Behavioral & Management

Theoretical frameworks from behavioral and management science, e.g., Bowen theory and coaching, are explored to provide multiple frameworks for assessing and understanding the family, the enterprise, and the individuals involved in multi-generational companies.

Urgency and Change: Time as a Crucial yet Undervalued Component in the Consulting Process

Continuing our series on Time, we are pleased to present an article by Joseph Astrachan and Claudia Binz Astrachan.

How Positive Psychology Can Help Family Enterprises Flourish

The FFI Practitioner podcast is pleased to host Doug Gray, PhD, discussing the field of positive psychology, 360 assessments, and how both can help family enterprise advisors with their clients.

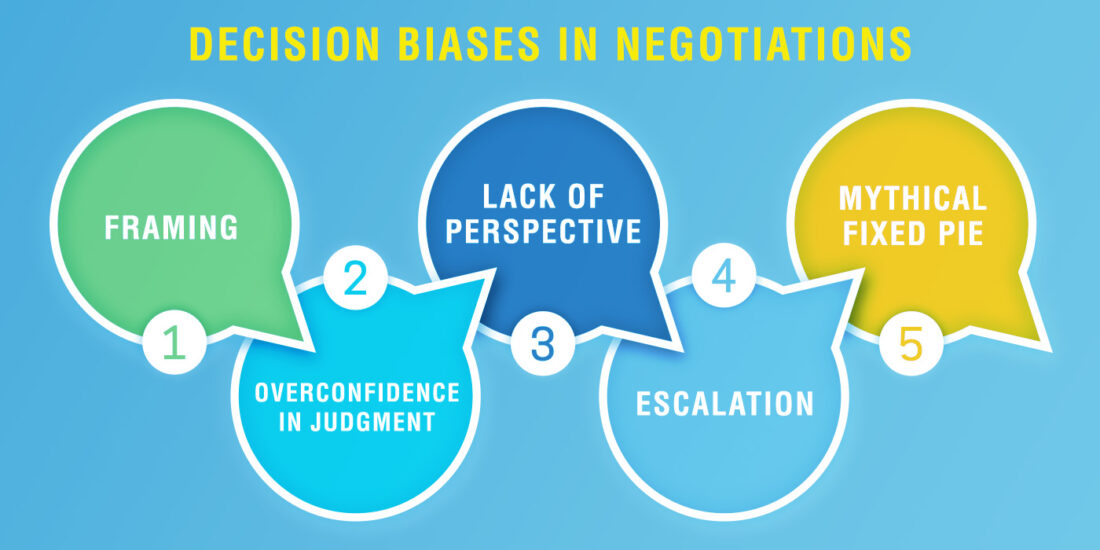

Creating Value in the Family Enterprise: A negotiation perspective

In this week’s edition of FFI Practitioner, Jack Troast shares lessons on negotiation that he’s developed over his 25-year career as a mediator and family enterprise advisor.

Recognizing Evolutionary Behavior in Enterprise Families: An interview with Andrew Gersick

For this week’s edition, FFI Practitioner is pleased to feature Andrew Gersick, a Visiting Researcher and Lecturer in Ecology and Evolutionary Biology at Princeton University and a Researcher in Computer Science at San Diego State University.

Capturing Murray Bowen Moments: Ideas and photos

Last week we looked to the future with FFI Futurenaut-in-Residence Mark Stevenson. Today, like Janus, we look in another direction to reflect on the work of 20th century psychiatrist (and futurist!) Murray Bowen.

Mental Wellbeing for the HERO in Families and their Businesses

Thanks to this week’s contributors, Diane Arijs, Anneleen Michiels, and Dianne H.B. Welsh, for this edition about their recent research on mental health in family businesses and how to work with your clients to stimulate their psychological capital to promote mental wellbeing.

Psychodynamics and Family Governance: An interview with Julien Lescs

This week’s edition of FFI Practitioner features a podcast interview with Julien Lescs, family office advisor and co-founder of Kanopé Impact.

