View this edition in our enhanced digital edition format with supporting visual insight and information.

Thank you to this week’s contributor and member of the Applied Research Board, Louisa Brunner, for her précis of “From Intention to Trust to Behavioral Trust: Trust building in family business advising.” The article will appear in the June 2021 issue of FBR. In the précis, Louisa provides a summary of the research and key findings, and explores the practical implication of the research for families, advisors, and researchers in the field.

INTRODUCTION

In family businesses, the business and ownership are closely connected to the family. In such enterprises, goals are not only economic or financial, but affected by socioemotional wealth (SEW) aspects. SEW is mostly determined by the emotional dimension: the family’s strong identification with, attachment to, and control of the company (Berrone et al., 2012), with trust being a crucial element. These SEW factors can strongly impact the family business owner manager’s choice about important external stakeholders, including third-party advisors.

This study investigates the evolving relationship and trust building between family businesses—which the authors’ model refers to as the trustor—and their external third-party advisors—which the authors call the trustee (formally, paid external advisors such as accountants, bankers or boards, and informally, spouses)—through the cognitive and affective lens of a psychological approach. For example, on a cognitive level, third-party advisors can play a pivotal role in facilitating generational transitions and supporting the future leadership (Corbetta & Salvato, 2013). On an affective level, advisors can use their own competence or specific ability, such as using their empathy (Strike 2013) to build rapport and employing their emotional intelligence to mitigate overt and covert fears, uncertainties, and/or resistances within the family business.

Trust building is an interactive and interpersonal process that involves an affective dimension comprised of intimacy and bonds, and it depends on the readiness of both the trustor and the trustee to engage in a relationship. On one hand, it is important that the trustor be willing to take the risk of trusting another person and of being exposed to the trustee’s ideas and behavior from a vulnerable position. On the other hand, the trustee’s attitude and ability to enter and create a trustworthy relationship is fundamental to becoming a third-party trusted advisor, in particular a long-term advisor who can strongly impact both the family and the business.

Although the third-party advisor’s important stakeholder role is acknowledged in academic research, and although trust plays a fundamental role and can also be a competitive advantage, the decision-making and trust building dynamic at the micro-level between trustor and trustee has had limited research.

This inductive, multi-case, qualitative study aims to fill the gap by capturing the deep nuances of this process and its underlying psychological dynamics, through the experience of the top management and their third-party paid advisors in 20 family businesses in Switzerland.

