View this edition in our enhanced digital edition format with supporting visual insight and information.

Thank you to FFI Fellow Rocki-Lee DeWitt for this précis of a December 2024 FBR article entitled “Why and How Do Family Firms Go Public? A Socioemotional Wealth Perspective of IPO.” This précis is the third in the 2025 FBR précis series.

Overview

Initial Public Offerings (IPOs) offer a way for family business owners to maximize financial value and provide ongoing access to capital through public markets. Each country-based exchange has its own filing and reporting requirements, but across countries, an array of financial and non-financial motives influence how families consider opportunities and outcomes when considering the “go public” decision.

In the FBR article, authors Emma Carbone, Giovanna Campopiano, Alessandro Cirillo and Donata Mussolino use a socioemotional wealth (SEW) lens in interviews with eight Italian family firms that went public between 2015 and 2020. Exploring the influence of non-financial goals on IPO decision-making, this research focused on the following:

- Why and how do family firms go public?

- How does SEW shape family influence on IPO and its outcomes?

Methodology and Findings

The participants in the study included firms of various size and industries that met the following requirements:

- At least two generations of family involvement

- Family retained control of the firm after the IPO

- CEO/chairperson was a family member

- At least one family member was actively involved in governance prior to the IPO

Interviews and other published materials were also used to gather data about family business IPO motives and outcomes.

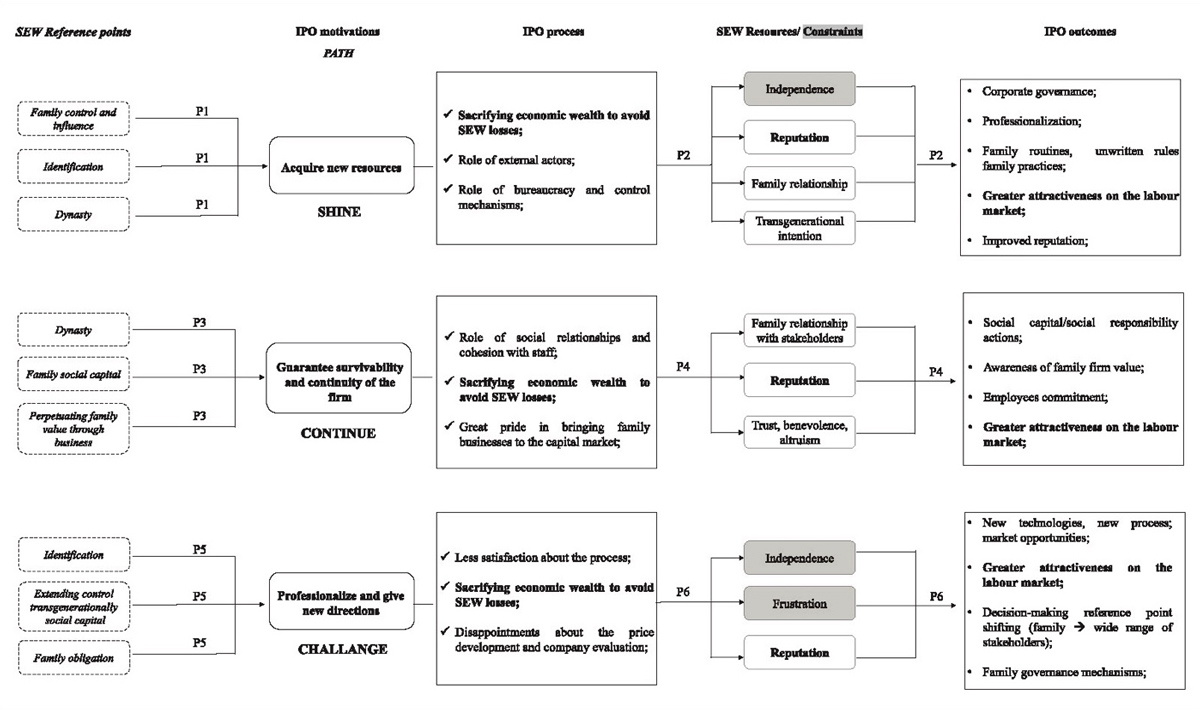

The analysis of interviews completed during and post-IPO revealed three different paths for motives and outcomes. Figure 1 is a visual summary of the IPO paths and derivation of propositions supported by the findings and extant literature.

Figure 1 “IPO Paths in Family Firms”1

- Shine Path: This path aligns with the purpose of acquiring new resources to sustain business growth and ambitions without losing control and influence over the company. For the families in this study who followed the Shine path, the IPO process and outcomes satisfied their primary need for financing growth. These families also recognized additional non-financial advantages including increased visibility and professionalization of their corporate governance.

- Continue Path: This path aligns with family owners who are driven by a deep commitment to family heritage, social relationships, and responsibility toward stakeholders. Families on this path pursue IPOs to ensure the long-term survival of the business, even if it means reducing family control. Sacrifice of SEW and reputation do matter, but greater emphasis is put on social relationships and pride in bringing the family firm to the capital markets. Post-IPO, these families experienced outcomes of increased stakeholder trust, stronger social relationships, and enhanced reputation, positioning the business for long-term sustainability.