Personal Life Crisis: How it can affect leadership in the Family Enterprise

Thanks to Steven Rolfe for this week’s edition about the importance of recognizing the impacts that a family business leader’s personal life crisis can have on the entire enterprise. In his article, Steven shares two examples and his reflections for practitioners to consider when their clients are confronted with such a scenario.

The Value of Learning About Families as Emotional Systems

This week, FFI Practitioner is pleased to continue our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

What is WYSIATI in Our Profession? Some observations and a suggestion

Thanks to Doug Gray for his article on VIA Classification assessment tools, which can help family enterprise practitioners think differently about their clients’ family system.

The Benefits of Coaching for Family Enterprise Leaders and Practitioners

Thanks to Greg McCann for this week’s article discussing some widely held notions about professional coaching and how family enterprise leaders and advisors can maximize their leadership development through effective coaching.

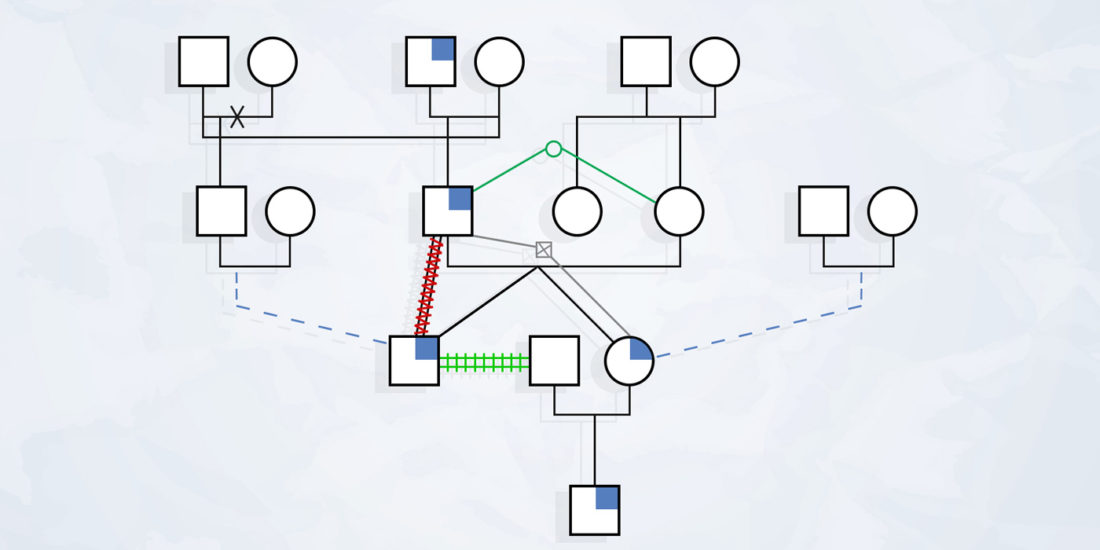

Working with Family Diagrams in Family Business: Reflections from 20 years of practice

Thanks to Guillermo Salazar, a member of the FFI IberoAmercian Virtual Study Group, for this article reflecting on the value of utilizing Family Diagrams in his consulting work with families over the years.

Interdependent Wealth: How family systems theory illuminates successful intergenerational wealth transitions

Thanks to this week’s contributor, Steve Legler, for highlighting key concepts in his recently released book, Interdependent Wealth: How Family Systems Theory Illuminates Successful Intergenerational Wealth Transitions, on relationships between family wealth and family systems theory.

Behavioural Risk in Family Business: Some thoughts on individual stories

This week’s FFI Practitioner dives into risky individual behavior within the family enterprise which, if ignored, can impact the performance of the business and the unity of the family. Thank you to Elizabeth Bagger, director general of the Institute for Family Business, for her examination of the topic and explaining how helping individuals become aware of this behavior can transform their story into their greatest asset.

