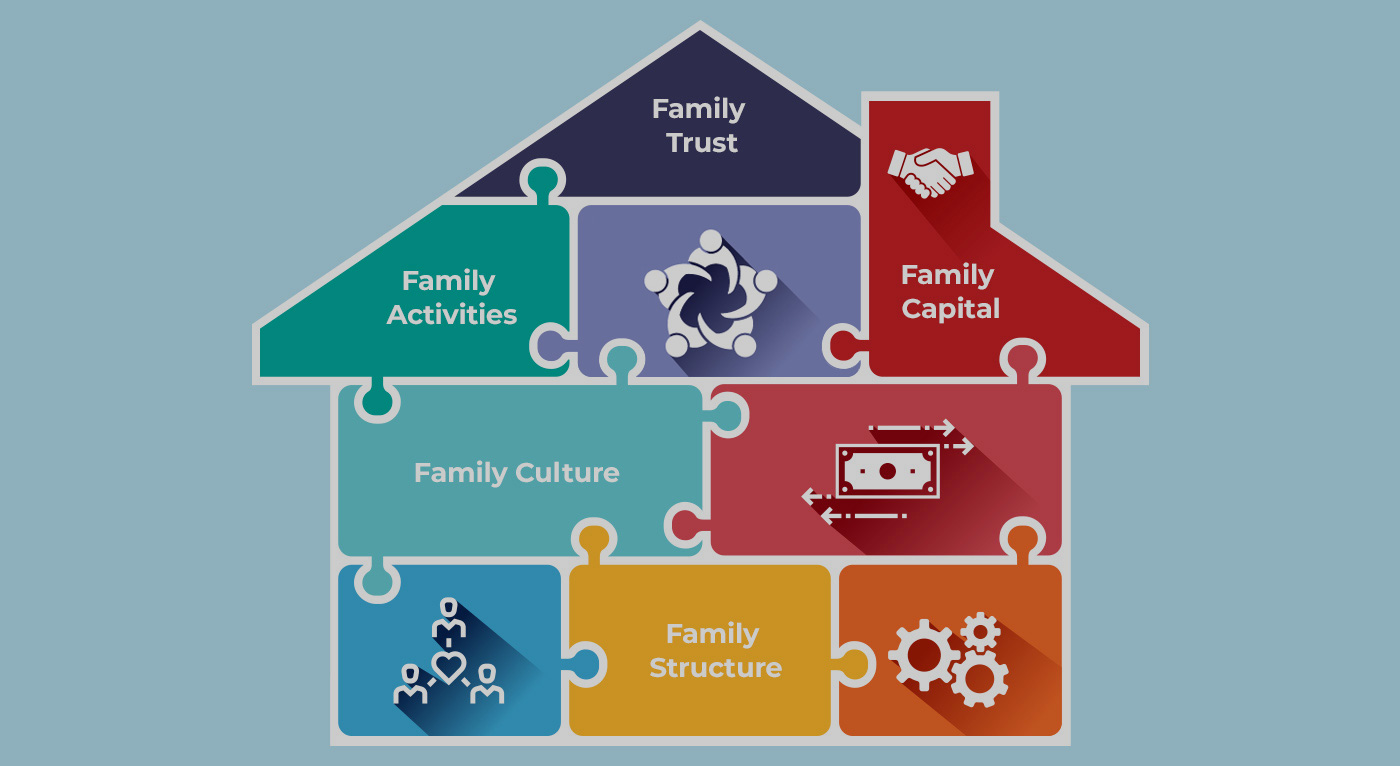

Over my consulting career, I have identified five factors that influence family capital: 1) Family Structure, 2) Family Culture, 3) Family Activities, 4) Family Trust, and 5) Family Capital Transfer Activities, and I have encouraged my clients to enhance each of these factors to strengthen their family businesses (See Figure 1).

Figure 1

I have found that certain family structures, cultures, activities, and processes lead to “resource-rich families” which lead to business and family success.

Family Structure

There is a variety of family structures today: blended, nuclear, cohabiting, single-parent, etc. Regardless of family structure, to create family capital it’s important that family relations be: 1) stable; and 2) part of a large family network. To encourage family stability, I often ask my clients to work with a family counselor to strengthen their marriage or their relationship with their significant other and to identify family members in their extended family who they might get to know better and build stronger relationships. Family capital is shared as family members create norms of reciprocity with one another. To encourage that, relationships need to be enduring and exist with as large a family network as possible.

Family Culture

Family culture consists of the shared assumptions within the family regarding each other, their relationships, the environment, about how to gain knowledge, and about time. Along these dimensions I have found that healthy families assume that other family members can be trusted, and that over time, as children mature, that relationships are assumed to be more equal in nature rather than keeping the children in a dependent position. In healthy families, family members are also assumed to be “assets” to be developed, and hence are given significant opportunities to develop their skills and talents, and also assume their situation can be changed, so they are proactive in doing so and also see themselves looking to the future to improve their lot.

In contrast, family cultures based on distrust have relationships that foster undue dependency or conflict, see family members as individuals to be exploited rather than nurtured, only allow senior family members to make decisions, and see themselves as victims of their environment and only looking to meet immediate needs, tend to function poorly, and when operating a family business they have a difficult time managing the succession process.

Family cultures are not easy to change. They often do so only after key family leaders pass away or the family, after recognizing the dysfunctional aspects of the culture, are willing to work with a skilled therapist who can help them articulate their cultural problems and help them develop a new set of assumptions that will serve as the foundation of the family’s culture.

Family Activities

Family capital can also be enhanced through certain family activities. These include:

- Building a family identity through a family mission or values statement.

- Family rituals and traditions.

- Commitment of time and energy to the family.

- Having the ability to cope with family crises (illness, death, etc.)

- Having a sense of “spiritual wellness”—having family goals of service to others.

Family Trust

While trust is a key element of family culture, it requires special attention to help build family capital. Without trust, family members will be less willing to help one another. Family trust is created as family members have the ability to: 1) build interpersonal trust by identifying the sources of mistrust in a family relationship, take steps to repair the relationship and are willing to extend forgiveness; 2) create competence trust by ensuring that family members develop the skills and abilities needed to be seen as competent members of the family; and 3) build institutional trust in the family by being open with one another and sharing with the family needed information, such as the family’s succession plan.

Family Capital Transfer Activities

The final set of activities that are important to preserving family capital is family capital transfer activities. These include: 1) creating a genogram of the family for at least three generations; 2) creating a “family capital genogram” that identifies family capital within the family; 3) developing stronger relationships within the family structure; and 4) identifying what needs to be done to transfer human, social, and financial capital (or other assets) to members within the family network to strengthen and support them. A “learning by doing” approach is generally the best, where family elders mentor the younger generation to develop the family capital they will need to succeed in the future.

Conclusion

This brief summary presents my approach to help families build family capital. I hope that my ideas, based on years of research and practical experience, will be useful to those new to the field as well as to experienced practitioners.

About the Contributors

Gibb Dyer is the O. Leslie Stone Professor in the Marriott School of Business at Brigham Young University. He is an award-winning author of over 50 articles and 9 books. He has been ranked as one of the top ten researchers in the world in the field of family business.

View this edition in our enhanced digital edition format with supporting visual insight and information.