View this edition in our enhanced digital edition format with supporting visual insight and information.

Thank you to FFI Asian Circle Virtual Study Group member Andre Loh for this article exploring the nuances of family office governance within the Asian context, offering insights into a model that contextualizes corporate governance principles while aligning with the unique dynamics of Asian business families. Through examining governance levels and pillars, the author provides a framework for practitioners to navigate the intricacies of family office governance, emphasizing the importance of cultural understanding and principled decision-making through two case examples.

Over the last decade in Asia, there has been an exponential rise in the establishment of family offices in Singapore and Hong Kong from families from across the world. As a result, there has been a huge growth in the need of family advisors who are well-versed in family office governance.

As a significant percentage of the families that establish a family office in Singapore or Hong Kong are Asian families, the need to develop a family office governance framework that is contextualized for Asian business families has become increasingly important.

A Model for Family Office Governance

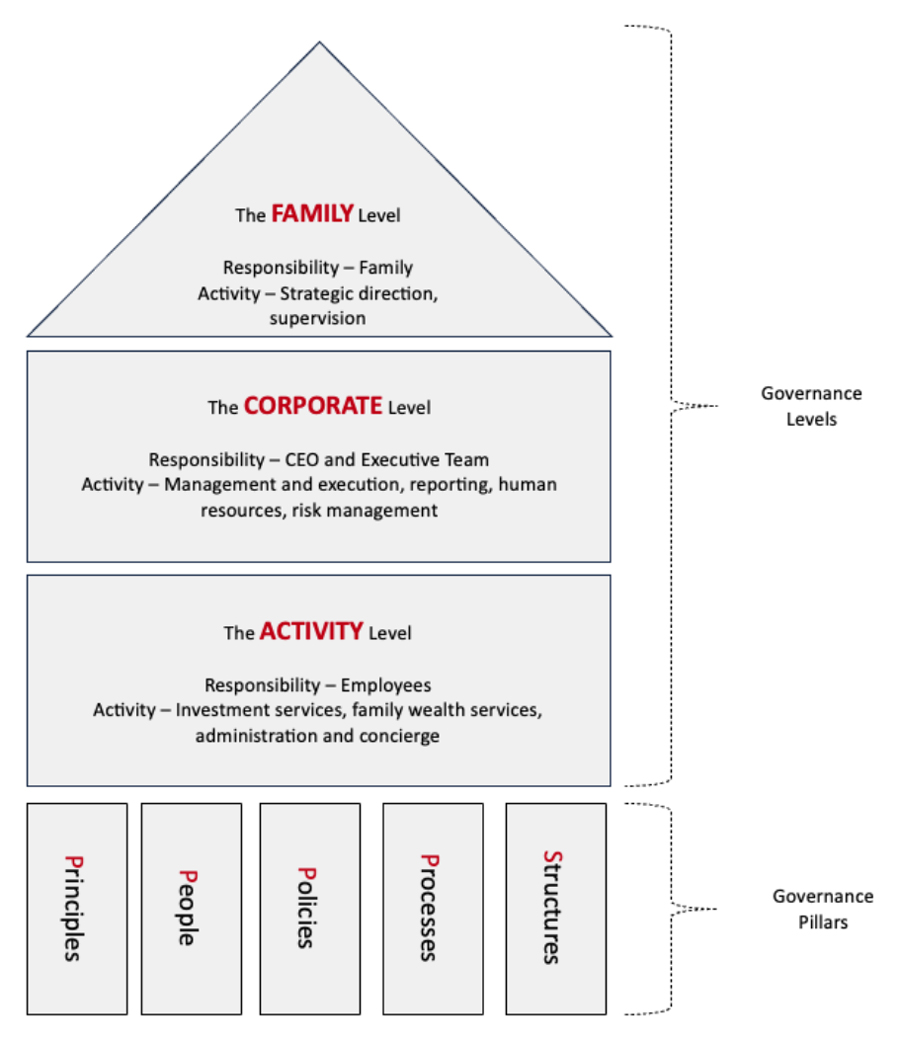

Family office governance contextualizes corporate governance to the specific business or activity of a family office, while remaining cognizant of the stakeholders, governing bodies, and mechanisms within a family governance framework. A way for practitioners to approach family office governance can be visualized using the model below:

Model adapted from UBS Family Office Compass – Creating Your Wealth Engine, revised version 2022

This model allows practitioners to conceptualize the family office governance framework based on two dimensions:

- Governance LEVELS within the family office1 (The Three Levels)

- Governance PILLARS within the family office (The “Four Ps and One S”)

The Family Office Governance Levels

The three levels within the model refer to the following governance categories:

Activity Level

In the activity level, the foundation of the model, advisors and/or the executive team may develop frameworks and policies which are central to the specific business activities that a family office operates and conducts. Examples of governance frameworks and policies at the activity level typically include investment frameworks, non-investment frameworks, and risk management frameworks.

Family office management is executed at the activity level. Although the concepts of family office governance and family office management have frequently been used interchangeably, there are key distinctions between the two. Family office governance is about developing the objectives and refining the policies and processes within the family office, while family office management is about ensuring that the family office objectives are achieved, and the family office’s policies and processes adhered to.

