View this edition in our enhanced digital edition format with supporting visual insight and information.

Thanks to Mette Ballari for today’s FFI Practitioner article, which discusses the missing link in family business growth. In this article she uses the Three-Circle Model as well as a case study from her work with a client family to explore the idea of a “missing link.”

Family businesses represent a significant driver of economic value around the world,1 yet according to the “shirtsleeves to shirtsleeves” adage, relatively few achieve multigenerational success. This trend highlights a significant challenge facing family enterprises globally: achieving sustained growth across generations. After two decades of working with family businesses worldwide—particularly in the Nordic region—and drawing insights from leading family business experts, the question remains: Why does this challenge continue to persist?

Some obstacles to sustained multi-generational family business development are evident. The unique dynamics of family businesses are widely recognized in the field. For example, John Davis and Renato Taguri’s Three-Circle Model2 continues to illustrate the complexity of roles, structures, and relationships within these enterprises. Additionally, research by Dennis Jaffe on 100-year-old family businesses3 highlights common attributes that achieve long-term success, such as strong family values, a family-first approach, cross-generational collaboration, and clearly defined roles. However, models or research alone are often not enough to provide a comprehensive blueprint for establishing a foundation that fosters these qualities and sustains growth.

Critical questions remain regarding initial steps and long-term allocation of resources to ensure long-term success. So, what is the missing link between a founding generation’s business success and the sustained growth of that business across multiple generations?

The Three-Circle Model is a helpful starting point for understanding the missing link. By systematically addressing the three circles, families may be more likely to position themselves for lasting success.

Circle 1: Ownership

Effective ownership begins with a clear, shared vision and purpose among the owners, supported by a long-term strategy and robust legal and governance framework. While addressing this first circle may seem straightforward, it requires significant alignment and commitment among the owners to establish a strong foundation.

Circle 2: Business

Aligning ownership and business strategies without conflating the two is critical. By clarifying the roles and responsibilities of the owners, the board, and top management, as well as ensuring that the corporate and ownership strategies are aligned and support one another, advisors can help to prepare both ownership and business systems for long-term success.

Circle 3: Family

When addressing the family circle with their clients, advisors often encounter significant challenges and complexity in assisting clients to develop multi-generational success. Family members frequently hold multiple roles within the family enterprise system, leading to diverse viewpoints on a range of topics. It is essential for advisors to recognize both role-based differences but also the unique personalities, values, and communication styles within the family.

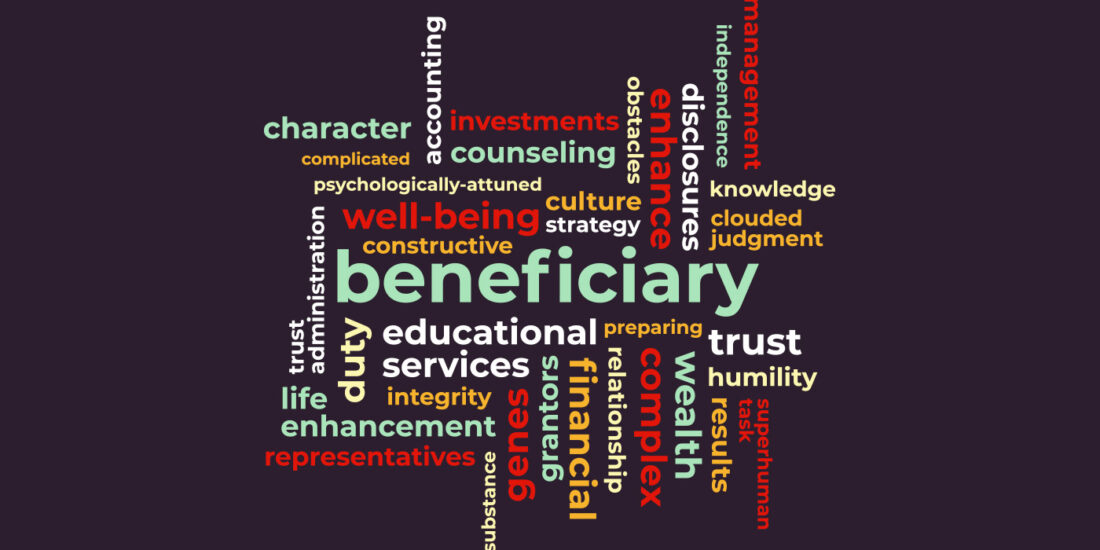

Key Elements Shaping Family Member Perceptions

Human emotions, behaviors, and interactions are influenced by perceptions, which are “filtered” through the following elements:

- Values tend to be inherited and form a moral and ethical foundation, influencing strong reactions when they feel challenged.

- Beliefs are powerful internal truths that, while beneficial, can sometimes impede growth.

- Experiences shape attitudes and choices, either reinforcing positive behaviors or creating limitations.

- Personality represents unique strengths or “talents,” providing insight into how people interact and communicate.

- Mental Programs function as internal “software,” influencing reactions, often made without awareness.

