View this edition in our enhanced digital edition format with supporting visual insight and information.

In this week’s FFI Practitioner, Steve Legler shares his observation that, in some family enterprises, when a generational shift occurs, an existing corporate hierarchy may transform into a less defined and ambiguous structure when the next gen leaders have roughly equivalent managerial roles. In his article, Steve explores the challenges of working with clients who are experiencing what he has dubbed as the flat “FOOT”: the “Family Owner-Operator Team.”

When I entered this field about a decade ago, I most frequently came across families who were preparing for a transition from one generation to the next, where the rising generation was working side-by-side with parents and other relatives who preceded them.

Ownership issues came to the foreground, for instance cases where siblings who did not work in the business but were co-owners, who required careful handling on account of the unique dynamics that may exist for family owners who are not active in the business.

While those situations continue to exist, and such families still reach out to practitioners for assistance, I’ve noticed a particular subset of families who are increasingly facing variations on this prevalent issue. I’ve encountered more cases of what I have dubbed the “FOOT,” i.e., the Family Owner-Operator Team.

Family Owner-Operator Teams

One major characteristic of a FOOT is that it contains a preponderance of family members who are active leaders in the day-to-day operations of the business. Perhaps a non-family member or two is involved at the executive management level, but the leadership is generally comprised of family members, each with their own responsibilities, and with frequent interactions as these duties often require coordinated actions.

While these team members have different roles in the day-to-day operations of the company, their ownership interests in the business may be essentially equal. Every family business practitioner talks about the importance of separating the discussions about operations from those regarding ownership, but when the same leadership team governs both and they interact every day, it’s easy to confound things.

Flat, Where There Once Was a Hierarchy

It may be due to shifting demographics as more Baby Boomers are exiting family businesses, but many of these enterprises are now dealing with a new reality that makes things trickier than they were before. While family members in the management team were already working together before senior leaders stepped down, corporate structures used to have more of an implicit hierarchy due to the respect given to the tenure of the senior generation leadership.

I keep encountering versions of this: a recent departure of previous leadership allows next generation leaders their turn at the helm, but now, without a hierarchy, these teammates are part of a flat structure. It is not impossible for a “flat” leadership structure to succeed, but it’s quite different from a hierarchical leadership structure.

When the family enterprise management and ownership combine in the newly flat structure, some level of confusion can occur, and growing pains can become evident.

Challenges and Growing Pains

The departure of the previous leadership can create a bit of a vacuum and maybe some jockeying for position. Perhaps the new leadership structure that the owners planned for turns out to have looked more appropriate in theory than in practice. In that leadership void, sibling (or cousin) dynamics pop up in places where they used to lie beneath the surface. Silos that exist in the business operations, which otherwise kept team members from stepping on each other’s toes, disappear when ownership issues come up. While the rising generation used to be able to appeal to those in a higher leadership tier when unanticipated problems, they’re now on their own.