Solution-Focused Brief Therapy: A communication model for family business interventions (Part 2)

This week’s FFI Practitioner concludes a two-part examination of Solution-Focused Brief Therapy (SFBT), by Brett Coffman. In this week’s edition, Brett addresses the need to look for change in clients and provides a mnemonic device to help remind practitioners about the various techniques associated with SFBT.

Solution-Focused Brief Therapy: A communication model for family business interventions (Part 1)

This week’s FFI Practitioner begins a two-part examination of Solution-Focused Brief Therapy (SFBT), an evidence-based coaching and therapy model, and its potential application to help family enterprise members find solutions to a variety of challenges. Thanks to this week’s contributor, Brett Coffman for providing this analysis.

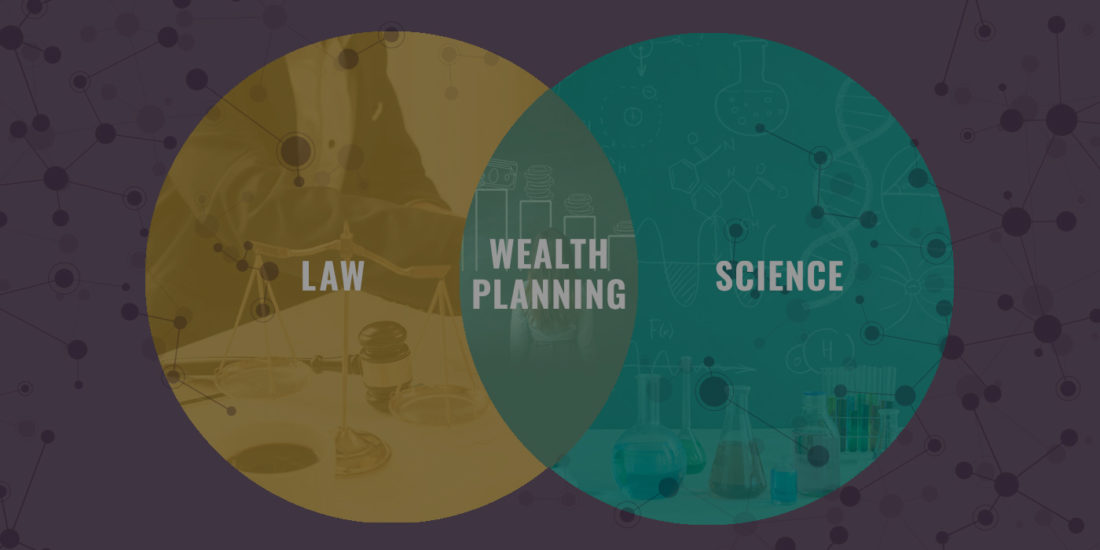

When Science and Law Intersect: Preparing for a new age of wealth transition planning

This week’s FFI Practitioner examines how advances in science can impact multidisciplinary approaches to family business consulting.

People Are Loyal to the Culture, Not the Strategy

In this week’s FFI Practitioner, Eva Wathén examines the importance of culture within family enterprises and explores some of the differences between the cultures of family-owned and nonfamily-owned enterprises.

Research Applied: FBR Précis for FFI Practitioner

How do the personalities differ between family and nonfamily CEOs and what impact could this difference have on the performance of family businesses? In this week’s edition, Kim Schneider Malek reexamines the popular argument about family and nonfamily CEOs through her précis of “CEO Personality: A Different Perspective on the Nonfamily Versus Family CEO Debate,” an article appearing the March 2019 issue of FBR.

Deviance in the Family Business: An interview with Kim Eddleston and Roland Kidwell

For this week’s edition, we are excited to share an interview between Russ Haworth, host of the Family Business Podcast, and Kim Eddleston and Roland Kidwell about their presentation at the upcoming FFI Global Conference. Their presentation is titled “The Diversity of Deviance: How breaking the rules can hurt (and help) families and family firms,” which will address the different types and outcomes of deviance as well as covering how to use deviance in the family and family firm to improve performance.