View this edition in our enhanced digital edition format with supporting visual insight and information.

Do your family business clients devote more time to fixing problems than to preventing them? That has been the experience of this week’s contributor, Matthew Erskine. In this article, Matthew explores this tendency and shares his process to efficiently identify and resolve the source of a client’s recurring problems.

I volunteer to mentor members of a business owners’ group on Facebook and one of the newest members asked for help. I spoke with her for more than an hour and had several email conversations that ended with this:

“I know I need to do some planning, but I am so busy running my business right now, and coping with chaos, that I can’t. When things settle down, I will do some strategic planning that I can share with you.”

So far, radio silence.

Does this sound familiar? It does to me. As a fourth-generation estate planning attorney, I have all too often heard the same sentiment expressed by clients over the years. All the time in the world to fix problems — no time to spend preventing them.

It would be nice to say that there is one quick fix that business owners, or anyone for that matter, can do that will solve their core driver that is the source of their recurring problems. Alas, there is not. Your clients and their businesses each have unique strengths and weaknesses. The core driver is the combination of those unique strengths and weaknesses, and so is different from what drives problems for others. This means that not only is there no one solution, but employees, family members, business partners, vendors, and customers will all try to pull in the direction of the solution to their immediate problems, even if that direction is not the best action for the business in the long run.

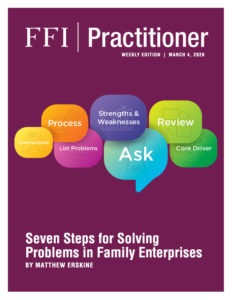

Even if there is no quick fix, there is a relatively quick process, no more than half a day, to identify your client’s core driver, outline the change needed to prevent problems, communicate that change to the stakeholders in the family business, and get buy-in on how an action plan will improve the business:

Step One: Determine the scope of the process.

Step Two: List 5-10 problems you are having.

Step Three: Examine what strengths and weaknesses cause these problems.

Step Four: Review, clarify, and check whether these causes are complete.

Step Five: Ask “So what?”

Step Six: Identify the Core Driver, and what needs to change to solve the family business’ problems.

Step Seven: Communicate why this change is necessary, sufficient, and possible.

With the commitment of half a day, you can likely pinpoint the core driver of problems in your client’s family enterprise, focus on what your clients are willing and able to do to change the situation, validate that change and communicate to others why this change is the necessary, sufficient and possible solution to the problems.

I think this approach represents a more effective way to spend your time than dealing with the chaos generated by your clients’ recurring problems and their efforts — as well as yours –to deal with the symptoms.

About the Contributor

Matthew Erskine is the managing partner of Erskine & Erskine LLC, a fourth-generation law firm, and The Erskine Company, LLC, a consulting firm. He focuses on strategic planning and legal services for business owners, professionals, individuals, families, collectors, and inheritors of unique assets. The Erskine family has been counsel to client families since 1876, overseeing estate and income taxation planning, personal trusts, dynasty trusts, private foundations, and family offices. Matthew can be reached at m.erskine@erskineco.com.

Matthew Erskine is the managing partner of Erskine & Erskine LLC, a fourth-generation law firm, and The Erskine Company, LLC, a consulting firm. He focuses on strategic planning and legal services for business owners, professionals, individuals, families, collectors, and inheritors of unique assets. The Erskine family has been counsel to client families since 1876, overseeing estate and income taxation planning, personal trusts, dynasty trusts, private foundations, and family offices. Matthew can be reached at m.erskine@erskineco.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.