View this edition in our enhanced digital edition format with supporting visual insight and information.

What better way to start a new year than to look at some classic models in the family enterprise field and offer forward facing ideas. Thanks to FFI Fellow Paul Karofsky of Transition Consulting Group for refining some of his early work on a multi-roles model and providing examples from his client base for consideration by the readers of FFI Practitioner.

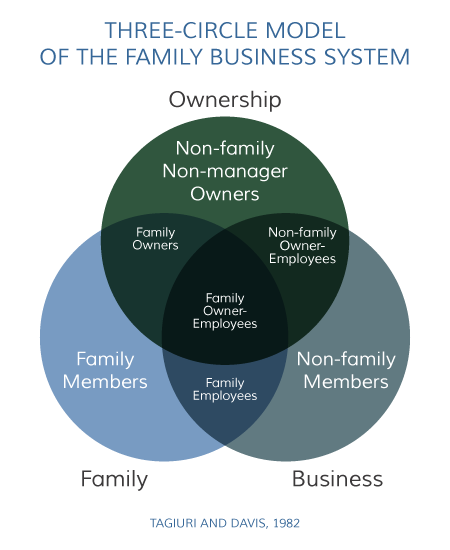

Since the 1980s, the Taguiri-Davis Three-Circle Model has been the hallmark graphic of family enterprise. In its exquisite simplicity, it allows for an understanding of the differing roles and interrelationships of family members, owners and those who work in the business.

But what about the system of governance?

Three brief case studies

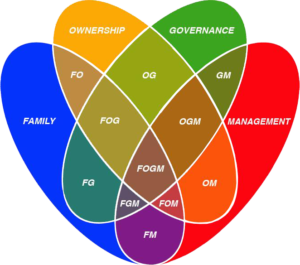

Early in my consulting career, I worked with a family enterprise with a board member who was an early investor in the business. He was neither a family member nor an employee and repeatedly brought up the question of selling the business. His interests were in significant conflict with family member-owner- directors whose focus was on reinvestment and the sustainability of the business. In the Multi-Roles Model© below, he is a member of the sub-system, “OG.”

In another client engagement, I worked with a woman who was the owners’ daughter. Her husband, a recent board member, was a brilliant man whose skill set was a nearly identical match to the critical success factors of the business. In board meetings, when the topic of succession arose, he was asked to leave the room as other board members believed he had a conflict of interest since his wife was a potential future CEO. He was further conflicted because he resented the fact that his father-in-law, who controlled the enterprise, believed stock should only be passed down to direct descendants. He is a member of the sub-system “FB” in the Multi-Roles Model©.

And in another example, I worked with a family enterprise where the board chair was a family member-owner who did not work in the business. His role became complicated by a plea from a sibling who worked in the business and sought a role in management and seat on the board. In the Multi-Roles Model©, he is a member of the sub-system, “FOG.”

In each of these examples, the system of governance plays a significant role as it interacts with those of family, ownership and management. Yet, there appears to be no way to express this using the traditional model.

The research and writings of John Ward, Craig Aronoff, Randel Carlock and Dennis Jaffe, among others, have given increased attention to governance matters. There are thousands of articles, research projects and books on governance to be found on the internet. These writings, plus the preponderance of independent directors on business family boards, suggests that a model which adds governance as a fourth system, might help us understand the differing perspectives of the resulting 15 (vs. 7) sub-systems. Though lacking in simplicity with sub-systems differing in shape and disproportionate in size, the Multi-Roles Model© is an attempt to do that.

This model was presented a few years ago in the curriculum for the precursor to the GEN 503 course on tools (now called “Tools for Positive Change in Family Business Systems: Analysis and application”) and has been refined over the years into its present form, but the concept remains unchanged. I offer the Multi-Roles Model© in this venue to stimulate discussion on how the distinct system of “governance” in a family enterprise can best be incorporated into a model to help practitioners and their clients appreciate and dissect the complexity of the family business system where governance plays such a significant role.

The Multi-Roles Model©

Roles of Family, Ownership,

Governance and Management

Fifteen Differing Perspectives in the Multi-Roles Model©

1. Family (F) = family members who have no role in ownership, governance or management. Examples include spouses, in-laws, young children, and adult family members who may have grown up in a business family and/or feel a sense of attachment to a business owned by their spouses, siblings, parents or children. Typical interests and concerns: family first, history, culture, values, fairness, equality, inclusion. Positioning often includes “fighting for the spouse who works in the business” or desire for future career opportunities for themselves or their children. Others may feel disengaged or resentful of family business conversation at family gatherings.

2. Ownership (O) = owners who are not family members, not involved in governance and not managers in the company. Examples may include shareholders in publicly held family businesses or silent partners, limited partners, or other investors. Typical interests and concerns include “strictly” business performance: rising stock price, profitability and dividends; often focused on short-term results; typically want a professionally managed business free from interference by family issues and battles for control. For non-management level employee owners, such as members of ESOPS, a common concern is job preservation, growth, compensation, and distributions.

3. Governance (G) = people who have a governance role and are neither family members, owners nor managers. These “outside” directors are ideally “neutral and objective watch dogs” though often allied with one or more family member shareholders. Often referred to as “independent directors,” their typical interests and concerns are: fiduciary responsibilities, the “big” picture, representing the shareholders as a group, increasing shareholder value, performance of key executives, strategy, sustainability, meeting potentially diverse shareholder needs, not at the expense of the business, plus succession planning. Can often become embroiled in family conflict and challenged to maintain neutrality.

