Succession

Decisions on how to sell, continue or diversify a company from one generation to another are complex; these varied articles approach the topic in multiple ways.

FFI Practitioner Articles We Love: Donald Neubaum of Family Business Review

This week we are pleased to continue our series of guest-curated FFI Practitioner articles with Donald Neubaum, editor of Family Business Review.

Family Business Leadership 360 Assessments: Case studies on the art of experience and the science of data-driven decision making

Thanks to Doug Gray and FFI Fellow Natalie McVeigh for providing two case studies about how they utilize 360 assessments to provide comprehensive and objective feedback to family business leaders and to evaluate potential next generation successors.

Leadership Succession: Selecting an internal or external successor?

This week, Paolo Morosetti explores the complexities involved in the process of selecting the successor in a family enterprise and shares an approach to help your clients answer the fundamental question of whether to select an internal or external successor.

Challenges of the Sandwich Generation in Leading a Family Enterprise

Thanks to the FFI Asian Circle Virtual Study Group and Yirhan Sim for this week’s edition that features a family enterprise case that demonstrates the challenges experienced by the “sandwich generation” through the transition to lead a family enterprise.

Discussing Prenuptial Agreements with Next-Generation Family Members

In this week’s issue of FFI Practitioner, Matthew Erskine considers the ways that a prenuptial agreement can be an effective tool for family enterprises not only to protect family assets, but to articulate their philosophy and vision for the family’s future.

Sympathy and Succession: Lessons from history

This year is the 300th anniversary of notable economist and philosopher Adam Smith’s birth.

Three Kingdoms: Three Succession Results from Chinese-Indonesian Family Businesses

Thanks to the FFI Asian Circle Virtual Study Group and Linda Salim for this week’s edition featuring mini-cases on succession planning in three Chinese-Indonesian family enterprises with lessons for advisors around the world.

Choosing the Next Chair While Differentiating From the CEO: How to handle a key transition

In this week’s FFI Practitioner, Daniela Montemerlo explores the important role of the board chair in a family enterprise and explains the benefits of appointing two different people to serve as chair and CEO.

The Challenges of Working with a “Flat FOOT” Enterprise

In this week’s FFI Practitioner, Steve Legler shares his observation that, in some family enterprises, when a generational shift occurs, an existing corporate hierarchy may transform into a less defined and ambiguous structure when the next gen leaders have roughly equivalent managerial roles.

Planning for the Sudden Death of a Family Business Leader

In this week’s edition of FFI Practitioner, FFI Fellow Patricia Annino explores the impact that the sudden death of a family business leader can have on the entire enterprise.

Reverse Succession in Family Businesses: A pandemic effect

Thank you to this week’s contributor, Luz Leyda Vega-Rosado, for her article exploring a phenomenon she refers to as, “reverse succession.”

Building Resilience in the Shadows of the Past

This week’s edition continues the series of editions by presenters at the in-person 2021 FFI Global Conference, with an article by Andrew Keyt, who will be presenting alongside Dr. Fabian Bernhard at the conference on October 21.

Keeping the Entrepreneurial Flame Alive: Insights from the Loy Family in Malaysia

Thank you to this week’s contributors from the FFI Asian Circle Virtual Study Group, Mita Dixit and Esther Kong.

The Heartbeat of Family Business Leadership Succession: A perspective from Southeast Asia

In this week’s edition of FFI Practitioner, Jonathan Ramos explores the unique challenges faced by enterprising families when making the transition from the second to the third generations.

The Impact of a Global Crisis on Family Business Transitions: Some scenarios

Thanks to this week’s contributor, Ken McCracken, for his article exploring the impact of the Covid-19 pandemic on family business succession planning.

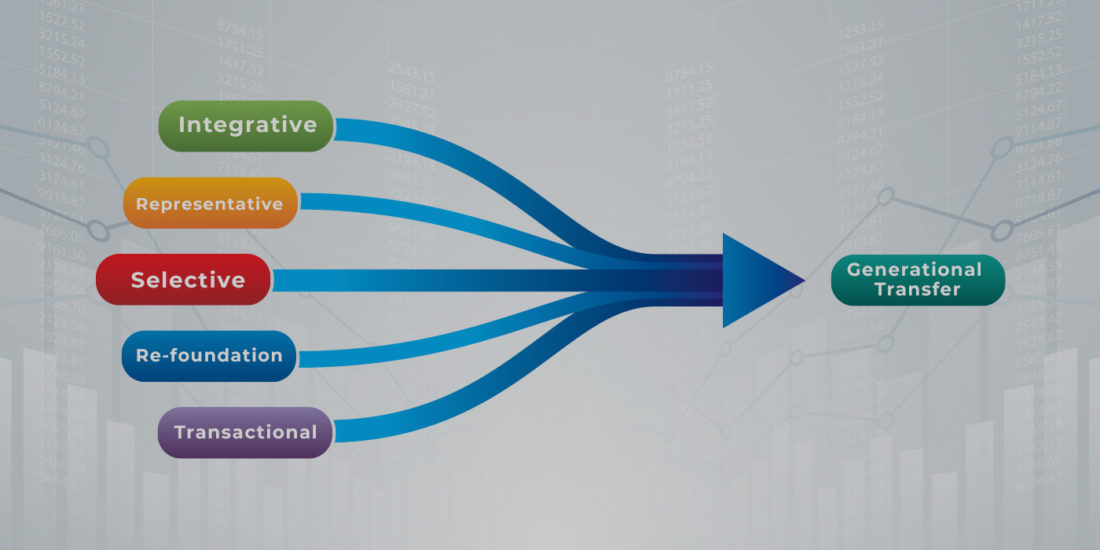

Generational Transfer Models

Thanks to Leonardo Glikin, a member of the FFI IberoAmercian Virtual Study Group (VSG), for today’s article exploring five models for generational transition as he has encountered them in his family enterprise consulting practice.

Changing Demographics in Family Businesses: Highlights from the STEP 2019 Quantitative Survey

Thanks to this week’s contributor, Andrea Calabrò, for summarizing the findings of the STEP 2019 Global Family Business Survey, which was introduced in the January 8 FFI Practitioner edition about applied research in the field.

Transitioning from a Family Business to a Family Brand

Many family enterprises develop strong branding around their visionary founders. But what happens to this brand when the next generation assumes leadership?

Succession Planning Using OKR Leadership: A case study

In this week’s edition, we are pleased to share a piece about OKR Leadership, a management methodology that can help advisors organize and measure their clients’ succession planning process.

Case Study: The Seibu Group – The fall of the Seibu Empire

Thanks to this week’s contributor, Morio Nishikawa, for providing this case study about the Seibu Group, a Japanese family-owned business that faced a variety of legal challenges beginning in 1993 as the country’s laws changed, and the company’s practices and protocols were not updated.