View this edition in our enhanced digital edition format with supporting visual insight and information.

Family enterprise advisors play a crucial role in guiding their clients through an ownership transition from a sibling partnership to a cousin consortium. As ownership moves to a group of cousins that is potentially much larger and more diverse than prior generations of family co-owners, advisors may need to introduce new strategies to help their clients resolve conflicts, make decisions, and formalize governance structures. In this article, Chirag Baid and Bharathi V discuss the unique challenges of this ownership transition and suggest tactics for family enterprise clients who are transitioning business ownership to a cousin consortium.

As family businesses transition through generations, cousins often find themselves at the helm, navigating complex dynamics that involve both familial ties and business interests. Collaborating with cousins in succession planning is crucial for ensuring the longevity and stability of family-owned businesses. Succession planning in large families can be an increasingly complex and sensitive process that can contribute to conflicts between siblings and cousins. These conflicts, if not managed properly, can disrupt family harmony and undermine the effective transition of ownership and leadership. Unlike siblings who grow up in the same household, cousins often come from increasingly diverse backgrounds, bringing varied experiences and perspectives. This diversity can spark both innovation and conflict.

By focusing on common goals and implementing professional management practices, cousins can transform potential challenges into opportunities for growth. This approach allows them to utilize their diverse perspectives and shared family values, ultimately driving the business towards long-term success.

Managing the Business in the Cousin Consortium Stage

To be successful in the cousin consortium stage, it is desirable to think of the cousins group as one broader family engaged in one enterprise. To help ensure the overall unity and success of the business, it is important to avoid the creation of internal factions and reduce the impacts of any inequity towards specific family branches. The cousin stage business can focus on five key areas:

- Business Strategy: Developing a cohesive business strategy is crucial for long-term success, involving clear goals, market analysis, and regular reviews. It is beneficial if all family members involved in the enterprise understand and work towards the shared vision, ensuring decisions support the enterprise’s growth and sustainability.

- Leadership: Effective leadership within a family business involves identifying and nurturing talent based on merit, skills, and experience through development programs, mentoring, and education. Collaborative decision-making further strengthens leadership across the organization.

- Family Employment: As the family business evolves, it’s essential to establish or review existing employment policies to ensure they establish clear entry standards, and match roles to individual skills, ensuring opportunities align with both family members capabilities and the Company’s needs.

- Compensation: A fair and competitive compensation policy includes a baseline salary structure that aligns with industry standards, performance-based bonuses and incentives tied to measurable metrics, and appropriate compensation for non-family managers to recognize their crucial role in the business.

- Managing Expectations: Managing expectations in a family business involves clearly defining roles and career paths to align personal and business goals. Open communication, regular family meetings, and a defined governance structure foster transparency and mutual respect, helping to resolve issues and avoid conflicts.

Why Cousin Cooperation Is Important

As the family business evolves, the dynamics and relationships among the next generation of owners, often cousins, become crucial to maintaining stability, fostering growth, and ensuring the long-term success of the enterprise.

Strengths of Cousin Cooperation

- Diverse Perspectives and Skills: Cousins with diverse educational backgrounds and professional experiences bring a wide range of skills and perspectives, fostering innovation, comprehensive problem-solving, and a holistic understanding of the business landscape, enabling the family business to adapt more effectively to changing markets and challenges.

- Enhanced Decision Making: Collaborative efforts among cousins lead to inclusive decision-making and shared responsibility, ensuring multiple viewpoints are considered and fostering commitment to the success of strategic plans.

- Expanding Networks and Opportunities: Joint efforts with cousins expands the family business’s network and allows for resource sharing, leveraging diverse professional connections and pooling financial, intellectual, and social assets for new opportunities and competitive advantage.

- Building a Sustainable Legacy: Collaboration among cousins creates a long-term vision and resilience for the family business, aligning goals to stay true to founding values and providing a united front against external pressures and market fluctuations.

By leveraging the strengths of cousin cooperation, family businesses can tap into significant potential. Through the pooling of knowledge, dedication to common values, and a collaborative approach, cousins can drive the family enterprise forward, securing its ongoing success for future generations.

Potential Causes of Conflicts Among Cousins

- Diverging Interests and Goals: Cousins may pursue different career paths from each other, ranging from professions in medicine, law, engineering, business, arts, or academia. These diverse career trajectories can influence their perspectives on how the family business should be managed or whether it should continue to be collectively owned.

- Financial Objectives: Cousins often have diverse financial objectives and investment philosophies, ranging from emphasizing immediate profits to long-term stability and growth. Some may prefer to reinvest profits into expanding the family business, while others may advocate for dividend distributions or diversification into new ventures.

- Favoritism and Perceived Injustice: Parents or senior family members may be perceived to have favored one cousin over another, leading to resentment and a sense of unfairness.

