View this edition in our enhanced digital edition format with supporting visual insight and information.

Thank you to Kristen Heaney and Stephan Lindenthal for this week’s FFI Practitioner discussing peer learning programs as a resource for advisors working with the rising generation. The article includes a case study in which discussions of family dynamics and personal development as well as financial and technical skills were included, and the outcomes were quantified.

The Challenge of Preparing the Rising Generation

Advisors in the family wealth space have often seen it—capable, well-intentioned, next-generation family members complete programs to develop wealth and leadership skills, but they are still hesitant to step forward into family enterprise roles. Although they might not mention it in meetings with advisors, they later admit to feeling like outsiders in their own family enterprise.

A possible conclusion is that for rising generation family members, financial education alone is not enough. They need both technical skills to navigate wealth and personal empowerment and identity development to step into roles with confidence. Advisors and programs that offer board training, an overview of investing principles, and a trusts and estate planning primer are necessary, but when taught in the absence of the skills required to apply, integrate, and process the implications of new technical knowledge, this education can result in limited long-term impact.

So, how can advisors bridge this gap? One approach is through peer group learning, often an underutilized yet highly effective resource. As a complement to traditional one-on-one coaching or advisor-led instruction, peer learning provides another space to share and normalize wealth-related complexities—a sort of positive peer pressure beneficial impact.

What follows is a case study of how the one peer group learning program, RisingGen Cohort, demonstrated that peer group learning may improve personal development and may have a synergistic beneficial impact on the development of financial skills as well.

A Case Study: Learning Model

This example is based on the RisingGen Cohort, a two-semester virtual family enterprise primer for UHNW adults aged twenty-five or older. Through twelve themed virtual group calls, cohorts of approximately ten participants explore topics such as identity, purpose, and confidence. The curriculum covers topics including those listed below:

- Family Dynamics and Family Governance: Family Dynamics Frameworks, Family Governance Basics, Communication and Conflict Resolution Skills

- Personal Development: Identity and Purpose, Wealth Narrative, Individual Strengths, Impact of Wealth on Friendships and Significant Other Relationships

- Beneficiary 101: Trusts, Risk, Philanthropy/Impact

This integrated approach invites participants to consider the realities of their unique circumstances with peers who are also navigating similar complexities. Some participants admit that they have never spoken to anyone else about these topics, but they have craved the chance to do so. In this example, the advisor or educator begins with these questions:

- What are some of the benefits you have enjoyed from being part of a successful family?

- What are some of the challenges you have faced from being part of a successful family?

- What are your unique strengths and interests, and how do you see them being integrated into existing or future roles within your family enterprise?

- How do you make sense of the idea that you may be part of a family with greater influence and/or access to resources than others?

- How have the realities of your family’s success or your access to wealth impacted your friendships and significant other relationships?

As participants and their peers grapple with these questions, another learning experience opens in which participants can envision, possibly for the first time, the impact of the role they will play in their family enterprises. As one participant described the peer learning cohort experience, “I went from feeling like all of this [participation in the family office or family enterprise] is happening to me, to feeling like it’s happening with me.”

Evidence of Impact

Statistically Significant Outcome Data

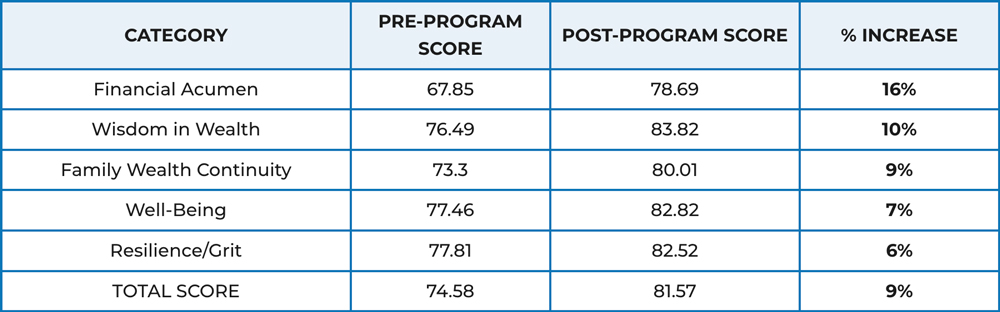

Participants in this peer leaning cohort group completed a fifty-item Success Index before and after the program. A 1–5 scale (1=Strong Disagree to 5=Strongly Agree) was used. Total scores were then converted to a 100-point scale and the data from sixty participants across nine cohorts were analyzed using a paired t-test with dependent samples. The outcomes suggest that the program generates more than anecdotal stories of impact, as it indicated statistically significant improvements in several categories:

- Perceived financial competence*

- Skills for navigating the family enterprise

- Personal agency and confidence

*The Financial Acumen category saw the greatest improvement, even though the curriculum’s primary focus was on qualitative development.

