View this edition in our enhanced digital edition format with supporting visual insight and information.

When family business owners are evaluating non-family ownership succession options, often their advisers may suggest two primary options; selling the business to a “strategic buyer” or a “financial buyer.” However, this week’s edition presents an alternative option – selling the business to the employees, a “friendly buyer,” through an ESOP. Thank you to this week’s contributor, Dan Bayston, for sharing his analysis of ESOPs and the role they can play in a non-family ownership succession plan.

Ownership succession in a family business is one of the most difficult challenges facing owners of family enterprises and often leads to conflict, frustration, and ultimately fractured family relationships. Family stakeholders have often spent their entire professional lives building, nurturing, and cultivating a business organization that embodies their family’s values and vision. The growth of the business has been built through hard work, sacrifice, and the contributions of family members and non-family employees alike.

When next generation family members are prepared to take over senior managerial responsibilities and ownership oversight of the business, conflict tends to focus around timing and individual personalities and capabilities. However, when next generation family members are unprepared or unwilling to take on these senior executive responsibilities and/or the personal and financial risks associated with a higher equity ownership stake in the business, a different set of conflict issues arise as family members evaluate the potential alternatives of transitioning the ownership of the business to non-family owners.

Too often in this analysis, family business owners and their advisers focus only on ownership transition alternatives involving either: (1) an industry partner, sometimes a competitor, vendor or supplier – a “strategic buyer” or (2) an experienced financial investor, like a dedicated investment fund, that has an investment focus in certain industries or specific transaction structures – a “financial buyer.” Unfortunately, while the financial objectives of the selling family shareholders may be achieved through working with a strategic or financial buyer, too often the cultural values and business vision established and nurtured by the family are often lost as a result of the ownership transition.

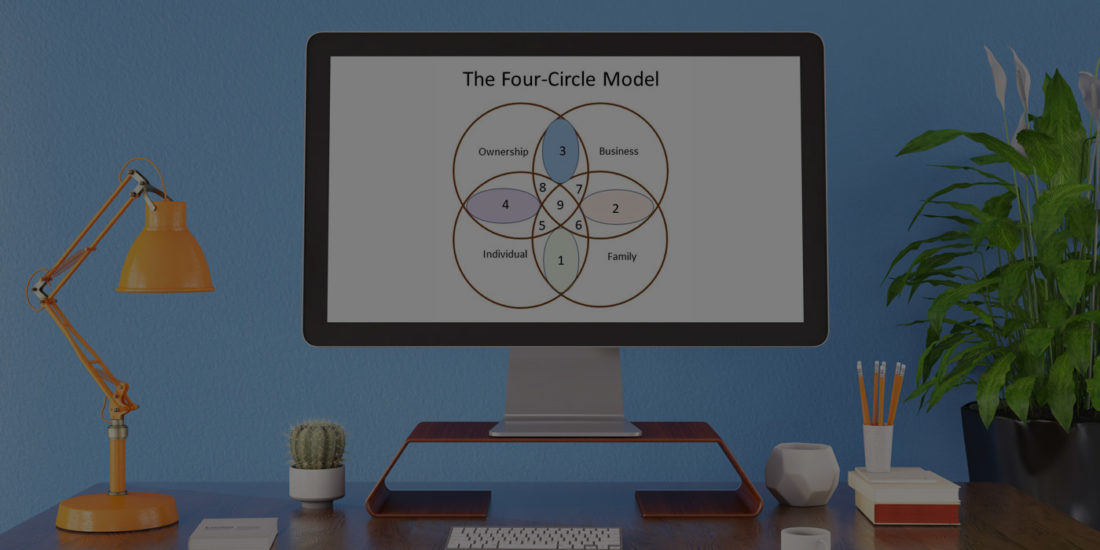

Introduced by Tagiuri and Davis in 1992, the three-circle model of family businesses (ownership, family, and business) is one of the most common frameworks for understanding family enterprises. In evaluating potential non-family ownership transition alternatives, a fourth group should also be considered – the employees. Selling a family business to a qualified retirement trust established for the benefit of the employees through an employee stock ownership plan (ESOP) is an often overlooked and sometimes controversial topic among financial advisers, family business consultants, and lawyers.

ESOPs were initially established as a viable business ownership success option for closely-held companies in the 1970’s. According to the National Center for Employee Ownership (NCEO) there exist approximately 7,000 ESOP-owned companies in the U.S. covering over 14 million employee participants. These ESOP-owned companies are involved in a wide variety of industries including manufacturing, services, finance, and construction.

An ESOP is a “friendly” buyer which pays a fair market multiple for the family business that is similar to multiples paid for other similar companies in the market. Importantly, a transaction with an ESOP buyer avoids the disclosure of confidential financial and operating information to unaffiliated third party strategic or financial potential buyers. In addition, most ESOP transactions allow (and often encourage) a continuation of the existing management leadership to operate the business. Family members who were involved in the management of the company often continue in their current positions. An ESOP transaction also provides stability to the work force and avoids the disruptive and unpredictable actions common with other third-party buyers. In addition, ESOP transactions can be structured to provide substantial tax benefits to selling shareholders and to the company.