- Risk Appetite: Varied risk tolerances among family members play a crucial role in shaping decisions related to investments, diversification strategies, and the willingness to take on debt. While some emphasize conservative financial practices aimed at safeguarding wealth, others advocate for more aggressive growth strategies aimed at expanding assets and seizing opportunities.

- Emotional Ties: Emotional ties within families can deeply influence succession planning, often intertwining with past family dynamics to complicate rational decision-making. Family traditions, historical conflicts, and personal relationships can deeply influence how roles are perceived, and decisions are made within the family enterprise.

- Communication Breakdown: Lack of open communication about expectations, roles, and ownership structures can breed mistrust and hinder collaborative decision-making.

Strategies for Bridging Conflicts Among Cousins

- Developing Effective Owners: Families can focus on developing members of the cousin group to effectively assume a variety of roles within the enterprise in the future. This will help to ensure that a number of them are prepared to serve as active owners (who take an active interest in the family business and helping to make decisions on important issues) rather than passive owners (those who take dividends but do not actively participate in making decisions for the enterprise) or investor owners (like passive owners but they make conscious decisions as long as returns are satisfactory).

- Develop Constructive Relationships with One Another: Building and maintaining constructive relationships among family members is essential for understanding one another. Cousins might consider organizing themselves to ensure inclusive decision-making and to foster commitment among shareholders, regardless of geographical distances. Strengthening family bonds through gatherings like reunions or retreats will enhance collaboration beyond business matters.

- Implement Fair Policies and Procedures: Establish and enforce fair policies regarding compensation, promotions, and performance evaluations. Create a transparent decision-making process to ensure that all family members feel involved and respected and include non-family members in the governance structure to provide unbiased perspectives.

- Address Personal and Family Needs Separately from the Business: Encourage clear boundaries between family relationships and business decisions. Schedule regular family meetings specifically for non-business discussions. This allows family members to connect, address personal concerns, and celebrate milestones outside the pressure of business decisions.

- Develop Succession Planning Documents: Formalize agreements through clear and well-drafted succession planning documents that outline ownership structure, leadership roles, and conflict resolution mechanisms.

- Build a Family Charter or Constitution: Develop a family charter or constitution that outlines the family’s values, vision, and agreed-upon rules for conflict resolution. This document can serve as a guiding framework for addressing conflicts and maintaining family harmony.

The ZOPA Model

The Zone of Possible Agreement (ZOPA) model is a framework to handle emotional negotiations, including those within family businesses. This model helps family members navigate the complexities of business and personal relationships. Family businesses often face emotional challenges that can complicate negotiations. These include personal relationships, generational differences, and varying visions for the business’s future. Effective emotional negotiation is crucial for maintaining family harmony and business success. For more on how advisors can use the ZOPA model as a guide for their clients, read FFI Practitioner’s “The ZOPA Model: An Approach for Navigating Emotional Negotiations in Family Enterprises” by Doug Gray.

Role of Family Enterprise Advisors at Cousin Consortium Stage

Family enterprise advisors play a pivotal role in ensuring the long-term success and stability of family businesses, particularly leading up to and during critical periods of transition. As family businesses move through generations, structured governance and conflict resolution can become increasingly beneficial. Effective advisors can help to identify vulnerabilities in existing governance frameworks and can guide families in establishing new, more robust structures such as family charters, family councils, and formal succession plans.

These advisors can be instrumental in preventing and resolving disputes by embedding clear governance mechanisms and dispute resolution strategies into the company’s foundational documents.

Evolution of the Role of Family Enterprise Advisors with Different Generations

As family businesses transition through generations, the need for advice evolves significantly. Research shows that advice needs are lowest in the second generation, where family experience and internal understanding remain relatively high, but increase as the business transitions to the third generation where the growing complexity in governance that comes with a cousin consortium.1 Family enterprise advisors must adapt their approach accordingly to meet the needs of each generation. This updated approach may entail moving from providing personal guidance to one founding owner in the first generation to implementing more formal and representative governance structures in the cousin consortium stage.

For example, in the controlling owner stage, an owner may seek a more personal relationship with a trusted advisor who works behind the scenes, offering support, perspective, and connections to specialized experts. As the business enters the second generation, the sibling owners’ focus may shift towards managing family interrelationships and building trust among all family members. At this stage, wealth management and estate planning expertise may become more relevant.

However, once the firm moves into a more complex cousin consortium, the family’s advisory needs can expand significantly. At this stage, family businesses may benefit from utilizing a multidisciplinary advisory team, including experts in governance, succession planning, conflict resolution, and wealth preservation, among other topics.

When working with later stage families, the advisory process may need to focus more on developing formal structures, policies, and processes, as these elements are often necessary to help manage the growing complexity of both family and business. For some families, this may also include designing a dedicated family office with external stakeholders occupying critical roles to preserve family legacy and to mitigate unwarranted disruptions to the business due to family conflicts.

