Family Wealth

The rise of the family office, single and multi-, in the evolutions of the family enterprise field; suggestion on how to structure, use as an alternative to selling the company, vehicle for clarifying family values.

Embedded Family Offices in Asia: Why They Happen and Should They Be Avoided

In this week’s FFI Practitioner, FFI Asian Circle Virtual Study Group members Laurent Roux and Kimberly Go discuss embedded family offices—what they are, how they became prevalent among Asian enterprise families, and their risks.

The 360 Legacy Wheel Balances What Needs to be Preserved and What Needs to be Shared: A Model for Philanthropic Advising

Thank you to Dennis Oteng, member of the 2025 Conference Program Committee, for this article about the 360 Legacy Wheel, a model that can help client families consider which resources to share outside of the family and which to protect within the family.

Family Constitutions to Guide Founders, Owners, Families, and Advisors

Thank you to co-authors William Kambas and Linda Meade for this week’s FFI Practitioner, which begins a periodic series of editions dedicated to topics related to private trust companies.

The Rising Role of Women in Family Offices and Family Businesses: A Podcast Interview with Sasha Lund, Jessica McGawley, and Larisa Miller

FFI Practitioner is pleased to feature a podcast conversation with Sasha Lund, Jessica McGawley, and Larisa Miller, discussing a recently published Special Report from Globe Law and Business publisher: The Rising Role of Women in Family Offices and Family Businesses.

Fires and Storms: Navigating Disasters in Single-Family Offices

In this week’s edition of FFI Practitioner, Matthew Erskine explores how the principles of disaster theory can be adapted for single-family offices.

The FFI 2086 Society: Fostering Applied Research

The 2086 Society enhances FFI’s leadership in applied research for family enterprise professionals and researchers by providing annual grants to advance knowledge in multi-generational family enterprise management.

Family Office Compensation Considerations: An Introduction to the Lawyer’s Perspective on Incentivizing and Compensating Key Leadership of a Family Office

Thank you to William J. Kambas, David Guin, and Elliot Katz for this article, which provides a high-level introduction to the complex topic of compensation and incentive systems for family office leadership.

How Wealthy Families Can Instill a Culture of Stewardship Part II: From Value Contribution to Leadership—Increasing Engagement in the Rising Generation

The second part in this article by Dennis Jaffe and Amy Hart Clyne picks up where Part I ends.

How Wealthy Multigenerational Families Can Instill a Culture of Stewardship Part I: Setting Baseline Agreements for Stewardship Behavior

Thanks to Dennis Jaffe and Amy Hart Clyne for this two-part article that draws on their experience working with successful families to create an ongoing value-based culture for the responsible use of wealth across generations.

A Conversation on Mental Health and Addiction with Gary Mendell and Dr. Paul Hokemeyer

Thank you to Gary Mendell, founder and CEO of Shatterproof, and Dr. Paul Hokemeyer, licensed family therapist and founding principal of UK-based Drayson Mews, for this conversation with the FFI Practitioner podcast about addiction and mental health treatment in enterprising and ultra-high-net-worth families.

Family Office Governance: An Asian Business Family Perspective

Thank you to FFI Asian Circle Virtual Study Group member Andre Loh for this article exploring the nuances of family office governance within the Asian context, offering insights into a model that contextualizes corporate governance principles while aligning with the unique dynamics of Asian business families.

Perspectives on Family Philanthropy and Social Impact Governance: An Interview with Christina Wing

This week, we are pleased to feature a podcast conversation with Christina Wing, founder of Wingspan Legacy Partners.

FFI Practitioner: Family Enterprise Philanthropy and Social Impact

In family enterprises, philanthropy and social impact initiatives serve as vital mechanisms for fostering multigenerational collaboration and reinforcing the family’s values while also contributing to its lasting legacy in the community.

