Family Business Cases

The case studies included here are brief vignettes that can be used by professionals as conversation starters or for in-depth analysis in the consulting process.

Trust in the Family Enterprise: A Model and a Case Study

As with the April 16 FFI Practitioner issue, today’s article is a conversation starter in which Emily Bouchard and Charles Feltman use a model and a case to open conversations that can repair conflicts and build trust among client families.

The Missing Link in Family Business Growth: A Pathway to Generational Success

Thanks to Mette Ballari for today’s FFI Practitioner article, which discusses the missing link in family business growth.

Ghosts and Possession in the Family System

Thanks to the FFI Asian Circle Virtual Study Group member and FFI Fellow Kazuyoshi Takei and co-authors Yukio Fujimi and Chikako Kishihara for this week’s edition.

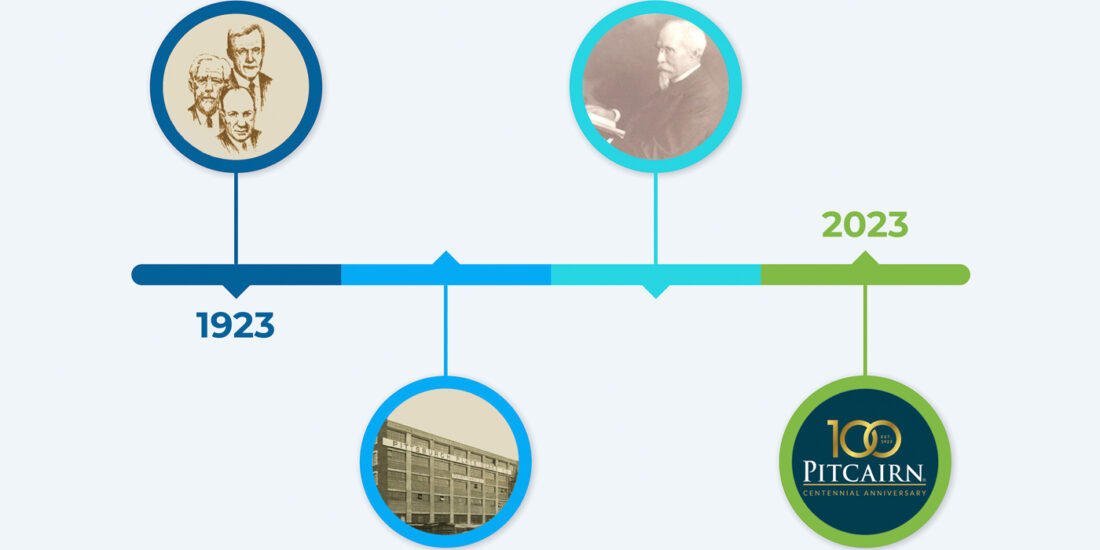

Celebrating 100 Years: How Pitcairn evolved from a 19th century operating company to a 21st century multi-family office

Today, we’re featuring an interview and a podcast with Dirk Junge, former CEO and Executive Chairman of the Pitcairn board, and Leslie Voth, currently Chairman, CEO and President of Pitcairn.

Chief Emotional Officers in Asia’s Collectivist Cultures

Thanks to the FFI Asian Circle Virtual Study Group members, Linda Salim and Kimberly Go for this week’s edition that examines the important role of the Chief Emotional Officer (CEO) in Asian family enterprises.

Education and Development: Preparing NextGen members for family enterprise ownership

What should family enterprise clients do to help ensure members of the next generation are prepared to assume ownership of the enterprise when the time comes?

Balancing Representation with Qualification on Family Business Boards

In this week’s FFI Practitioner, contributors Omar Romman and Ben Francois explore the topic of how to balance family member and independent director participation on the board.

Challenges of the Sandwich Generation in Leading a Family Enterprise

Thanks to the FFI Asian Circle Virtual Study Group and Yirhan Sim for this week’s edition that features a family enterprise case that demonstrates the challenges experienced by the “sandwich generation” through the transition to lead a family enterprise.

Professionalizing Family Businesses: How to orchestrate, change, and get things done

In this week’s FFI Practitioner, Paolo Morosetti addresses the topic of family enterprise professionalization.

How to Break a Vicious Intergenerational Cycle in Family Enterprises

In this week’s FFI Practitioner, Eduardo Gentil, Bruna Tokunaga Dias, and Renata Brecailo share their observations about a common challenge facing intergenerational enterprising families

Cases for Clients: 2022

In this week’s edition, we continue our periodic series featuring a selection of family business cases previously published in FFI Practitioner.

Keeping the Entrepreneurial Flame Alive: Insights from the Loy Family in Malaysia

Thank you to this week’s contributors from the FFI Asian Circle Virtual Study Group, Mita Dixit and Esther Kong.

Personal Life Crisis: How it can affect leadership in the Family Enterprise

Thanks to Steven Rolfe for this week’s edition about the importance of recognizing the impacts that a family business leader’s personal life crisis can have on the entire enterprise. In his article, Steven shares two examples and his reflections for practitioners to consider when their clients are confronted with such a scenario.

Five Sisters and Two Executors: A case study

Thanks to Vijay Sathe, Alfredo Enrione, Donna Finley for this week’s edition, which is a case study about how five sisters, who suddenly and unexpectedly inherited their father’s businesses, and how they dealt with the influence of two executors to reach harmonious ownership of the family enterprise.

From Safety, Through Sustainability to Stewardship: The Triple-S journey of Jebsen & Jessen Family Enterprise

Thanks to Marta Widz and Sameh Abadir from IMD for this article based on the Jebsen & Jessen Family Enterprise story, which illustrates how responsible leadership and early awareness can coalesce to pioneer safety, environmental sustainability, and stewardship strategies and thus lead to impactful social innovation.

How Corporate Governance Helps in Decision Making: A case study

This week, we are pleased to share a case study that demonstrates how effective corporate and family governance can help clarify decision-making protocols in family enterprises. Thanks to Roberto Vainrub for sharing this case with practical implications for advisors.

Education and the Rules for Engagement: A case study on ways to encourage young entrepreneurs

Thanks to Ricardo Mejia for this case study discussing how education and clear rules of engagement may still be the best strategy for developing young entrepreneurs in family enterprises.

Commentary #5 on Professionalizing the Business Family: A research report sponsored by the FFI 2086 Society

This week, we are pleased to continue the series of commentaries on the 2086 Society sponsored research “Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership.”

Family Businesses in the Times of Crisis and Global Recession: A story of resilience and sustainability

This week, we are pleased to share a family business case illustrating how Firmenich, the world’s largest privately-owned perfume and taste company, has utilized their concentrated family ownership and governance model to navigate worldwide crises.

Succession Planning Using OKR Leadership: A case study

In this week’s edition, we are pleased to share a piece about OKR Leadership, a management methodology that can help advisors organize and measure their clients’ succession planning process.