4. Management (M) = management level employees who are not family members, have no ownership stake and do not have a role in governance. Typical interests and concerns: day-to-day operations, short-term issues, preserving/enhancing their own position in the organization (i.e., job security and career tracking), and autonomy. At the c-level, typical concerns are around strategy and sustainability, meeting the expectations of the board and often competing needs of family member owners. Note: in the Three Circle Model and other models, the word “management” as used here is often referred to as “business” or “employees.”

5. FO = family members who are owners, but are neither managers nor have a role in governance. Examples often include children who have been gifted or inherited shares or non-management level family member-owners. Typical interests and concerns: cash distributions, fairness of employed family members’ compensation and perks, liquidity, employment for self, community perceptions. Some have a keen sense of stewardship and wish to preserve the business for the next generation. Others are self-focused, asking “How can I benefit from this business?” Some are ambivalent about ownership and desirous of exit options. They are frequently in conflict with FOMs, FOGs, and FOMGS.

6. FG = family members who have a role in governance, but are neither owners nor managers. Examples may include retired members of the senior generation who have transitioned ownership and leadership to the next generation. Typical interests and concerns: how business “was,” what they could or couldn’t do, how next generation will “measure up,” possibly their having “let go” too soon. Others are cultural icons and still retain significant informal control and play a major role perpetuating values and guiding the next generation of leaders. Some FGs are spouses of FOGMs to ensure board control. Others may be in-laws with skill sets matched to the needs of the business.

7. FM = family members who are managers in the business, but have neither an ownership stake nor a role in governance. Examples include parents, siblings or cousins of FOGMs or children do not desire or who have not yet been granted an ownership stake. Typical concerns and interests: their own role and responsibility, their future security, fairness, and for some, acquiring an ownership stake and/or a seat on the board. They are often in conflict with FOMs and FOGMs.

8. OG = non-family owners who have a governance role, but are not involved in management. Examples may include individual investors with seats on the board or representatives of venture capital firms. They are often focused on more immediate returns, distributions and a 3-5-year exit/M&A strategy for the business. Their goals may conflict with Fs, FOs, FOMs and FOGMs.

9. OM = non-family member managers who are owners with no governance role. Examples include key non-family employees who have been granted stock in companies where the family typically retains the governance role or where there are many such employees in an equity position, such as in an ESOP. Many are in a publicly owned family business. Interests include job security, dividends and stock growth, and an exit strategy as well as an opportunity for their children.

10. GM = non-family member managers who have a role in governance yet have no ownership stake. Examples often include professional c-level key non-family executives like the Chief Financial Officer or non-family President or CEO. Roles often include mentoring the younger generation and helping to address family differences. They often wish to be OGMs.

11. FOG = family member owners who have a governance role but are not in management. Examples often include retired FOGMs. Others may be family board members with a different career who have a significant ownership stake. Some who are focused on stewardship and long-term wealth creation may conflict with others who are more focused on immediate or short-term rewards. Some need to balance the expectations and needs of FOs and the role of Gs.

12. FOM = family member owners who are managers but are not involved in governance. Examples are common in third generation or older family businesses or in situations where many family members are owner-managers. Role is often accompanied by frustration about not having a governance role.

13. FGM = non-owner family member managers who are involved in governance. Perhaps the least common of the sub-sets, examples may include seniors who have divested their equity. Others may include cousin, spouse or in-law managers with unique skill sets. In some instances, they are family managers with token governance roles. Some are desirous of ownership.

14. OGM = non-family member managers with an ownership stake and a role in governance. Examples often include c-level and other non-family managers who are co-founders or have been granted or purchased an equity position. Their role is often to help keep family members under control and family issues out of the boardroom. They may also be interested in an exit strategy for themselves and an entry opportunity for their children.

15. FOGM = family member owners who are managers and involved in governance. Examples include, the founder, and other c-level family member leaders and next-gen emerging leaders in the enterprise. Their interests are typically the totality of the family and the enterprise.

With special thanks to John Davis, Jane Hilburt-Davis and Judy Green for their constructive feedback.

About the contributor:

Paul Karofsky was awarded FFI’s Certificate in Family Business Advising with Fellow Status in 2001. A recipient of the Barbara Hollander Award, Paul helped launch Northeastern University’s Center for Family Business in 1991 and founded Transition Consulting Group. He co-authored, with his son, David, So You’re in the Family Business… A guide to Sustainability.

Paul Karofsky was awarded FFI’s Certificate in Family Business Advising with Fellow Status in 2001. A recipient of the Barbara Hollander Award, Paul helped launch Northeastern University’s Center for Family Business in 1991 and founded Transition Consulting Group. He co-authored, with his son, David, So You’re in the Family Business… A guide to Sustainability.

About Transition Consulting Group

The mission of Transition Consulting Group is to help family members in business together enjoy Thanksgiving dinner with one another. Through a variety of engaging methods, TCG helps clients work through family issues which affect the business – and business issues which affect the family. With the goal of building better alignment, communication and relationships among all stakeholders, TCG’s flexible consulting process addresses the specific, unique challenges and opportunities of each family business.

View this edition in our enhanced digital edition format with supporting visual insight and information.