Research Applied: FBR Précis on How Some Family Firms Boost Innovation Prior to Succession

Thank you to Peter Jaskiewicz, James Combs, Torsten Wulf, Thomas Dorsch, and Katrina Barclay, for this précis of their article “Uncertainty around Transgenerational Control: Implications for Innovation Prior to Succession,” which appeared in the December 2023 issue of Family Business Review.

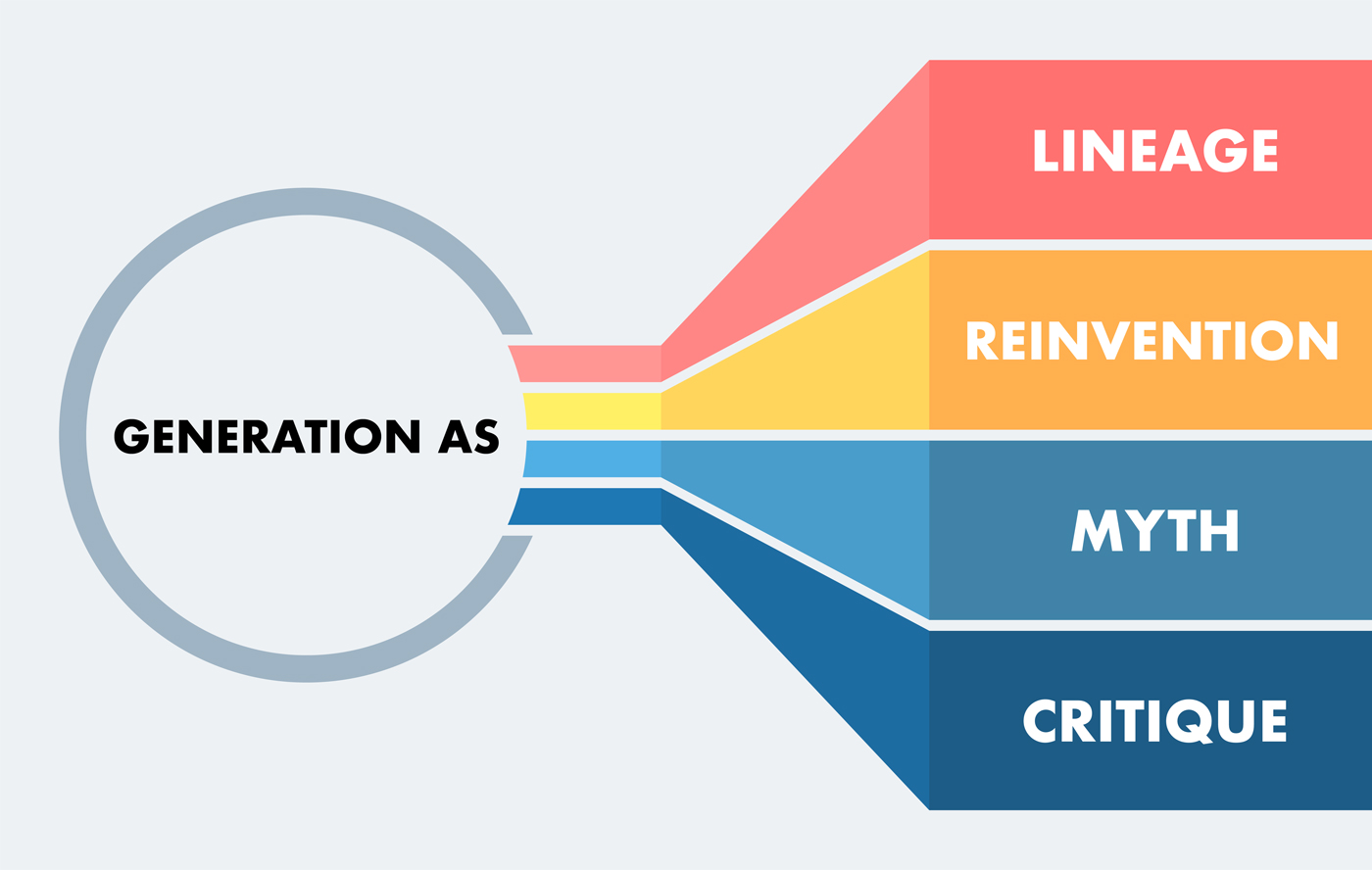

Research Applied: FBR Précis on the use of Generation as Rhetorical History in Family Business

Thank you to this week’s contributor, Louisa Diana Brunner, for sharing her précis of “Talking About (My) Generation: The Use of Generation as Rhetorical History in Family Business” – an article that appears in the March 2023 issue of FBR.

Research Applied: FBR Précis on Socioemotional Wealth and Its Influence on CSR Strategy

Thank you to this week’s contributor, Navneet Bhatnagar, for sharing his précis of “Examining Heterogeneous Configurations of Socioemotional Wealth in Family Firms through the Formalization of Corporate Social Responsibility Strategy” – an article that appears in the June 2023 issue of FBR.

Research for Clients

As part of its mission, FFI strives to advance the field of family enterprise through applied research, providing practitioners with practical applications for research conducted by academics from around the world.

