View this edition in our enhanced digital edition format with supporting visual insight and information.

Thanks to this week’s author, Natalie McVeigh, for summarizing a recent US-based study on children (ages 16-26) of millionaires, presenting key points that could be useful to advisors, their clients, and researchers globally.

The children of millionaires want to be stewards of wealth. This might sound like a bold statement, and it is. Wells Fargo Private Bank, with Versta Research, created the Children of Millionaires (or Children of Wealth) Study in Q3 2018 and the data indicates that a stewardship lens is important to what is inherited, not just the concrete assets. As we do with our clients, let’s create a common definition of these terms before we dive into the study.

Stewardship

Inheritance is something that is, or may be, inherited; property passing at the owner’s death to the heir or those entitled to succeed.1

Stewardship is “an attitude about wealth and personal relationships that considered not just self-interest but also the impact on the current, and even future generations.”2

How are these different? All stewards inherit something tangible, however, not all people who inherit are stewards. If I inherit a plot of land from a distant aunt, I get to do with that property what I choose (i.e. sell, rent, learn about it, etc.). That is my right as an inheritor. On the other hand, if I were to find out more about my aunt, her legacy and this patch of land, and decide to carry that legacy into the future, in my own way, that is stewardship. No one path is the way heirs must behave, and the path of stewardship does provide more opportunity for relationships and reciprocity, if that is the goal.

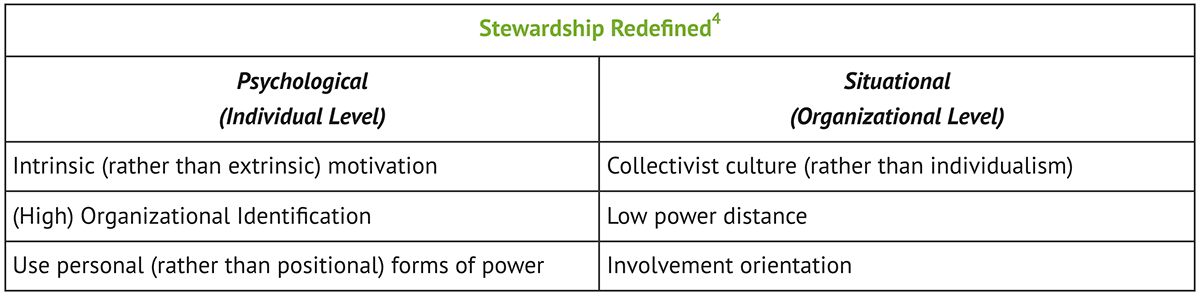

As advisors to families, the work we do has a ‘come from’ of stewardship. Families get to choose if the stewardship approach is meaningful to them or not, and we have seen how stewardship can benefit families. There are many measures of stewardship. One linked to success for enterprising families is the Stewardship Climate Scale3 introduced in the March 2017 Family Business Review. This scale speaks to both the organization and individuals who make up that organization. This two-dimensional model is easily applied to families themselves since families, like organizations, are groups of people.

These psychological and situational metrics combine to create a metric for assessing and identifying a stewardship mindset in enterprising families. The Wells Fargo Study helps us see that these children of millionaires are displaying many of the aforementioned attributes.

Study

Often when we study generations, it is just that: a study. We study and look at them from the outside, which on first blush looks ‘objective.’ This vantage point may lack an understanding that being on the ‘inside’ might shed some light. Jay Hughes said “every generation is the first generation.”5 With this thought in mind, it was important for Wells Fargo to find out: what does the rising first generation want?

The specific goal of the Wells Fargo and Versta Research study was to understand how young adults (younger Millennials and older Gen Z) are thinking about, and discussing with their parents, personal and family expectations around inheritance, philanthropy, and other aspects of family wealth. Versta conducted this national survey from July through August 2018 with children between the ages of 16 and 26, and whose parents had estimated assets of $1 million or more. The sampling was stratified by age and gender, and the results were weighted to ensure a sample that reflects the full United States population of children whose parents have similar affluence. This robust survey has many lessons, and we will highlight a few in this article.

Wealth conversations can be challenging and are desired:

- 95% children of millionaires report their parents having discussed with them practical issues about how to save, invest, and manage money, with 59% reporting that this is a regular conversation.

- 94% of millionaire children report their parents having discussed “money values,” including the role money plays in their lives; only 50% report that these conversations are happening regularly.

- 44% feel that they have a different focus on money than their parents (either more focused or less focused).

- 35% of children report that their family ever had a formal meeting to discuss family finances; only 6% say this happens regularly.

