View this edition in our enhanced digital edition format with supporting visual insight and information.

This year is the 300th anniversary of notable economist and philosopher Adam Smith’s birth. To honor this occasion, this week’s contributor, Ken McCracken, explores how some of Smith’s most prominent thinking on self-interest and sympathy could be applied to succession planning discussions in family enterprises.

The year 2023 is the tercentenary of the birth of Adam Smith, author of An Inquiry into the Nature and Causes of the Wealth of Nations (1776). This is considered to be one of the most important books ever written and Smith is credited with founding the field of political economy. He is often described as the father of economics and the father of capitalism.

He was Professor of Moral Philosophy at the University of Glasgow (1753 – 1766) and one of the stars of the period known as the Scottish Enlightenment. Many of his ideas are still used today but are any of them particularly relevant to family enterprises?

A Bit of Sympathy

In his first book, The Theory of Moral Sentiments (1759), Smith argued that we are social beings who are neither entirely benevolent nor totally selfish. It is in our nature to pursue self-interest, but this is moderated by a natural desire to contribute to the happiness of others because this makes us feel happy too. We adjust our behavior to be acceptable in whichever group we are part of and to avoid upsetting others whenever possible, because their sadness can make us feel a bit miserable too.

Smith used the term “sympathy” to describe these moral sentiments that govern our actions and guide our decisions. It means that neither the relentless pursuit of self-interest that makes others miserable nor obliterating self-interest to make others happy will achieve outcomes that we judge to be morally satisfactory.

Succession Discussions

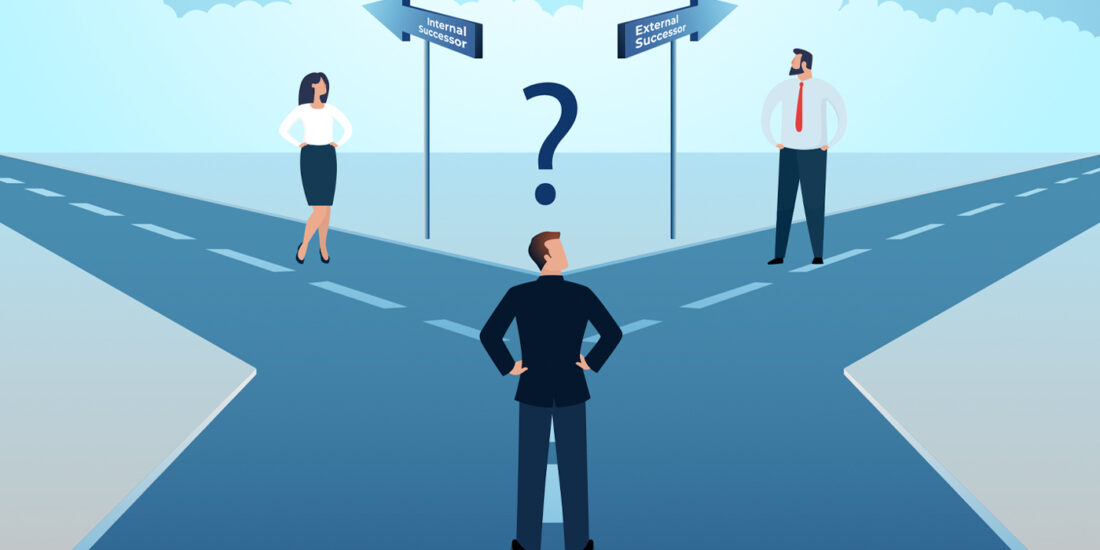

These moral sentiments are involved in discussions about the transitions of ownership and leadership in a family enterprise. During this period the changes in roles and responsibilities that some individuals want, depend on decisions to be made by their relatives.

For example, a son wants to become the next CEO, but this depends on the incumbent, who is also his mother, being ready to retire. If his mother is prepared to retire, not only are these respective self-interests compatible, but the transition is made even more joyous by the pleasure the son and his mother each gain from doing what makes the other happy.

“Congratulations, son,” says his mother. “I am delighted you’ll be the next CEO, and I can now retire,” to which her son responds, “I’m delighted to get the job, enjoy retirement; you deserve it.”

But what if the son is eager to take over when his mother is still reluctant to retire? Which direction will the discussion now take?