Looking at Organization Models for Help

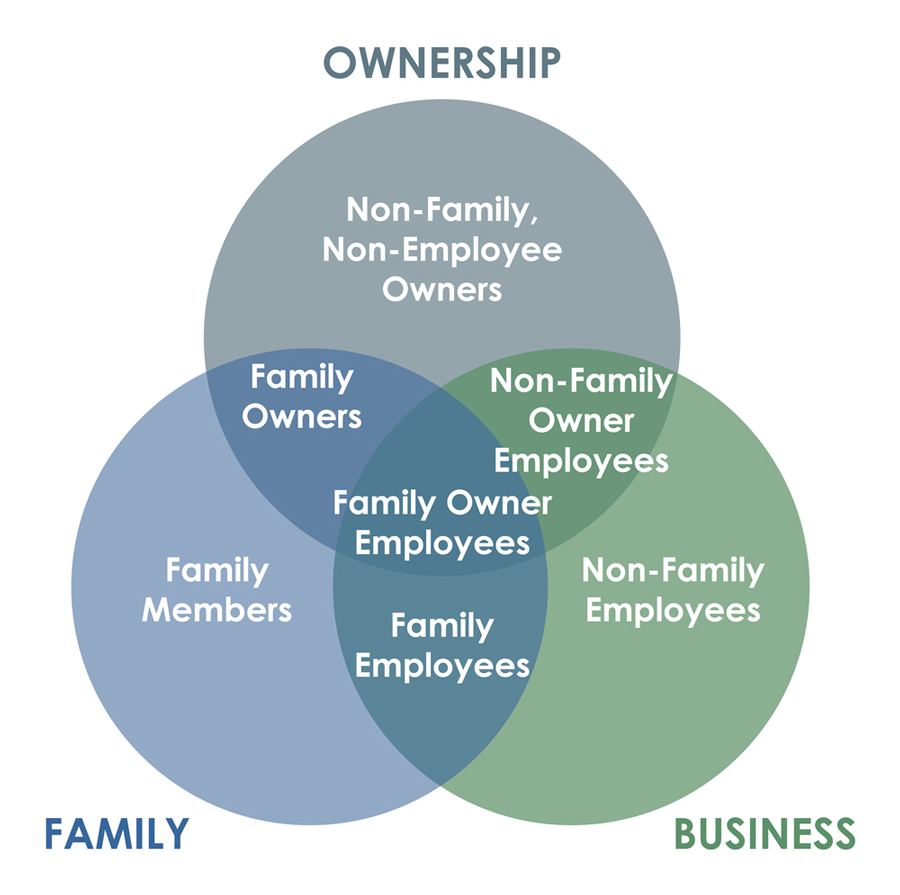

It might be helpful to examine this phenomenon through two well-known family business models to better understand the specific context. Let’s look at these situations through the lens of the Three-Circle Model as well as the Four Rooms Model.

The Three-Circle Model View

Most practitioners use the Three-Circle Model, created by Renato Tagiuri and John Davis, with clients at some point, and the familiarity with the model can be helpful. However, the most profound realizations I’ve seen when using the model are when clients who sit in one of the resulting seven sectors of the Venn diagram suddenly understand why someone who inhabits a different sector doesn’t see things the same way that they do.

When, by contrast, Flat FOOT folks are all in the same sector, they can bump up against each other and prompt conflict. This is where it can be helpful to point out that each circle can (and perhaps should) have different leadership. While one member will often have a title making them the leader in the business circle, it can be useful to have someone else lead the ownership circle, and another person take charge of the family circle.

These roles can be fixed for long periods, or they can rotate, and these leadership decisions should be determined by consensus whenever possible.

The Four Rooms Model View

Baron and Lachenauer’s Four Rooms Model is more recent and not as deeply entrenched as Tagiuri and Davis’ Three Circles, but it adds another useful dimension in these cases.

