View this edition in our enhanced digital edition format with supporting visual insight and information.

Thank you to this week’s contributor, Sajjad Hamid, for his article exploring digital tools that family enterprise advisors can use to expand their practice.

Service professionals are experiencing seismic changes due to the widespread adoption of digital technologies and the resulting shifts in client preferences. The pandemic also likely contributed to this increased adoption rate for several technologies that benefit both the advisor and the family enterprise client.

A family business advisor has no choice but to find new ways to generate income, manage costs, and take risks. While traditional consultants and advisors are stuck in the rituals of gaining references from other aligned professionals (lawyers, accountants, bankers, insurance agents) and word of mouth from satisfied clients, those with new mindsets will experiment with new tools. The advisors with a different mindset will question how one can build a practice more quickly and how to broaden their horizons using the latest digital tools.

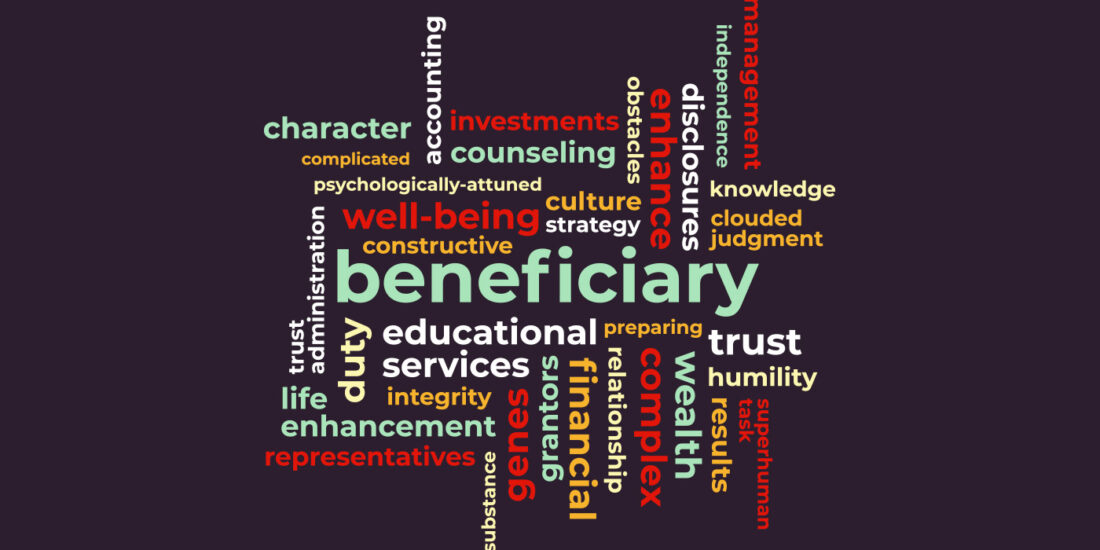

Knowledge Entrepreneur

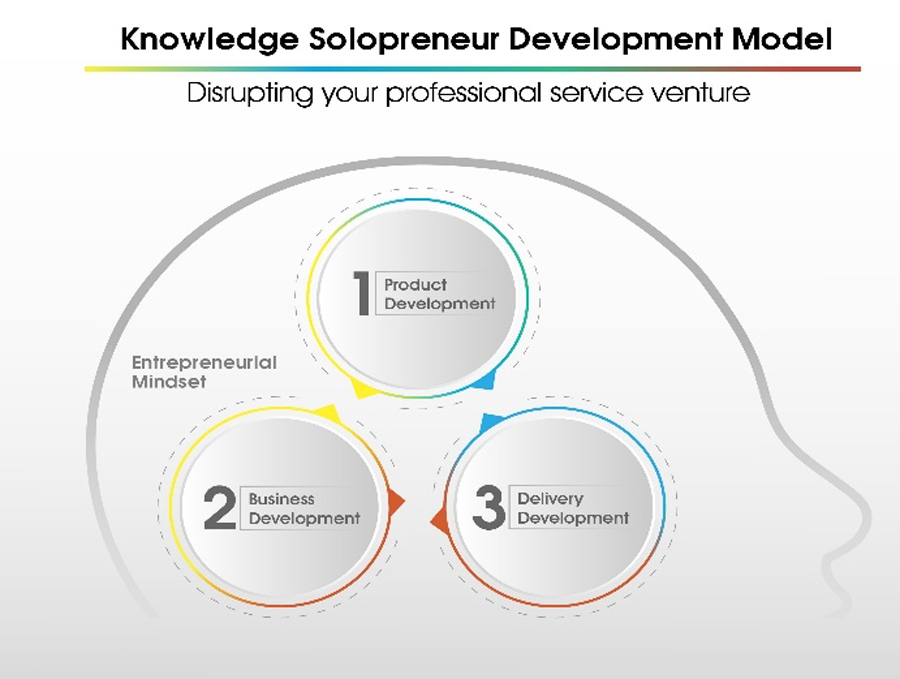

In a previous FFI Practitioner article, I explored how family enterprise advisors are developing a new way of thinking about building relationships and are becoming knowledge solopreneurs (since many advisors are soloists). I introduced the Knowledge Solopreneur Development Model to advance this new way of thinking.