ESOPs can be established to purchase a minority interest stake in the business. The selling shareholders are able to diversify their equity holdings and still maintain a meaningful ownership stake in the family enterprise. Strategic and financial buyers do not typically purchase minority equity positions in privately-held businesses. In addition, an ESOP is a long-term investor unlike the short-term perspective (three to five years) of many financial investors. The fact that ESOP shares are held in a qualified retirement account trust and that those shares are voted by the ESOP trustee (not necessarily the ESOP participants) provides comfort on control issues to many companies and managements considering an ESOP transaction.

ESOPs can also be structured to purchase 100% of a business, either at one time or in a series of stages. This is typically funded through the use of senior debt and seller notes. Importantly, the selling shareholders of C-Corporation stock to an ESOP can defer recognizing a capital gain on the transaction provided that the ESOP holds at least 30% of the stock immediately after the sale and the proceeds are reinvested in U.S. stocks or bonds. If these stock and bond investments are held through the selling shareholder’s lifetime, they are passed on to the shareholder’s heirs and the tax basis is automatically stepped up, so that no capital gain is ever paid on the gain on the sale to the ESOP.

From a corporate perspective, the new ESOP company can deduct from taxable income the contributions required to service the debt (both interest and principal) needed to fund the transaction. This improves the company’s cash flow compared to conventional financing. For S-Corporations that are 100% owned by an ESOP, no federal income taxes are imposed on the company’s income, because ESOP retirement trusts are considered nontaxable entities for federal tax purposes.

From an employee perspective, the shares in an ESOP are held in a tax-exempt trust retirement account for the benefit of the employees. A participant’s account balance is paid out upon retirement, death, disability, or separation from service. In the interim, an employee receives an account statement at least annually that shows the number of shares allocated to their account, the value of the shares (as determined by the plan trustee, based on a valuation by a third-party appraiser), and their vested account balance – similar to a 401(k) account statement. There is no legal obligation for the company to share any financial information to the ESOP participants. However, most successful ESOP-owned companies share at least certain abbreviated financial and operational information to better educate the employees on factors that impact the value of the business.

While the objectives of selling family shareholders vary, a great benefit of an ESOP transaction structure is the flexibility in its design, magnitude, and timing. In June 2018, Barnes, Inc., a 175 employee lawn care and snow removal business, was sold by its founders to an ESOP. Co-founder Mark Barnes discussed his decision and commented, as cited by the NCEO, “I didn’t want the legacy to be that we walked off into the sunset with a bunch of money. I realized the sale to a third party was going to mean that a lot of these people were going to lose their jobs…. It was likely their positions would be implicated by a parent company that would have bought us out. My wife and I realized that’s not what we wanted.”

Similarly, when Regent Surgical HealthCare, an owner and operator of 23 ambulatory surgery centers, was assessing its ownership transition options in 2017, co-founder and Chairman Tom Mallon commented: “Regent considered various strategic financial alternatives as we evaluated the proper ownership transition of the business including the sale of the company to a strategic or financial buyer. We ultimately chose to sell the business to the employees – our partners – so they can directly participate as owners in the future financial benefits of executing our successful business model.”

For family firms faced with the decision to potentially discontinue or contract family ownership of the business, shareholders and their advisers would be well advised to expand their nonfamily ownership transition discussions beyond traditional strategic and financial buyers. A properly structured ESOP transaction involving the sale of stock to a qualified retirement trust for the benefit of the company’s employees may, in fact, achieve more of the financial, tax and estate planning, organizational, cultural, and legacy objectives of selling family shareholders. Expanding traditional thinking through the three-circle model of family businesses to include the employees provides another viable and attractive alternative for sellers of family businesses.

About the contributor

Daniel Bayston, CFBA, CFA is a managing director of Cognient Group in Chicago, IL. He has over thirty-five years of professional experience in advising privately-held and family-owned firms on corporate valuation matters and strategic corporate ownership alternatives. He also sits on the board of directors for several privately-held and ESOP-owned companies. He has served on the board of directors of the Family Firm Institute and currently serves as its Treasurer. Mr. Bayston can be reached at dan.bayston@cognient.com.

Daniel Bayston, CFBA, CFA is a managing director of Cognient Group in Chicago, IL. He has over thirty-five years of professional experience in advising privately-held and family-owned firms on corporate valuation matters and strategic corporate ownership alternatives. He also sits on the board of directors for several privately-held and ESOP-owned companies. He has served on the board of directors of the Family Firm Institute and currently serves as its Treasurer. Mr. Bayston can be reached at dan.bayston@cognient.com.

About Cognient Group

Cognient Group is a nationally recognized firm providing financial advisory, valuation and investment banking services. The firm’s services enable companies to confidently make informed, strategic decisions about their businesses. Clients range from privately held middle-market companies to large publicly traded corporations, as well as an increasing number of private equity firms, hedge funds and business development companies.

View this edition in our enhanced digital edition format with supporting visual insight and information.