Corporate Level

Moving up to the corporate or entity level, advisors and/or the executive team may develop frameworks and committees that govern the policies and processes of the family office. These policies typically include performance framework and human resource framework, strategic planning policy and processes, capital budgeting processes, etc. The governing committees at this entity level may include an investment committee in addition to the board of directors for the family office.

Corporate governance refers to the way that a company is governed and to what purpose. It identifies who has power and accountability and who makes decisions. Corporate governance ensures that appropriate decision-making processes and controls are in place and that the company achieves its objectives while ensuring that stakeholders have trust in the company.2 In this model, corporate governance is primarily the responsibility of the board of the family office.

Family Level

Just as the roof covers a house and protects it from the elements, the family level acts as the roof of the family office governance framework—the overarching governing mechanism ensuring that the key elements included within the family office governance design align with the family’s constitution and family values. The family level ensures that the family office’s objective and purpose are coherent with the family’s values and aligned with the family’s own long-term strategy and vision. The family is involved in the strategic direction of the family office, defining family values, vision, and mission, as well as the defining the objectives and purpose of the family office. In this model, the governing committee at the family level typically refers to the family council.

The Family Office Governing Pillars: The “Four Ps and One S”

When designing and conceptualizing governance frameworks at each of the three levels, advisors should apply each of the “four Ps and one S” within the governance pillars to conceptualize and design the framework.

Principle: What are the values and purpose of the family office? Establishing the principle at the outset helps anchor the objectives, purpose, and direction of the other pillars in this model.

People: Who will be accountable or in charge of the process at the activity level? When establishing the people component, it may be helpful to designate either a committee (e.g., an investment committee) or a role (e.g., Chief Investment Officer) as the responsible party for the relevant policy and/or process.

Policy: What policies should be in place to achieve the objectives of the family office and align them with the values and principles the family would like to see applied?

Process: After the policies are defined, what processes should be in place to ensure that the policies are implemented?

Structure: Are our current or proposed structures appropriate to meet the family office purpose and the family’s objectives? At the activity level, one example of a structure assessment may be assessing and implementing the appropriate use of technology platforms or IT systems.

After having familiarized themselves with the family office governance model, practitioners and advisors can then culturally contextualize the advisory process for the business family they are working with.

Although the governance levels within the family office governance framework tend to be universal, the governance pillars within the framework—which refers to how the four Ps and one S are considered and implemented—may differ across cultures.

Prioritizing Family Harmony as a Policy

Relating to the first P of “Principle,” I have been in discussions with Asian business families whereby family harmony is prioritized over business decisions whenever there may be a potential conflict between the two.

For example, the family office of one Asian business family has a policy that encourages the family office to invest in and support their succeeding generations’ new business ventures. However, if family consensus cannot be reached and there is a risk that supporting the new business venture may cause a fracture among the next generation family members who formed the Board of Directors of this family office, then even if the new business venture were to be commercially viable or have huge future business upside, the family office would not invest the collective family’s funds. This policy was designed and influenced by the family’s principle, which is to always place family harmony first.

Shifting a Patriarch’s Investment Process

In another example, I have worked with a single Asian family office that had a traditional and dominant patriarch. The patriarch was aging and wanted his non-family investment professionals to step forward to take more ownership and voice their opinions in investment committee meetings. However, the patriarch frequently led the discussions during these meetings. When investment decisions had to be made, the controlling patriarch would share his investment views, and the non-family investment professionals would go along with his opinion, regardless of their own assessment of the proposed investment.

The patriarch came to recognize that his own dominance was an investment process risk, and that he was precluding the investment team’s proper deliberation.

Understanding the Asian cultural context of reverence for the family leader, I advised the patriarch to change the investment process so that instead of having the patriarch speak first during the investment meetings, he would speak last, only after all of the investment professionals had presented their perspectives on the proposed investments.

It took a while for the family office to adjust to this change in process, but once implemented, this change resulted in more robust investment committee meetings with greater diversity in investment views. The discussions became much more holistic and comprehensive, allowing the family office to shift to a more professional, institutionalized decision-making culture.

Focus on Defining Principles First

For practitioners working with Asian business families on their family office governance process, an important first step towards designing a sustainable and implementable family office governance is taking the time to understand the family’s cultural context and values: in other words, its principles—the first “P” in the model’s governance pillars.

Once the family’s principles and values are clearly defined, articulated, and established, and the family office purpose is defined and understood, the business family and advisors can build the other governance pillars: people, policy, process, and structure.

References

1 UBS Family Office Compass – Creating Your Wealth Engine, revised version 2022

2 https://www.cgi.org.uk/about-us/policy/what-is-corporate-governance

About the Contributor

Andre Loh, CFBA/CFWA is a family office advisor and family advisor at UBS, advising UHNW individuals and clients in the areas of family office setup, strategy, governance, and succession, as well as the broader family governance framework. Andre has been instrumental in establishing numerous family offices in Singapore. Within UBS, he leads the UBS Family Office Academy Program and works alongside next gens in preparation to lead their single family offices. A member of the FFI Asian Circle Virtual Study Group, Andre holds FFI Global Education Network (GEN) certificates in family business (CFBA) and in family wealth advising (CFWA). He can be reached at andreloh@gmail.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.