- Of those who do not meet regularly to discuss family finances, 60% feel that such a meeting would be valuable.

- Relative to what their parents talked about when growing up, children of millionaires are generally less focused on education and hard work, and more focused on the importance of family, enjoying life, making the world better, and charitable giving.

Children of millionaires desire to be stewards; they want a holistic relationship to the wealth of their family that includes more than just tangible assets:

- 90% agree that the most important thing they will inherit from their parents is their values, not their money.

- 89% say wealthy or not, they want to work.

- 84% say they want to sustain and build on their family’s legacy.

- 75% expressed an interest in social impact investing which was defined as “choosing investments based on the effect they have on things like the environment, human rights, diversity, and other social values in addition to investment returns.”

- 75% see themselves as leaders rather than followers.

- 73% are interested in managing their family’s wealth someday.

Philanthropic involvement is a meaningful driver:

- 84% feel that their family’s charitable giving aligns with their own values, and 63% report that they “give together” with their families.

- 72% say that because of their financial situation, they should give back.

- 44% do not believe there is a specific giving strategy in place, and 21% do not know if there is one.

- 40% desire more of a say in their family’s giving decisions.

There is an impact of wealth on these adult children’s lives; the wealth has advantages and an impact on how they see the world, at times contributing to interfamily conflict about wealth. Here are some insights:

- 97% felt fortunate and lucky for that they have.

- 79% consider their families to be wealthy, with only 42% considering themselves to be wealthy.

- 62% believe that money is a good measure of success.

- 60% feel pressure to live up to their family’s standard of wealth and success.

- 46% of these children of wealth believe that money can buy happiness.

- 31% report that their parents use money to reward and punish them.

- 26% feel that wealth is a burden.

- 26% report sometimes or frequently having conflict with their parents about money.

- 21% report that wealth makes them feel guilty.

- 19% report occasional or frequent conflict with their siblings about money.

The respondents reported differing views on the family firm: the children of millionaires are split on whether they want to work for the family business or not; however, a majority say that they want information and involvement around that asset. Let’s add some color here:

- Of the children whose parents have a family business, 36% plan to work for the family business and 23% do so now, leaving a majority involved with their parents’ family business.

- Among those currently working for their family businesses, 89% say they feel lucky to do so.

- 52% of respondents say they have little interest in working for their family company, with 41% hoping they never have to.

- 38% of children say their parents expect them to work for the family business.

- Among the parents who have at least $10 Million, 62% of their children said they want to start their own business; 47% of all respondents desire to start their own business.

There is an old Latin quote, “Quod me nurit me destruit,” meaning “what nourishes me destroys me.” From this survey, that does not seem to be as much of a risk as current generation parents might think. The young adults in this survey seem to be displaying traits and beliefs that are rooted in the psychological and situational Stewardship Redefined Model. To continue the nourishment of wealth from one generation to the next has to do with conversation, co-creation, and transparency. This next generation wants to do this work with their parents and have said as much, and we, as practitioners, know that a process helps transfer the skills more than pure modeling or talking at someone.

Wells Fargo Private Bank provide products and services through Wells Fargo Bank, N.A. and its various affiliates and subsidiaries. Wells Fargo Bank, N.A. is the banking affiliate of Wells Fargo & Company

References

2 Dennis T Jaffe, Ph.D. Stewardship in Your Family Enterprise (USA: Pioneer Imprints, 2010)

3 Neubaum, D. O., Dibrell, C., Thomas, C., & Craig, J. B. (2017) Stewardship climate: Scale development and validation

4 Craig, J.B. and Moores, K (in Press) Leading a Family Business: Best Practices for Long-term Stewardship. Praeger Publishing

5 Hughes, James E. Jr. Family: The Compact Among Generations (New York, New York: Bloomberg, 2007)

About the Contributors

Natalie McVeigh, CFWA, ACFBA, is vice president, family dynamics consultant with Wells Fargo Private Bank. In addition to her work with clients and teaching, she is the chair of FFI’s Next Gen Practitioners Virtual Study Group and is a member of FFI’s Board of Directors. Natalie is also a member of the GEN faculty.

About Wells Fargo Private Bank

Wells Fargo Private Bank, the fourth largest wealth management provider in the United States (Barron’s 2018), offers a full range of financial services and products to help individuals and families build, manage, preserve and transfer their wealth. The Private Bank services clients across North America and internationally with $131 billion in assets under management (12/31/18).

View this edition in our enhanced digital edition format with supporting visual insight and information.