Family Office

Observations, wisdom and models of organization and governance for single and multi-family offices.

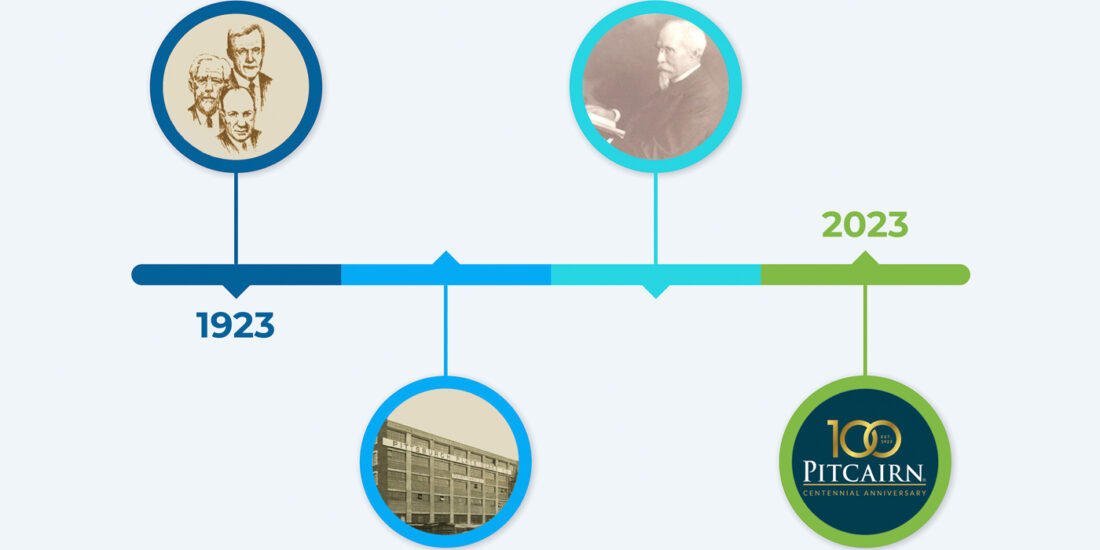

Celebrating 100 Years: How Pitcairn evolved from a 19th century operating company to a 21st century multi-family office

Today, we’re featuring an interview and a podcast with Dirk Junge, former CEO and Executive Chairman of the Pitcairn board, and Leslie Voth, currently Chairman, CEO and President of Pitcairn.

Starting on the Wrong Foot When Creating Family Offices?

According to this week’s contributor, Jim Coutre of Fidelity Family Office Services, in order to create better family offices, practitioners must be honest about what (or who) may be holding the family office back from delivering the highest value to their clients.

Challenges of Burgeoning Family Offices in Mainland China

This week’s article concludes FFI Practitioner’s month-long series of editions dedicated to topics related to family offices.

Family Offices in a Changed World: Turning risk into opportunity

Thank you to this week’s contributor, Jim Coutre, for continuing FFI Practitioner’s November series of editions on topics related to the family office.

The Family-Focused Office

This week’s article continues FFI Practitioner’s November series on topics related to the family office. Thank you to Scott Peppet for this article that makes the case that effective family offices be invest more time and budget in enterprising families’ most important resource – the family.

Family Office Technology: An interview with Tania Neild

With today’s article, we introduce a month-long series on topics related to the family office. Today’s issue features an interview with Tania Neild by FFI Fellow and board member Mary Duke.

Thoughts on Singapore’s Appeal as the Asian Hub for Family Offices: Information for advisors

The number of family offices established in Singapore has increased considerably over the past several years.

Family Offices and Artwork: Mitigating the risks

Thanks to Matthew Erskine for this week’s issue discussing the most important steps that family offices and their clients can take to mitigate risk to clients’ collections of art and other collectibles.

The Reality of Relevancy in the Family Office System: Exploring forces and key drivers that can affect relevancy

Thank you to this week’s contributor, Jim Coutré, for continuing our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

Challenges that Asian Families Face in Developing a Full-service Family Office

This week’s FFI Practitioner edition continues our series of articles written by members of the Editorial Committee. Thank you to Paul Chung, Jeremy Cheng, and Chin Chin Koh for this article examining the challenges confronting Asian families interested in establishing a single family office as well as practical advice for advisors navigating these family office challenges around the world.

The Roles Past, Present, and Future of the Family Office Executive

This week’s FFI Practitioner edition addresses a topic of importance in the field of family enterprise – the family office. In addition to an article examining the history of the role of a family office executive by Annischka Holmes-Moncur, we are pleased to share four global perspectives on this topic as published earlier in FFI Practitioner.

Managing Wealth as a Business: A Family Office – to be or not to be?

When should a family begin to think about forming a family office and what factors should they consider when making this decision? Thank you to Iñigo Susaeta, this week’s contributor for continuing FFI Practitioner’s series of articles written in both English and Spanish by members of the FFI IberoAmerican Virtual Study Group.

Single Family Office Finesse

Family offices have been following wealth. Historically, in Europe, private banking addressed most family issues. In the US, that concept followed the Titanic and did not cross the Atlantic that well.

Selling the Family Business? Set up a Family Office First!

Most businesses are cash guzzlers. They have liquidity cycles which usually define the remuneration structure — the way a family spends and lives its life.

The Family Office: The glue to keep Chinese families together

Chinese business families are facing generational transitions, often subject to the curse of “wealth does not go beyond three generations.” In many of these entrepreneurial families, the business itself is a means to keep the entire family together.

Global Family Offices: An Ibero-American perspective

Thanks to Iñigo Susaeta, general director of Arcano Family Office for his thoughts on the evolution of the family office in the Ibero-America region and how a movement toward more holistic models is emerging.

Family Offices Globales: Una perspectiva iberoamericana

Iberoamerica ha sido en los últimos años una de las regiones de mayor crecimiento a nivel mundial gracias, entre otros factores, al buen hacer de sus empresarios y sus empresas.

Myths, Realities And The Family Office CFOs’ Leap Of Faith

Not many choose to be a professor, tax partner or an entrepreneur in their school essays querying aspirations.

Interview with Adi Divgi on collaborative procurement

The third feature this week is an audio interview with Adi Divgi on the topic of “collaborative procurement.” Adi is the president of EA Global – a single family office created in 2005. Interviewed by Practitioner editorial committee member, Kirby Rosplock.

Alternative to Private Equity: Partnering with the family office

In this issue, François M. de Visscher explores the concept of family enterprise partnering with family offices to defend their global market position or take advantage of growth opportunities.