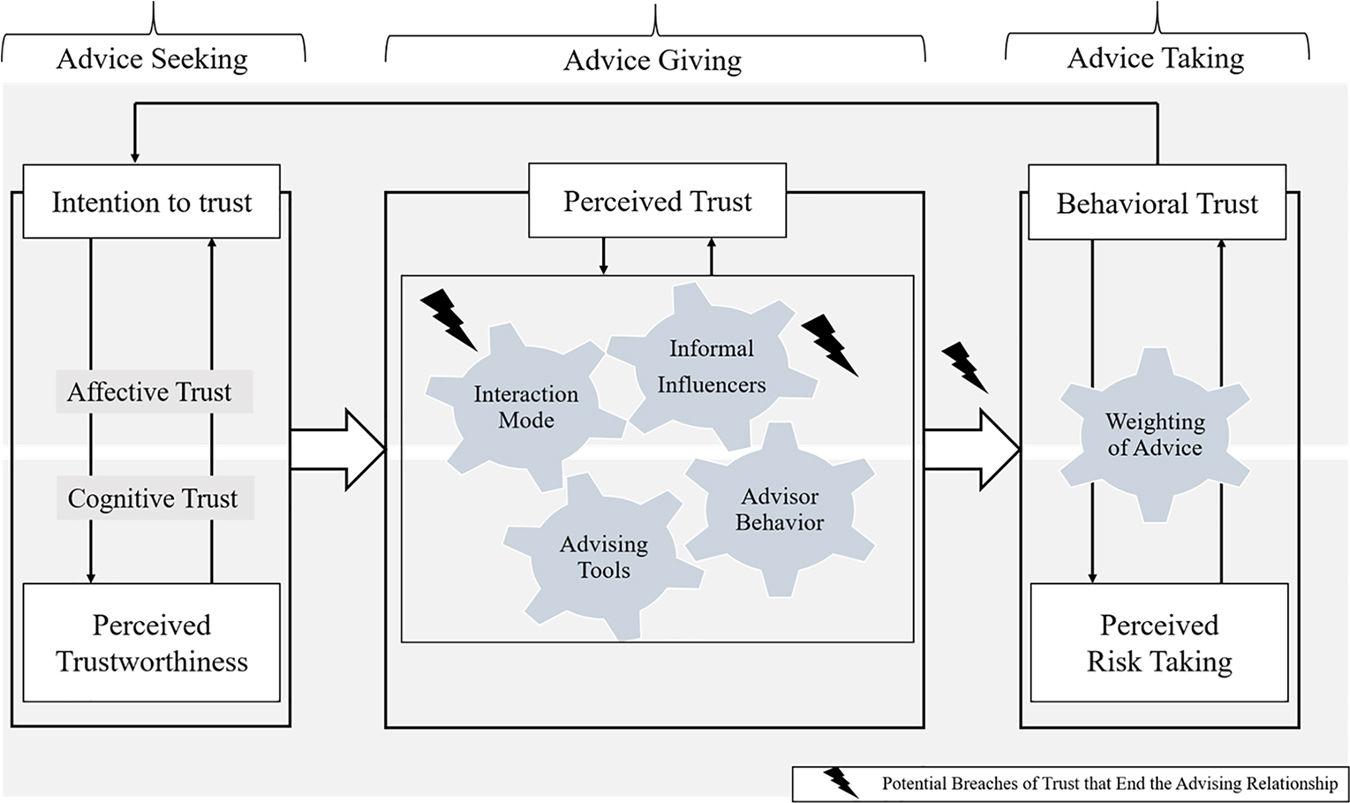

The research identifies three phases—advice seeking, advice giving, and advice taking—to explore the relationship and trust building between the family business and the external advisor.

FINDINGS

The study identified three different types of trust—intention to trust, perceived trust, and behavioral trust—in the evolving trust relationship between the family business owner manager and the third-party advisor.

1. Intention to Trust

“Intention to trust” pertains to the readiness of the family business trustor to become engaged in a trust relationship with an advisor and to trust him/her in the initial stages of the relationship. It can depend on the following qualities:

- Observable Advisor Attributes: Manifest demographic attributes such as age, gender, citizenship, and nationality can play an important role in the trustor’s choice and in assessing the advisor’s competence.

- Advisor Experience: For the trustor, education is a required given, but not a guarantee of high-quality advice, while experience and demonstrable prior success are appreciated.

- Rapport: Perceived chemistry and alliance, e.g., liking each other, common interests and hobbies, etc., can enhance the trustor’s trust and are more significant than observable attributes.

- Existing Relationships: In their choice of an advisor, trustors often take into consideration references, recommendations (especially from other family businesses or friends), shared values, a similar history (often family business advisors have a connection to a family business in their own family), the ability to guarantee confidentiality, and belonging to the same social circles.

2. Perceived Trust

Perceived trust depends on whether the trustor perceives the advisor’s actions as trustable or not. The following may be taken into consideration:

- Interaction Mode: This aspect concerns the availability for personal contact, be it informal or formal, long-term or short-term. Trustors prefer face-to-face encounters.

- Advisor Behavior: Trustors value honesty, modesty, reliability, open communication, the offer of feedback, a caring and attentive attitude, empathy, the capacity to recognize mistakes, and the demonstration of trustworthy behaviors.

- Advising Tools: Among the methods that support and facilitate the relationship between trustor and trustee are listening skills, time availability, open questions, offering alternatives, and visualizations.

- Stakeholders Interaction: Employee and family member involvement, both formally and informally, may be important if the advice can impact them.

3. Behavioral Trust

Behavioral trust is perceived and manifested when the owner manager decides to accept the risk of taking the advice of a trusted third-party advisor. Such acceptance may involve the following aspects:

- Readiness to Assume Risks: Risk assumption could be influenced by the trustor’s personality, whether decisions are taken intuitively, emotionally, or rationally, as well as gender and age.

