View this edition in our enhanced digital edition format with supporting visual insight and information.

Thanks to this week’s contributor, Ruth Steverlynck, for sharing her diary of some insights she’s acquired as a family enterprise advisor. We hope you enjoy this week’s issue in which Ruth outlines key principles that have guided her work over the years.

For as long as I can remember, I have kept a diary to capture in a written format what I am learning both personally and professionally.

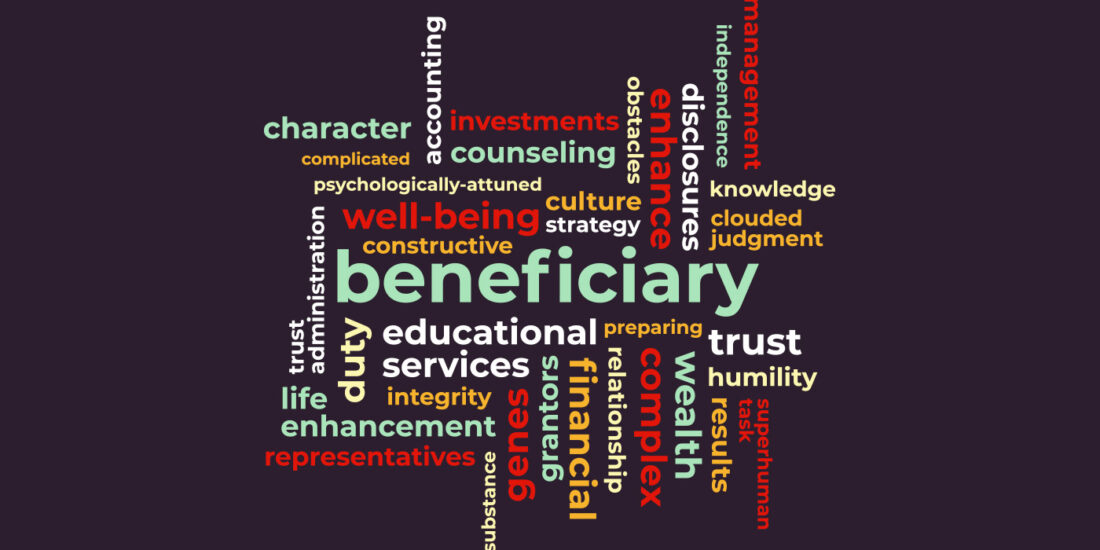

The lessons I recorded in my diaries over the years have become the key principles that guide and instruct my work today. These may be familiar to you, serve as good reminders, or perhaps help to short circuit your own learning journey.

Process Trumps Outcome

I have dedicated the past 15 years of my life to learning, honing skills, and seeking mentors – all with a view to having optimal impact for the families I serve as a family enterprise advisor. Yet I frequently feel overwhelmed when I first meet family enterprise clients. As they share their stories, and the morass of worries and concerns they are facing, I feel submerged in professional self-doubt. I ask myself, “Oh no, how am I going to solve these problems?”, a default reaction from my days as a lawyer.

In my career as a lawyer, I was a problem solver. When I met clients, I was trained to listen for the solvable problem. Clients shared, I told them what their problem was, and then I worked to solve the problem for them.

Families are confronted with multi-faceted problems, and there is not a single “expert” that can “solve” their situation. My initial feelings of helplessness emerge because I cannot “solve” family enterprise issues. But families don’t need to be “solved.” What might actually benefit them is someone who facilitates a process for them. Good process calms down the system.

When family members feel they cannot trust each other, they can trust the process. When they feel overwhelmed with the myriad of issues they are confronting, the process filters out the “noise” to allow space to focus on what matters and is meaningful. When inevitable struggles to fully understand structures and roles and expectations confront the family: good process is supported by resources to facilitate learning and understanding.

When family members are at sea emotionally, a healthy process provides the lifeboat. The consistency and predictability of the mechanics of the process allows the family to feel safe – they can rely on the process, knowing they are being taken to a place of refuge.