Systemic Investing: A year-end conversation with 2023 FFI Scholar-in-Residence Jason Jay and John Davis

FFI Practitioner is pleased to feature a podcast conversation with Jason Jay, 2023 FFI Scholar-in-Residence, Senior Lecturer at the MIT Sloan School of Management and Director of the Sustainability Initiative at MIT Sloan, and John Davis, chairman and founder of the Cambridge Family Enterprise Group, Senior Lecturer in Family Enterprise at MIT Sloan, and a founding member of the FFI 2086 Society.

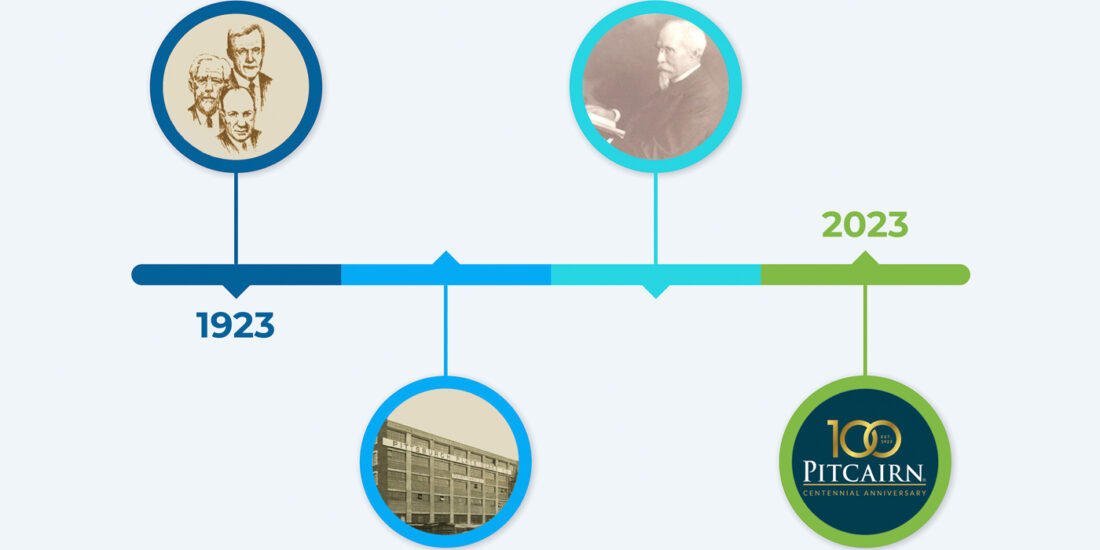

Celebrating 100 Years: How Pitcairn evolved from a 19th century operating company to a 21st century multi-family office

Today, we’re featuring an interview and a podcast with Dirk Junge, former CEO and Executive Chairman of the Pitcairn board, and Leslie Voth, currently Chairman, CEO and President of Pitcairn.

The Manifestations of Money in the Business Family: An interview with Claudia Astrachan, Anneleen Michiels, and Randy Waesche

FFI Practitioner is pleased to feature a podcast discussion with Claudia Astrachan, Anneleen Michiels, and Randy Waesche.

Teaching Kids the Value of Money: Four strategies for enterprising families

Thank you to Elaine King, this week’s contributor, for her article that provides a model for educating younger next gen family members about financial skills and practices.

Lessons for Advisors from the Nordic Perspective on Family Office Impact Investing: An interview with Camille Korschun and Erik Wetter

This week’s FFI Practitioner podcast concludes our series of interviews with presenters from this year’s FFI Global Conference.

The Evolving Dynamics of Next-Generation Philanthropy

FFI Practitioner is pleased to invite Jon Quinn, Deputy Director at Rockefeller Philanthropy Advisors, to discuss the factors contributing to the rising generation’s philanthropic goals and decisions.

Creating Climate Futures: Business in a Changing World

FFI Practitioner is pleased to share a conversation with Jason Jay, Senior Lecturer and Director of the MIT Sloan Sustainability Initiative.