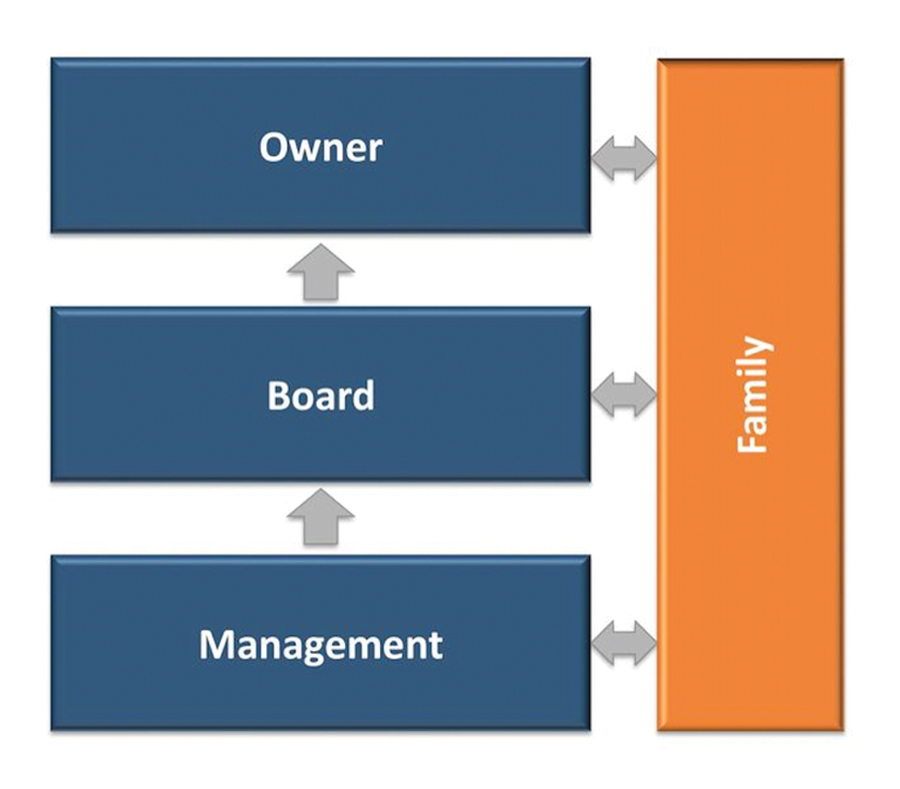

Four Rooms adds a Board Room to the familiar Family, Business, and Ownership circles, as well as orienting them in a particular way. This model puts the owners above the board, and the business below, with the family room along the side, because family members can enter any of the other three rooms irrespective of hierarchy. It is precisely the addition of the Board Room that I believe is useful as a new focal point for such Flat FOOT teams.

The Team Acting as the Board = Quarterly Meetings

Corporate boards of directors generally meet formally once per quarter. I propose that such Flat FOOT teams initiate a similar routine, with some additional twists. Each quarterly meeting can be done in the same structured sequence, moving through the other three rooms or circles. Beginning in the family room, some discussion about each member’s family can set the stage and the mood and remind everyone of the importance of family matters that sometimes get lost along the way. One family member can be charged with setting the agenda and leading this section of the meeting.

The business / management “room” discussion would then follow, where the focus becomes working in the business, looking at operations and what the company does on a day-to-day and week-to-week basis. A different person would prepare and lead this part of the meeting, often the one with the corresponding hierarchical title.

Finally, the third part of the meeting would concentrate on the ownership perspective, focusing on working on the business, and yet another person would take the lead for this part of the meeting.

Coaching Flat FOOT Teams into Their Evolving Roles

I don’t expect that most Flat FOOT team members will be able to read this and immediately get this going as I’ve laid it out above, because turning theory into practice doesn’t always go smoothly. These flat teams tend to have difficulty precisely because they no longer have a hierarchy to rely on to guide things. This is where a skilled facilitator, coach, or mentor can play a key role in implementing their first meetings, likely for the first year or longer, depending on how quickly they get the hang of doing this themselves.

A series of monthly one-on-one coaching calls can also be useful, as well as monthly facilitated calls with the entire group between quarterly meetings. This will enable the FOOT to work out the logistical details as they start down this road.

Flat FOOT businesses can succeed and do well, once they get into the right groove to make sure that they regularly meet in a habitual and structured way.

About the Contributor

Steve Legler, ACFBA, ACFWA, is a family legacy advisor based in Montreal, Canada. He is an advisor with the More Than Money 360 online platform and he works with family clients as a facilitator, and sometimes as a mediator. He also does individual coaching with family members. Steve holds advanced certificates in Family Business and Family Wealth Advising from FFI and is a member of the FFI GEN faculty. He is the author of SHIFT your Family Business and Interdependent Wealth: How Family Systems Theory Illuminates Successful Intergenerational Wealth Transitions. Steve can be reached at sl@stevelegler.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.