View this edition in our enhanced digital edition format with supporting visual insight and information.

This week, we conclude our series of commentaries about the report sponsored by the FFI 2086 Society titled, “Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership.” Thank you to Nancy Drozdow, a member of the 2086 Society, for sharing her reflections on the implications of the research and the growth of the field over the past three decades.

From its first days, a bedrock for FFI is to enhance our practice—our service to the family enterprise—through research, particularly multi-disciplinary research. Research has exploded since the establishment of Family Business Review. Since then, other outlets have been exploring ideas in search of answers surrounding the endurance and failure of family organizations: what about their families, their economics, their leadership, their governance encourages or discourages healthy longevity?

With this backdrop, I offer reflections on what I (and, I hope, what we) have learned from the research report on Professionalizing the Business Family.

Even after three decades, professionalizing is still experienced in our field and beyond as an urging toward leadership by non-family members, the creation of an “outside” board, etc. In my own practice, clients think of themselves as professionals and are such by any objective standard, so they find the idea of “professionalizing” insulting. That colors my outlook.

Competence and professionalizing are not the same thing, though of course they suggest a standard toward which owners and advisors can aim. The research team offers this: the ultimate goal of professionalizing the business family is to ensure the longevity and functionality of the ownership group and the business.

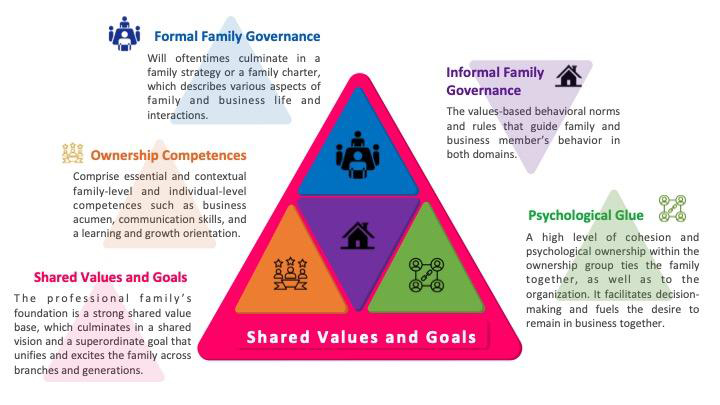

Longevity, functionality, and the ownership group: each is taken up in the research report through a focus on the ownership group, organizing and discussing five pillars on which a family ownership group can move toward becoming professional, by which the authors mean competent. Competent owners, whether family or not, exhibit features of these pillars.

Figure 1: The Business Family Professionalization Framework

Systems thinking is not out of style

These five pillars are a useful organizer for attributes of competence. Though not new, this synthesis can be a practical tool for families and their advisors to assess the families’ starting place on each of the pillars. (It is noted by the researchers that such an assessment is not as easy as one might think.) This sort of stocktaking assessment can orient an owner agenda toward the hard work of competence development. The five pillars present an argument for a systems approach to professionalization: any one or two of the attributes will not get the job done. The whole is more than the sum of the parts. This is my central takeaway from this research—while structures can be useful, while formality and informality can be useful, while communication and values can provide coherence, none alone, no matter how good they are, have the power of the set. The parts are not in themselves novel, but the pillars taken together give us things to think about, ideas to further explore.

Research methods and analysis

The research method rests on a literature search, including both qualitative and quantitative data, to develop a survey administered to the FFI network. The survey was composed of 4 topics: governance mechanisms, ownership competencies (individual and collective), sources of conflict, and demographics. The topics themselves are quite broad, and the researchers offer their interpretation of meaning and emphasis derived from the use of mathematically-calculated ratings. For example, a majority of respondents rated the governance mechanism “Developing a common purpose, shared values and joint vision (e.g., philanthropic engagement or other family goals)”1 as the most important (55%). For ownership competence, the highest-ranking individual skill was family dynamics (58%) (defined as “empathy and ability to interpret and de-escalate behaviors”);2 for collective competence of an ownership group, a culture of open communication and conflict management abilities ranked #1.3 (These are examples of quantitative results reported.)