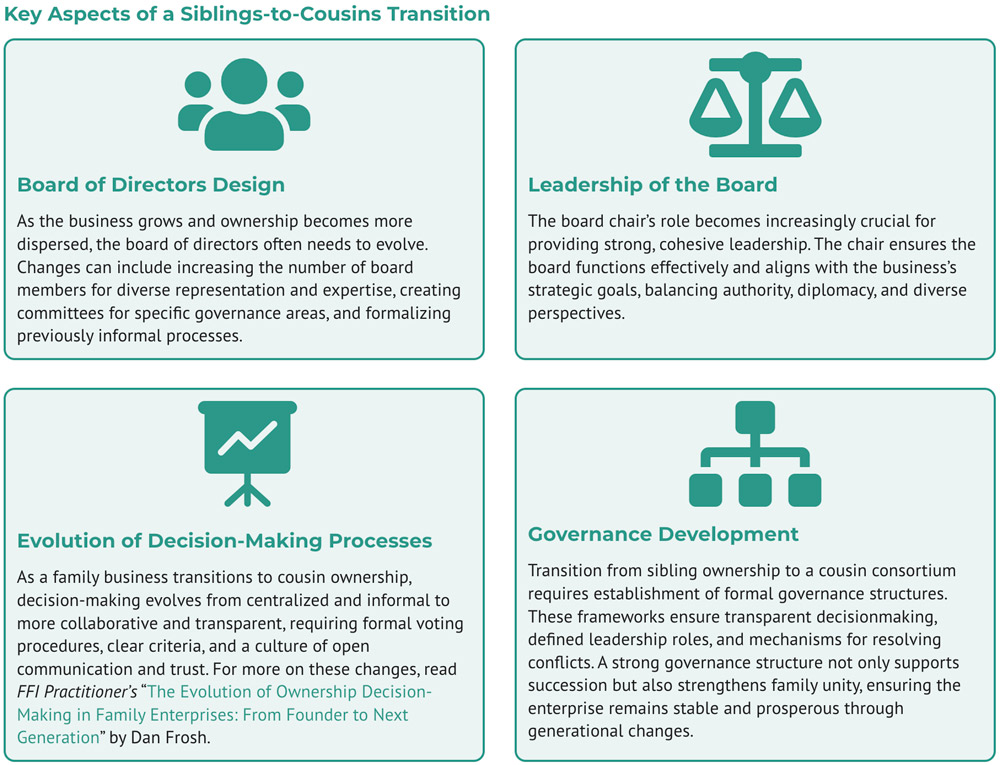

Governance in a Cousin-Owned Business

Succession planning in a family-owned business goes far beyond simply naming a new leader; it involves preparing the entire governance system for continued success and stability. This comprehensive process may include clarifying the design and function of the board of directors, the leadership dynamics within the board, and the evolving role of the chairperson. The challenge of succession becomes more complex as ownership transitions from siblings to cousins. In the sibling stage, governance is often less complex due to fewer individuals.

However, in the cousin stage, the governance system must often adapt to accommodate a larger and potentially more diverse group of stakeholders, significantly altering the foundational assumptions about governance.

Conclusion

Harmonizing heirs and resolving sibling and cousin conflicts are pivotal for the long-term success of family-owned businesses. Each new generation, especially in a cousin consortium, has the opportunity to review, renew, and revise the family business’s direction. This opportunity should not be squandered. Effective family organization with robust governance will not only strengthen familial bonds but also fortify the business itself. Eventually, the challenge lies more in uniting the family than managing the business. Without a united family, business remains at risk. When cousins set their hearts and minds towards collaboration, they can provide continuity to a thriving business and transform themselves from a disparate group into a cohesive, collaborative unit. This transformation will be both inspiring and rewarding, ensuring the business’s longevity and the family’s enduring legacy.

Reference

1 Bammens, Yannick, Wim Voordeckers, and Anita Van Gils. “Boards of Directors in Family Firms: A Generational Perspective.” Small Business Economics 31, no. 2 (2008): 163–180. https://doi.org/10.1007/s11187-007-9087-5.

About the Contributors

Chirag Baid is co-founder and CEO of Solique Advisors, a tax, regulatory, and accounting advisory company in India. Chirag is a chartered accountant and consultant with over fifteen years of specialization in tax and regulatory matters. He provides advisory, compliance, and litigation services to a wide range of clients, including global corporates, private equity funds, and UHNIs. Chirag is also a board member with the Indian arm of Nasdaq-listed entities. He can be reached at chirag.baid@soliqueadvisors.com.

Bharathi V is a semi-qualified chartered accountant and part of the tax and transaction advisory team at Solique Advisors. Bharathi specializes in areas such as foreign exchange regulations, business transfers, profit repatriations, and other related services and compliances. She can be reached at bharathi.v@soliqueadvisors.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.