View this edition in our enhanced digital edition format with supporting visual insight and information.

This week’s FFI Practitioner edition addresses a topic of importance in the field of family enterprise – the family office. In addition to an article examining the history of the role of a family office executive by Annischka Holmes-Moncur, we are pleased to share four global perspectives on this topic as published earlier in FFI Practitioner.

The article briefly examines the history of the role of a family office executive – a role that requires being both an outsider who is not a family member and an insider who is privy to the affairs of the principals.

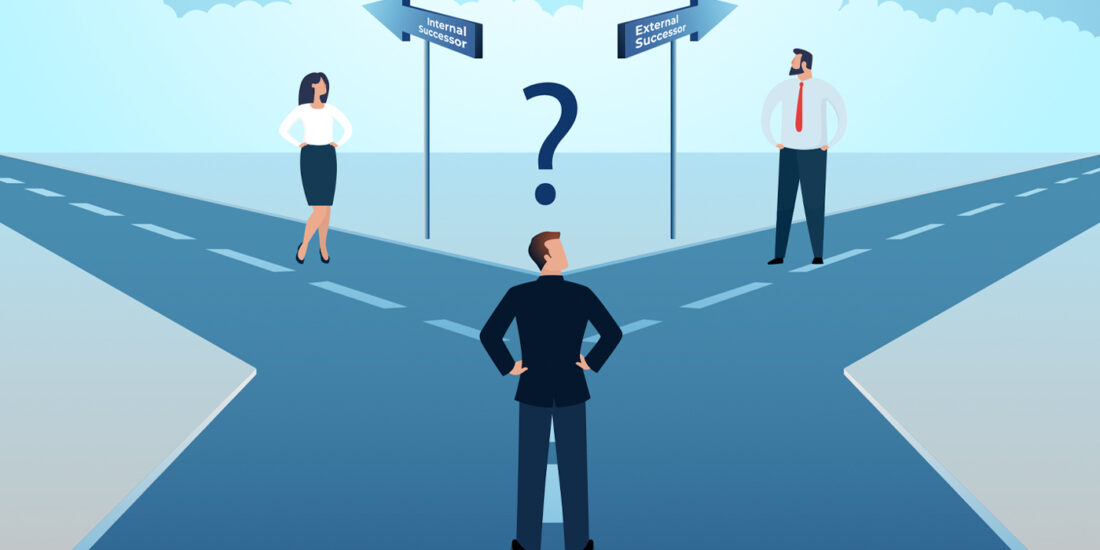

The modern family office structure has its genesis in the late nineteenth century America where the very wealthy John D. Rockefeller created an entity, separate from his oil business, staffed with professionals to manage and preserve his wealth for his family. Today, single-family offices exist to provide services to only one family while multi-family offices provide services to many families. Family offices are used globally by ultra-high net worth individuals and families. In some cases, family members may be involved in the operation of the single-family office, but normally non-family executives are hired to run family offices.

Beyond the previous two broad groupings that capture certain common features, e.g., services supplied, size of staff, amount of the wealth of the family that owns the office or receives the services, there are differentiating features in each family and family office. These features result from the uniqueness of the family and the specific factors affecting the family as a whole, e.g. values, culture, objectives, and interrelationships within the family. The family office and its executives operate in a multifactored and dynamic environment with many challenges to deliver superior service on a consistent basis.

Successful professionals working in the family office sector strive to achieve multiple objectives on behalf of the families they work for while maintaining privacy and confidentiality. Typically, advice may be provided on a range of matters pertaining to investments, portfolio management, accounting, governance, legal, taxation, regulatory, estate planning, and philanthropy. Additionally, the family office may also take care of educational needs and provide management and concierge services to the related families. Principled professionals in these roles give objective and independent advice, notwithstanding that in certain circumstances, the principals may not heed the advice given by the non-family member executive. In certain family situations, issues between family members, or divergent views on decisions impacting the family office, may present difficulties for the executives striving to carry out their mandates in a manner satisfactory to all parties.

Over the past decade, executives within family offices have had to evolve and adapt to volatility in the global economic environment, significant technological developments, and global regulatory initiatives with increased focus on tax transparency. In this same period, the number of beneficiaries in families have increased, the wealth strategies of families have changed, and younger generations have started, in growing numbers, to take leadership roles in family businesses.

As the demand grew for competent and capable family office executives with the skills to perform effectively in the changing landscape of increased professionalism and formality, many executives have obtained industry related certifications and joined specialist industry organizations providing continuing professional education through courses, conferences, journals, and publications. Membership in these organisations has given family office executives the opportunity to develop professional networks as well as facilitated mentoring and the sharing of views and practices. Academic research into family businesses and family offices and surveys by professional firms and other organisations have also contributed to an increased body of knowledge available to today’s family office professionals.

Given the significant percentage of the global economy attributed to family-owned businesses and the related growth and prevalence of family offices, executives in family offices have a key role to play in the successful and ongoing functioning of these entities by continually ensuring that the strategic needs of the principals are met by the operations of the family office. As the past decade has shown, continuous skills upgrades across a multitude of disciplines and areas, such as the core professional competencies – wealth management, accounting, taxation, and law, but also extending to governance and regulatory compliance, information technology, cyber and broader risk management, psychology, communication, and facilitation skills, and or outsourcing to suitably qualified professionals — will be vital in the face of great dynamism within families as generational transfers occur and innovation and disruption continue to affect many industries and sectors. Undoubtedly many challenges lie ahead but these challenges are not insurmountable.

About the contributor

Annischka Holmes-Moncur, FFI Fellow, has worked in the family office industry for more than ten years. She has prior employment experience in the mutual fund industry, private banking, and public accounting. She is member of the AICPA, a licensed member of the Georgia State Board of Accountancy, a Chartered Accountant with membership in the Bahamas Institute of Chartered Accountants (BICA) and a member of the Society of Trust and Estate Practitioners (STEP). She can be reached at [email protected].

Annischka Holmes-Moncur, FFI Fellow, has worked in the family office industry for more than ten years. She has prior employment experience in the mutual fund industry, private banking, and public accounting. She is member of the AICPA, a licensed member of the Georgia State Board of Accountancy, a Chartered Accountant with membership in the Bahamas Institute of Chartered Accountants (BICA) and a member of the Society of Trust and Estate Practitioners (STEP). She can be reached at [email protected].

View this edition in our enhanced digital edition format with supporting visual insight and information.