Figure 1. Category-Level Improvements

The gains across categories are listed in order of statistically significant improvement. The values above show an extremely low chance these changes happened randomly, and they show strong evidence that the program is having a beneficial impact.

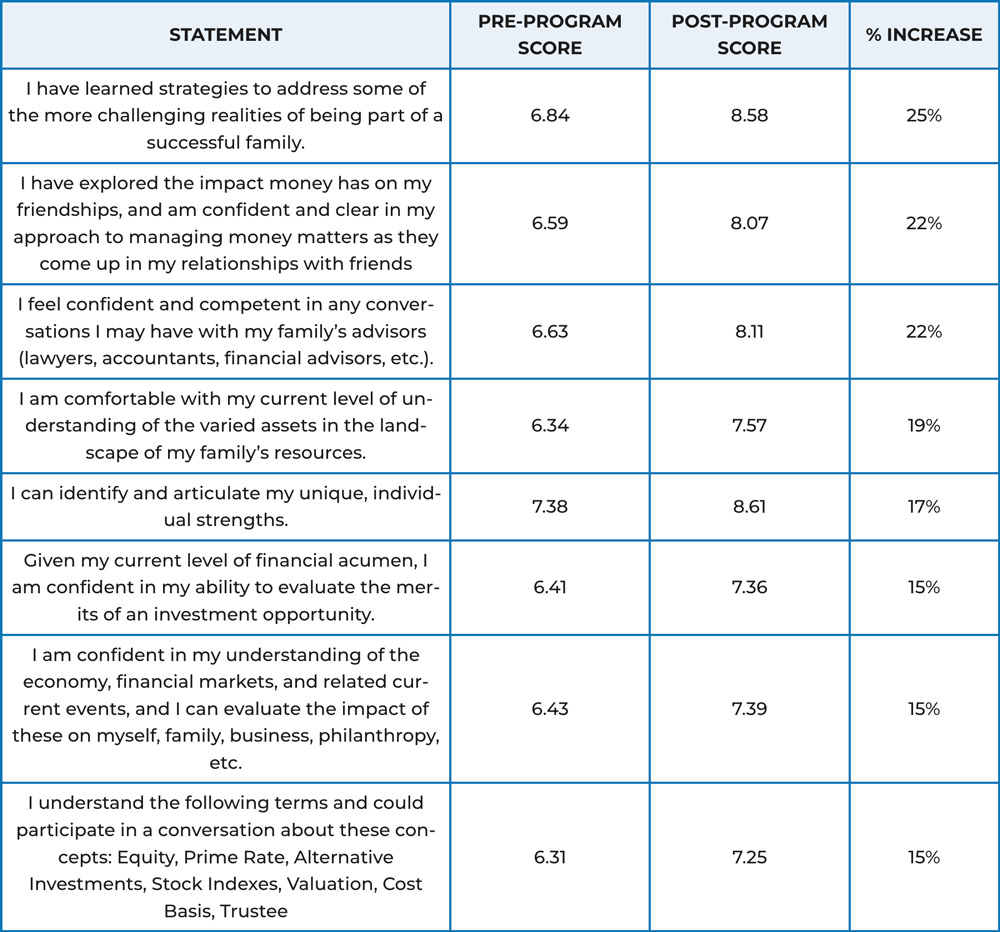

Individual Statement Gains

At the individual statement level, several areas stood out, highlighting the program’s impact on participants’ ability to understand their family’s financial landscape, envision their roles within it, and approach wealth with a greater sense of purpose and well-being. Several individual statements indicated that the greatest improvements were in themes related to the economy, financial terminology, and inheritors’ perceived confidence in interactions with advisors. (These topics were not addressed in the curriculum.) This data suggests that it may not be enough to only understand wealth but that inheritors must also feel capable and confident in engaging with it.

Figure 2. Individual-Level Improvements

The gains across categories are listed in order of statistically significant improvement. The values above show an extremely low chance these changes happened randomly, and they show strong evidence that the program is having a beneficial impact.

A New Paradigm: Outcomes and Evaluation

This case study with the RisingGen Cohort model is an example of how statistically significant outcome data suggests the utility of a dual approach, blending technical skills with personal empowerment. This case also highlights the benefits to practitioners in the family enterprise field when there is outcome data to compare and share, and not just anecdotal stories of success.

For UHNW families, passing down financial knowledge is not the only challenge. It is also a challenge to ensure that the next generation has the confidence, clarity, and community to integrate that knowledge effectively.

About the Contributors

Kristen Heaney, ACFWA, is founder and lead coach of In Three Generations, a consulting firm offering coaching and peer group-based education with extensive offerings for the rising generation. For more information about this data or In Three Generations’ RisingGen Cohort, visit www.In3Generations.com or contact Coach@In3Generations.com. Kristen can be reached at kristen@in3generations.com.

Stephan Lindenthal is pursuing a Bachelor of Science in biological engineering and business management at MIT. He contributed to the research and writing of this article as part of an independent collaboration. He can be reached at Olindy254@gmail.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.