Since emotions are likely to be aroused, it could be tempting for each of them to focus on promoting their self-interests. They could try to do this by criticizing each other. One exchange could be along these lines: “Mother, I’m frustrated living in your shadow.” The son’s comment then provokes his mother to retort, “You’ve had it easy, son, and not shown enough respect for what I’ve achieved.”

They could then start making threats if their demands are not met. The son might say, “If you don’t retire so I can become the CEO, I’ll leave the business,” to which his mother might reply, “Go ahead, son, but you’ll never inherit any shares.”

Smith would point out that by focusing only on self-interests, these discussions are devoid of the sympathy that is inherent in our humanity. He would also be concerned if the conversation swerved too far in the direction of either the mother or her son declaring, “Just tell me what you want and I’ll do it, if that makes you happy!” This might sound like a noble gesture, but if it entails someone sacrificing all self-interest there is a significant risk that this will result in sadness, and that sadness will rub off on the other person, leaving both of them feeling dejected.

In this situation, a bit of Smithian sympathy could direct the attention of the mother and son towards what they could each do to help satisfy the needs of the other. This could start with simple questions that provide essential information about the other’s views and feelings.

The son could try asking, “Why do you not want to retire?”

He might learn that his mother is worried about being financially secure independent of her income from the family enterprise, and about the loss of a sense of purpose if she is no longer the CEO. He could understand that she enjoys the status and reputation of being CEO and does not want to have to stand down from various community and commercial roles that are associated with her position in the business.

The mother might similarly enquire, “Why do you feel that you must become the CEO now?”

She learns that her son feels he is at an age and stage of life when he needs to know if becoming CEO is a viable career. Delay could deny him the opportunity to seek a similar role outside the family enterprise. His children will soon start school, and if he is not to become CEO and needs to pursue other opportunities, he and his partner might prefer to move and live somewhere else.

At this stage Smith might say, “Good, now you’re talking,” albeit using eighteenth-century English. Now that the mother and son can see more clearly what is at stake for each other, they can apply themselves to the task of coming up with solutions that could make each other happy, as well as paying attention to their respective self-interests.

What steps can be taken to help the mother feel financially secure and to continue in roles associated with the business? Are there other ways to help her find a sense of meaning and purpose for the stage of life that comes after retiring?

What commitments can be made to reassure the son that he will be the next CEO? How about setting a date for this to happen, appointing a mentor or coach to help develop his skills, and broadcasting this news to other stakeholders in the business and the family?

Is This Just an Eighteenth-Century Version of Win-Win?

“Win-win” describes an outcome to negotiations in which all parties benefit one way or another and none of them feel that they have lost the negotiation. To reach this outcome, participants calculate what they are willing to compromise to achieve a satisfactory version of what they want. If every party pursues their self-interest, they may be able to work towards an outcome that achieves a satisfactory balance of self-interests.

A win-win approach to discussions is to ask, “How little do I have to give away to get what I want?” For this approach, I do not need to know what the other party wants, and it is up to them to measure if an outcome represents a win.

This approach ignores a vital aspect of Smith’s insight to human nature. He suggests that our satisfactory outcome includes being confident that the other party is satisfied, because if it turns out they are not, my win will feel diminished and tarnished. His approach would be to ask, “How much can I do to help you get what you want without abandoning my self-interest?” To answer this question, it would help me to understand your wants and needs.

In negotiations between unrelated parties, there is some risk of later discovering that one of them was disappointed with what appeared to be a win-win outcome, but there is a much greater risk of this happening when the parties are bound by closer, family ties. This makes Smith’s ideas about our moral sentiments particularly important to family enterprises and those who advise them. All participants in important discussions can take responsibility for finding solutions that work and that will endure, because the individuals whose self-interests are affected can also derive pleasure from doing what is good for others.

“That’s life in a family business,” as Smith didn’t quite say, but he might agree with the sentiment were he to attend any of the many celebrations that will take place this year to celebrate his anniversary.

About the contributor

Ken McCracken, FFI Fellow, is a family business consultant and founder of MFBC Limited in Edinburgh, Scotland. He is secretary of the FFI Board of Directors and is a former member of the Research Applied Board for the Family Business Review, and he chaired the FFI Global Conference in London. In addition, he wrote and currently teaches a Family Business Module on the STEP Professional Postgraduate Diploma in Private Wealth Advising. Ken can be reached at ken@m-fbc.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.