Form Follows Function

Traditional planning feels upside-down: structures are developed through well-meaning planning and then the expectation is that the family culture, individual goals, and shared family hopes will adjust to fit those structures. We know from sobering statistics on family wealth transitions that this type of planning does not work well for families. Instead, to help families put function ahead of form, family enterprise advisors can present clients with questions about family culture, the values and aspirations that the family wants to preserve, and which results the family wants to avoid.

If we can help families first figure out what they collectively aspire to, what from their past they wish to bring forward, and what do they most want to guard against, we can then help them think about what they need to realize their deepest hopes and to manage their greatest concerns.

Avoid Binary Conversations

Too often as advisors, we pose binary questions:

- Do you want to stay together or split up?

- Is inheritance a birthright or something that should be earned?

- Do you like working with your dad or not?

- Do you favor this option or that option?

These types of questions can deepen chasms of difference rather than bridging them.

Differences in families can feel insurmountable. If we can help families elevate their dialogue away from binary “yes/no,” “good/bad,” or “right/wrong” questions to broader questions that open up conversations, we can perhaps help families address concerns that otherwise feel like dealbreakers:

- What are all the options available to us that we can explore?

- What matters most to us as a collective that we can honor in this process?

- What is our family wealth for ultimately?

- What are the principles that we agree to that can guide how we are going to work together to make the decisions that need to be made?

Trust is the Greatest and Most Beneficial Currency

When I started in the field of advising family enterprises, I was a project-based consultant who delivered glossy outcomes. I would swoop in, red cape and all, and would blast unsuspecting clients with my 85-slide presentation featuring “best practices” in governance: family meetings, decision making models, family constitutions, etc.

My ego was front and center. It was about “What I can do for you,” and “What you need from ME.” I made unrealistic promises of “guaranteed family harmony,” multi-generational legacies, and forever structures—just “Follow My Twelve Easy Steps!”

I rarely stayed engaged long enough to earn the trust needed to actually help bring the “best practices” to life. I quickly realized that this approach was not working for the families or for me. Meaningful trust is built over time.

Here is how I build trust:

- I do what I say I will do – always.

- I strive for equanimity: I show up ready to get to work, no matter what is going on in my personal life.

- I am the same person in front of the client as I am away from the client.

- I listen and I care.

And… I have learned to trust that the greatest gift a family can receive is the gift of being listened to, cared about, and trusted that they are indeed resilient, capable, and believed in by this advisor.

The Benefits of Advisor Collaboration

There is a well-known proverb that goes, “If you want to go fast, go alone. If you want to go far, go together.”

There is no doubt that an advisor working alone can be efficient, controllable, and sometimes more palatable for the families he or she is working with. But there is simply no one discipline and no singular advisor who can meaningfully help families with all their moving parts.

I have learned to become the champion of advisor collaborations. Generally, an advisor team benefits if one person takes the initiative to get to know everyone on the team, be intentional about consistent contact together, and to share work being done to ensure a holistic approach for the family. I have also learned not to assume that advisors serving a family will automatically get together to share. Actually, I have found the opposite to be true. Yet, when the advisors from different disciplines are intentional about working in collaboration rather than in silos, the impact is much greater for the family.

Beyond the need for a team approach with our families, I rely on my own team of mentors, peers, colleagues, study groups, book clubs, and organizations dedicated to professional learning in this field. I know I simply cannot do this work without the incredible support, care, challenge, and creativity of this network.

About the Contributor

Ruth Steverlynck, FFI Fellow, is a founding partner of Your Family Enterprise and works as a private consultant to high net worth and ultra-high net worth families. She has an international background in law, dispute resolution, education, and governance, and her particular area of expertise is the arena of inherited wealth. Ruth lives in West Vancouver, Canada and can be reached at ruth@yourfamilyenterprise.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.