Research Applied: An FBR Précis on Family Firms and Environmental Performance

Thank you to this week’s contributors, Alfredo De Massis and Ivan Miroshnychenko, for their précis of “Family Firms and Environmental Performance: A Meta-Analytic Review.”

Research Applied: FBR Précis for FFI Practitioner

Thank you to this week’s contributor, Kim Schneider Malek, for her précis of “Over My Dead Body”: Wives’ Influence in Family Business Succession.”

Research Applied: FBR Précis for FFI Practitioner

Thank you to this week’s contributor and member of the Applied Research Board, Kavil Ramachandran, for his précis of “Kinship and Gender in Family Firms: New insights into employees’ organizational citizenship behavior.”

Research Applied: FBR Précis for FFI Practitioner

Thank you to this week’s contributor and member of the Applied Research Board, Louisa Brunner, for her précis of “From Intention to Trust to Behavioral Trust: Trust building in family business advising.”

Research Applied: FBR Précis for FFI Practitioner

Thanks to this week’s contributor, Kim Schneider Malek of the FBR Research Applied Board, for her précis of “Founder-Controlled Family Firms, Overconfidence, and Corporate Social Responsibility Engagement: Evidence from Survey Data,” which appears in the March 2021 issue of FBR.

Research Applied: FBR Précis for FFI Practitioner

This week, we are pleased to publish the first précis of the 2021 Applied Research Board.

Research Applied: FBR Précis for FFI Practitioner

Thank you to this week’s contributor, Navneet Bhatnagar of the FBR Research Applied Board, for sharing his précis of “Community Socioemotional Wealth: Preservation, Succession, and Farming in Lancaster County, Pennsylvania” – an article that appears in the September 2020 issue of FBR.

Research Applied: FBR Précis for FFI Practitioner

Thank you to this week’s contributor, Navneet Bhatnagar of the FBR Research Applied Board, for sharing his précis of “Listening to the Heart or the Head?

Research Applied: FBR Précis for FFI Practitioner

In this week’s FFI Practitioner, we are pleased to share a précis of “Multilayered Socialization Processes in Transgenerational Family Firms” – an article that appears in the September 2019 issue of FBR.

Research Applied: FBR Précis for FFI Practitioner

What organizational configurations lead to the highest levels of innovation in family firms? In this week’s edition, which is a précis of “A Configurational Approach to Family Firm Innovation,” an article appearing in the June 2019 issue of FBR, Navneet Bhatnagar explores this question and its implications for family enterprise advisors.

Research Applied: FBR Précis for FFI Practitioner

How do the personalities differ between family and nonfamily CEOs and what impact could this difference have on the performance of family businesses? In this week’s edition, Kim Schneider Malek reexamines the popular argument about family and nonfamily CEOs through her précis of “CEO Personality: A Different Perspective on the Nonfamily Versus Family CEO Debate,” an article appearing the March 2019 issue of FBR.

Research Applied: FBR Précis for FFI Practitioner

How can relationship conflict and socioemotional costs impact a family business owner’s subjective assessment of the firm’s value? In this week’s edition, which is a précis of “Relationship Conflict, Family Name Congruence, and Socioemotional Wealth in Family Firms,” an article appearing in the December issue of FBR, Navneet Bhatnagar explores this question and the relevant implications for practitioners.

Research Applied: FBR Précis for FFI Practitioner

In a rapidly evolving and increasingly competitive environment, is the need for an Entrepreneurial Orientation critical to ensuring the long-term survival of family firms? In this week’s edition, which is a précis of “Entrepreneurial Orientation and the Family Firm: Mapping the Field and Tracing a Path for Future Research,” an article appearing in the September issue of FBR, Maya Prabhu explores this question and the important implications of this research on the field.

Research Applied: FBR Précis for FFI Practitioner

This week’s FFI Practitioner continues the month-long series of editions relating to the theme of “Reflections.” Thank you to Ken Moores for this reflective précis, where he examines the research conducted about developing a legacy of an entrepreneurial mindset in “The Development of an Entrepreneurial Legacy: Exploring the Role of Anticipated Futures in Transgenerational Entrepreneurship,” an article that appears in the September 2018 issue of FBR.

Research Applied: FBR Précis for FFI Practitioner

Among the unique characteristics differentiating family enterprises from their non-family counterparts is that family-owned businesses are much more driven by nonfinancial social and emotional motivators. In this week’s edition, Kim Schneider Malek explores the research that has been conducted on socioemotional wealth through her précis of “More Than Meets the Eye: A Review and Future Directions for the Social Psychology of Socioemotional Wealth,” an article appearing the March 2018 issue of FBR.

Research Applied: FBR Précis for FFI Practitioner

In this week’s FFI Practitioner, we are pleased to share a compelling précis of “Nonfamily Members in Family Firms: A Review and Future Research Agenda” – an article that appears in the March 2018 issue of FBR. Thanks to Guido Corbetta of the FBR Research Applied Board for sharing an insightful review of the research’s key findings as well as discussing its practical implications for advisers in the field.