- Physical Condition can impact focus and engagement, as discomfort affects our ability to process information.4

These elements, collectively forming a person’s “filters,” determine how one interprets and responds to the external world. Even among family members who share similar values or backgrounds, these filters create unique, individualized perspectives. Learning about these human patterns can help equip families to better understand and appreciate each other’s perspectives, fostering a more collaborative climate conducive to multi-generational success.

Bridging Impact : A Tool to Help Forge the Missing Link

The Nordic Family Office’s Bridging Impact program5 is a structured growth program designed for family business stakeholders. It can serve as another tool for advisors to consider in their client engagements and is designed to help develop skills including the following:

- Strengthen family collaboration and dialogue, fostering respect and understanding.

- Facilitate open, tolerant conversations based on the recognition that each person holds a unique perspective.

- Increase meeting effectiveness.

- Improve information-sharing and knowledge transfer.

- Increase motivation, entrepreneurial spirit, and healthy risk-taking.

By focusing on better understanding and harnessing human nature, educational programs such as Bridging Impact aim to provide families with the tools needed to create resilient, dynamic environments that foster growth and harmony across generations. In doing so, such programs can offer a strategic edge to carry family enterprises successfully into the future.

An Example from a Client Engagement

Here is a case from a client in Norway that illustrates the importance of addressing individual thoughts and feelings while designing an effective succession plan. This family developed a strategic process for transferring ownership to the next generation and had tailored the ownership structure for this purpose within available legal frameworks. The family was well prepared to begin the generational transition. However, more and more reasons to delay the transition kept emerging. First, it was postponed until after summer vacation, then until work became less busy, and eventually, the current family leader offered to retain responsibility, further delaying the ownership transfer, to ease the burden on the next generation.

The only thing that was clear to the family’s advisors was that no one had openly discussed what the family members were experiencing internally.

The advisors gathered the client family together and facilitated a meeting where members could openly share their perspectives on the generational transition. How would this transition impact each of their lives? How would the dynamics between generations evolve after control of the business transferred to the next generation? And how would these shifts affect family dynamics?

Through this discussion, it became evident that each person wanted to consider the needs and wishes of the others, yet no one felt able to express his or her own desires without knowing what everyone else truly wanted. Over the course of this two-day meeting, each family member was guided to reflect on his or her desired vision for the future, to share this individual vision with the group, and, importantly, to find a way to balance individual personal goals with the needs of the broader family and its enterprise.

In the end, the family agreed that the senior generation would retain leadership within the family, taking responsibility for organizing family gatherings during holidays and providing advice to the next generation when requested. During the discussion, when members of the rising generation voiced concerns or fears, the current generation was better equipped to understand the context and provide reassurance. As a result of the discussion, the family realized it was ready to start passing control of the business to the rising generation.

By the end of the weekend, the family was relieved and aligned, with a clear understanding of their roles within the family’s “three-circle model.” They had a concrete plan outlining who would do what and by when—a plan no one felt the need to delay. This provided the family with a stable, predictable foundation for moving forward, giving each member the security they needed.

Conclusion

The missing link in this family’s succession planning is the recognition that each family member needed support in understanding their own desires and goals within the context of the family enterprise. That understanding allowed the family to gain greater clarity on previously unspoken emotions and dynamics connected to ownership of the enterprise.

Advisors can help their client families by methodically facilitating important discussions that address the more personal side of ownership, in much the same way as advisors guide conversations about more technical ownership and governance strategies. When families better understand the missing link between individual family members’ interests and their vision for the family enterprise, they are much better prepared to pass ownership to the next generation, to continue to create value across generations, and to preserve the core of the family.

References

1 McKinsey & Company. ‘’All in the Family Business.’’ https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/charts/all-in-the-family-business.

2 Cambridge Family Enterprise Press. “How Three Circles Changed the Way We Understand Family Business.” 2018. Accessed December 4, 2024. https://johndavis.com/how-three-circles-changed-the-way-we-understand-family-business/

3 Jaffe, Dennis T. Resilience of 100-Year Family Enterprises: How Opportunistic Innovation, Business Discipline, and a Culture of Stewardship Guide the Journey Across Generations. CreateSpace Independent Publishing Platform, 2018.

4 Bodenhamer, Bob G., and L. Michael Hall. The User’s Manual for the Brain, Vol., 1. Crown House Publishing, 2001.

5 Bridging Impact Academy. “Bridging Impact: Et Vekst og Utviklingsprogram for Fremtidens Ledere og Påvirkere.” Accessed December 4, 2024. https://nordicfamilyoffice.no/

About the Contributor

Mette Ballari, ACFBA, has dedicated twenty years to advising family business owners and next-generation owners across the Nordic region and globally. With deep expertise in strategic ownership planning, she helps families align their business and personal goals to achieve long-term growth. Mette co-founded Family Business Norway, lead EY’s Family Enterprise Office, and now leads Nordic Family Office, a premier family business advisory center in Oslo, Norway. She can be reached at mette.ballari@nordicfamilyoffice.no.

View this edition in our enhanced digital edition format with supporting visual insight and information.