- Challenge Path: The challenge path is typically associated with generational transitions, where rising generation family members seek to assert themselves, modernize the business, and steer it in a new direction. IPOs are viewed as a way to gain the status derived from the listing and professionalize the company as well as enhancing its visibility and attractiveness in the job market. This path aligns with the purpose of professionalizing the enterprise and giving. Outcomes of this path include the implementation of new technologies, processes, and market opportunities. Interestingly, the researchers note that “for each company on this path, the family members translated their personal goals into company goals”2 and reported some degree of dissatisfaction with the IPO outcomes. This mismatch of expectations and outcomes suggested to the researchers that if the decision to go public comes more from personal desires than actual company needs, it is less likely to produce the desired outcomes for either the family or the business.

All three paths recognize that when considering an IPO, there may be:

- Sacrifices in economic wealth to avoid SEW losses,

- Concerns regarding the reputation of the family business, and

- Favorable outcomes in IPOs that increases the firm’s employment attractiveness in the labor market.

Additionally, in analyzing the results of the study, the researchers present several key propositions regarding how the path to IPO and the desired SEW goals can impact the outcomes for the family and business:

- When family businesses prioritize control, independence, family identification, and transgenerational continuity, IPOs serve as a way to acquire resources without incurring SEW losses.

- Pursuing SEW goals of family control, identification, and ensuring a strong future business through IPOs can generate SEW resources of reputation, stakeholder relationships, and transgenerational transfer, along with governance and professionalization benefits, though it constrains family independence due to public market requirements.

- When decision-making emphasizes family social capital, responsibility toward stakeholders, and preserving business identity, IPOs become a means to help ensure the company’s long-term survival.

- Pursuing these SEW goals such as family social capital, responsibility toward stakeholders, and assurance of the family business identity through the IPO was found to yield trust, altruism, benevolence, strong stakeholder relationships, and reputation, as well as employee well-being, social capital, and social responsibility.

- When focused on family control, heirs’ self-affirmation, and generational transfer, IPOs become a tool to give new direction to the business.

- Pursuing these goals generates reputation and business outcomes (new technologies, processes, market opportunities, governance mechanisms) but also can bring SEW constraints such as reduced independence, frustration, and disappointment by the family members.

Practical Implications

For advisors, academics, and family business owners versed in the application of SEW, this research on IPOs reinforces the importance of the following considerations:

- Carefully review the concepts related to the company’s ownership structure, including the implications of IPOs for both the business and the family.

- Examine opportunities for well-established family businesses that have a portfolio of privately held companies to take public a business within the portfolio.

- Evaluate an ESOP (Employee Stock Ownership Plan) to address differences in family willingness to support a business unit and/or the family’s concerns for the future for employees and/or business continuity without the family.

Conclusion

This research highlights the complex interplay between financial objectives and SEW considerations in family firms’ decisions to go public. By identifying three distinct IPO paths—Shine, Continue, and Challenge—the study underscores that family motivations are rarely driven solely by financial gain; instead, they reflect deeper priorities such as preserving family control, sustaining legacy, strengthening stakeholder relationships, and, in some cases, asserting generational influence.

For advisors, these findings reinforce the importance of aligning family business clients’ IPO decisions with both business needs and family goals, recognizing that mismatches between personal aspirations and organizational priorities can lead to dissatisfaction and unintended outcomes.

References

Berrone, Pascual, Cristina Cruz, and Luis R. Gómez-Mejia. “Socioemotional Wealth in Family Firms: Theoretical Dimensions, Assessment Approaches, and Agenda for Future Research.” Family Business Review 25, no. 3 (2012): 258–279. https://doi.org/10.1177/0894486511435355

Carbone, Emmadonata, Giovanna Campopiano, Alessandro Cirillo, and Donata Mussolino. (2024). “Why and How Do Family Firms Go Public? A Socioemotional Wealth Perspective of IPO.” Family Business Review 37, no. 4 (2024): 400–430. https://doi.org/10.1177/08944865241273380

Chua, Jess H., James J. Chrisman, and Alfredo De Massis. “A Closer Look at Socioemotional Wealth: Its Flows, Stock and Prospects for Moving Forward.” Entrepreneurship Theory and Practice 29, no. 5 (2015): 173–182. https://doi.org/10.1111/etap.12155

Gómez-Mejia, Luis R., Katalin Takács Haynes, Manuel Nuñez-Nickel, Kathyrn J. L. Jacobson, and José Moyano-Fuentes. “Socioemotional Wealth and Business Risks in Family-Controlled Firms: Evidence from Spanish Olive Oil Mills.” Administrative Science Quarterly 52, no. 1 (2007): 106–137. https://doi.org/10.2189/asqu.52.1.106

Hauck, Jana, Julia Suess-Reyes, Susanne Beck, S, Reinhard Prügl, and Hermann Frank. “Measuring Socioemotional Wealth in Family-Owned and -Managed Firms: A Validation and Short-Form of the FIBER Scale.” Journal of Family Business Strategy 7 (2016): 133–148. https://doi.org/10.1016/j.jfbs.2016.08.001

1 Carbone et al., “Why and How,” 418.

2 Carbone et al., “Why and How,” 417.

About the Contributor

Rocki-Lee DeWitt, PhD, FFI Fellow, is a professor of management in the Grossman School of Business at the University of Vermont. Her scholarship and advising address corporate restructuring, turnaround management, downsizing, unanticipated leadership changes in family business, and the effects of these events on entrepreneurial pursuits and innovation. She can be reached at Rocki.DeWitt@uvm.edu.

View this edition in our enhanced digital edition format with supporting visual insight and information.