- Family Business Values and Culture: Organizational culture and the capacity to tolerate the uncertainty inherent in any advising and change process, organizational values, and adopted routines all impact the acceptance of advice.

- Life-cycle: The acceptance of external advice is dependent upon different generations’ (first, second, etc.) attitude towards advising, the firm’s increasing complexity over generations, the generations’ levels of emotional attachment to the firm, and the willingness to delegate to external parties (delegation is more common in subsequent generations.)

- Breaches of Trust: Past and present experiences of unreliable behavior and low quality of advice can abruptly stop the advising relationship.

A process model of building trust in the family business/advisor relationship is portrayed in Figure 1. It integrates the three phases of advice giving and incorporates the three types of trust.

Figure 1: de Groote, J.K and Bertschi-Michel, A. (2020)

IMPLICATIONS

Implications for Advisors

- The model of the trust building process (Figure 1) can be helpful for family enterprise advisors both before and throughout any advising work. Keeping it in mind can enable advisors to position the advising process within this context and to test the level of trust building throughout an engagement. For example, the advisor should take into consideration that the trustor’s intention to trust can involve both an affective dimension (intuition, rapport, modesty) and a cognitive one (recommendations, age, geographic similarities), that during the whole process the trustor continually assesses the trustee, comparing the first impression with the one currently experienced, and that there can be breaches of trust.

- Investing time in trust building and learning more about the perception of the socioemotional dimension in the relationship with a specific family business system can enhance the advising task.

- Advisors should be alert to the notion that for trustors, seeking and taking advice may mean taking a risk and being in a vulnerable position, a “voluntary vulnerability” (Davis et al., 2000) in relation to another party. This requires a certain level of duty of care on the advisor’s part.

Implications for Family Firms

- An executive summary of this study would be helpful for family businesses to show that trust building is not linear nor immediate. Rather, it entails an underlying process, requires an investment of time, the emotional and cognitive availability to take risks, and can have some up and down cycles.

- As this study shows, in appraising a potential advisor, the owner manager tends to privilege the affective dimension, perhaps also with the hope that over time it could develop into a friendly relationship, reducing the feelings of loneliness often felt by family business owners and leaders. A more rational, cognitive approach can help avoid the premature idiosyncratic judgements or quick decisions often made to lower the anxiety of uncertainty inherent in any change or advising process.

Implications for Applied Research

- This study’s area of investigation is a specific national and economic one: Switzerland with its social and cultural identity. Further research in other contexts can test the trust building process model developed by the authors and the impact of a similar or different cultural and national background on advice seeking, giving, and taking.

- Additional studies may also explore other aspects, such as the number of advisors involved and the length of the advising project.

- Family businesses’ perception of their need for an advisor, the influence of time pressure in advice seeking, and the impact of a longer versus a shorter trust building process may be studied in more depth.

- This study is evidence for the ways in which foundations from psychology can contribute to a better understanding of complex family business dynamics such as trust building, therefore more applied qualitative research of this type is needed.

REFERENCES

Berrone, P., Cruz, C., & Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25(3), 258-279. https://doi.org/10.1177/08944.

Davis, J. H., Schoorman, F. D., Mayer, R. C., & Tan, H H. (2000). The trusted general manager and business unit performance: Empirical evidence of a competitive advantage. Strategic Management Journal, 21(5), 563-576. https://doi.org/10.1002/(SICI)1097-0266(200005) 21:5<563::AID-SMJ99>3.0.CO;2-0.

Salvato, C., & Corbetta, G. (2013). Transitional leadership of advisors as a facilitator of successors’ leadership construction. Family Business Review, 26(3), 235-255. https://doi.org/10.1177/0894486513490796.

Strike, V. M. (2013). The most trusted advisor and the subtle advice process in family firms. Family Business Review, 26(3), 293-313. https://doi.org/10.1177/0894486513492547.

About the Contributor

Louisa Diana Brunner, PhD, FFI Fellow, is a leadership consultant, coach, family business researcher and advisor in Milan, Italy. She has a longstanding international experience in systemic-psychodynamic group relations. She can be reached at louisadiana.brunner@gmail.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.