This model suggests that advisors think and act like entrepreneurs, as their enterprise family clients do. They can develop an innovative product(s) based on experimentation, use business development (often with digital marketing), and deliver their offering while constantly striving to further refine it. Information technology (IT) can make this process of ongoing refinement achievable on a more efficient and inexpensive scale.

For advisors, changing their “traditional” advisor mindset to an entrepreneurial mindset is all about adapting; furthermore, entrepreneurship often requires advisors to work outside of their comfort zones. No industry or profession will be immune from technology, and as a solopreneur, quick adoption can be critical to success. Advisors may have an overblown fear of technology, as they have accepted virtual meeting software during the pandemic. However, the world of virtual knowledge marketing offers much more.

Digital Platforms

In the previous paradigm, advisors would generally develop a proposal after some initial discussions with a family and then would likely engage the client with face-to-face interventions. Today, they can use a learning management system (LMS) to develop relationships in cyberspace. The development of these knowledge platforms is akin to Jeff Bezos using Kindle Direct Publishing to make self-publishing more accessible and marketing books on a global scale.

However, investing considerable sums to develop an LMS is no longer necessary, as many of them have monthly subscriptions and offer many options to build an advisory practice. Teachable and Kajabi are two examples of LMSs that offer broad avenues to sell coaching, mentorship, training courses, podcasts, books, and newsletters. While advisors may not want to expand their current offerings beyond core advisory services, they should be mindful that advising could include complimentary products, such as coaching and workshops.

Product Development

An LMS offers ways to develop and test innovative products. Suppose an advisor wants to test the idea of creating a community of followers, as influencers have on YouTube or LinkedIn. In that case, the advisor could start a public-facing platform to give general advice, while also offering private advisory services for a fee. While B2B professionals will never have millions of followers, a few thousand family business connections can be profitable. Advisors could also drive prospects to their digital community by offering them a newsletter (free or paid) to sign up for.

Three Cs are essential to the virtual family business advisor. First, virtual advisors need content—advice and innovative interventions where prospects can see the advisor as a thought leader. The advisor’s experience or research on a topic can offer valuable tips to these prospects. However, developing courses, webinars, articles, newsletters, and other digital downloads can burn out even the best practitioner. Artificial intelligence (AI) has made developing content easier, as mechanization did for mass production.

The second C is consistency, and virtual professionals should recognize that their audience might consume their content at a rapid pace. Advisors should accordingly post frequently and respond on a timely basis.

The third C is confidence, which is probably the biggest obstacle in transitioning to a virtual or hybrid model. Digital technologies require a different learning curve and an understanding of their effectiveness.

Business Development

Client acquisition requires three generic competencies: an entrepreneurial mindset and both sales and marketing talents. As pointed out, advisors must act like entrepreneurs to create innovative products and strategies. Selling has come a long way since the travelling salesclerk. With an LMS, virtual advisors can use a multitude of options to market their specific offerings. For example, if an advisor wanted to hold a free webinar to get prospects to register for a course or to get advisory clients, the advisor could send an automated email sequence over a couple of days. After participants have completed the paid workshop, they could be surveyed to determine if they feel prepared to implement the key takeaways from the course. Those participants who want more guidance may benefit from being offered a paid mentorship or advisory options. For a virtual advisor, the potential offerings can span the continuum of a business interventionist.

In essence, digital tools make advisory marketing more effective. Advisors can even upsell books and podcasts and direct their social media traffic to their community pages.

Delivery

When hosting a virtual event or creating a newsletter, advisors may even be able to attract sponsors and expand their income streams. Alternatively, advisors may choose to adopt a direct monetization model where they can forego ads and sponsorship and instead control their podcasts and newsletters in a direct-to-content way.

In addition, hosting a virtual training workshop on an LMS makes it easy to house presentations, quizzes, video links, chat meetings, and live sessions. Almost all LMSs have payment platforms, so clients can pay virtual advisors securely through their websites. LMSs and other virtual tools (SurveyMonkey, Zoom, and Calendly) can lower the barrier to entry for new advisors.

Family Business Advisor as SUV

Aspiring advisors no longer need to wait years to build a business. If they want to test the waters as a part-time player, digital technologies offer hope in starting a business with little financial investment or brand equity. For more established advisors, these tools can still help to generate leads, support delivering content to their community, or adopt a virtual business model.

The family business advisor’s title might be a misnomer in the future. The traditional advisor may perceive this change as “fast food advising;” however, the profession has to advance beyond advising, to involve training, community building, and using digital technologies to expand the product offering.

How you are defined will be dependent on how your clients perceive you.

About the Contributor

Sajjad Hamid, ACFBA, is an entrepreneurship educator at a community college in Trinidad and Tobago, and he lectures on entrepreneurship and family business management. Previously, he worked for a Fortune 500 company as a business development manager for the southern Caribbean. Sajjad serves on the board of directors for the Chaguanas Chamber of Industry and Commerce, and he assists SME owners in upscaling their ventures through training and consulting and growing family businesses. He can be reached at

entrepreneurtnt@gmail.com

View this edition in our enhanced digital edition format with supporting visual insight and information.