Regardless of research method, researchers necessarily bring themselves to any analysis. Self orients perspective, and perspective orients interpretation of results.

Taken as a whole, the reported results suggest that the survey was used not to provide new insight per se, but instead to point to areas for the researchers to explore and to document their own thinking (supplemented by interviews with 11 advisors and board members). We might further pursue the meaning of this data; the output of this research is more interpretive, expressing a view both in survey design and in reporting that sources of conflict are ultimately drivers to understanding and to enabling professionalization. This seems like it could be true, but I am not entirely convinced. The presence of conflict-management mechanisms may set the stage for professionalization, but without the rest of the pillars it just means we have a family that has figured out how to productively disagree. That may be a good start, but it is not sufficient or is even a signal of owner competence.

It is commonly understood that family organizations can have their own trouble with conflict, for all kinds of reasons, and as a common denominator across the vast array of kinds of families with pooled assets managed at least in part collectively, it is sensible to ask about conflict. But then results skew toward conflict mitigation or, more proactively, toward building cohesion. It is unclear to me, then, what sense to make of things like business and financial acumen, which are also foundational lenses by which to competently understand the system that is a family enterprise. So, my own orientation leaves questions unanswered.

It may be that the parsing of individual and group competences could shed some light—while business and strategic acumen are highly ranked for individual competence in the survey (taken together they are #2 and #3 in ranking), family dynamics skills are most highly ranked for group competence. This makes sense on its face, as even the best thinking about the business will be sidetracked by an owner group not practiced in managing their dynamics, hence the authors’ conclusion that relationships trump both process and structure. But still, we need to see these parts together, as not doing so can yield exactly the effect that our field was created to counter: putting either business or relationships first. We’ve come a long way to knowing that these are of course equivalent features in a well-functioning enterprise.

Suggestions for advisors

Other elements of the research suggest actionable pointers for families and advisors. Distinguishing between formal and informal governance (structures and processes), pulling apart components of owner competence into self, group, environment, or context, and business knowledge, affirming that while there are now many “best practices” for governing the enterprise, most of which are structural, taking any “off the shelf” ends up not being particularly helpful. This caution can’t be shared too often and is important to consider as advisors continue to look for ways to help in a client world that can leave any of us feeling stuck in a search to unlock our clients’ potential. No singular tool, technique, or template by itself will get our job done.

On the key areas of focus for building competence on the road to professionalization, the 3 Cs—communication, cohesion, and conflict management—no doubt are critical capabilities to foster. While I would disagree with the notion that unity, if it means unanimity, is the goal of cohesion, harmony certainly is, in that harmony allows for different voices making music together. And of course, harmonizing, the process of nurturing harmony, often begins with cacophony. With work and a good conductor, we have been witness to the possibility of beautiful and singular music, in the form of families that can govern professionally for the long term.

Things to try: the circle of ideas applied and assessed for value against some goal, setting the stage for further idea development.

Overall, the research report, graphically in particular, depicts systemic thinking. While the elements are not new, the synthesis should make our work more transparent and accessible. The idea that family members should possess a set of competencies in order to be experienced as professionals, and the importance of clarity around which competencies matter at the individual and collective levels to provide for functional ownership, are great ideas that can serve to push other researchers to dig deeper in these areas, including how to build competence in rising generations.

Last, if we take only one thing away from the researchers’ report, it is that there are no short cuts in developing competent owners. Thinking about the whole of competent ownership and sharing the most accessible elements of the report with families can advance the results of their and our work.

References

1Binz Astrachan, C., Waldkirch, M., Michiels, A., Pieper, T., & Bernhard, F. (2020). Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership. FFI Research Report. Available at: https://digital.ffi.org/pdf/ffi_professionalizing_the_business_family_v6.pdf, p.50

2Ibid., 51

3Ibid.

About the Contributors

Nancy Drozdow, FFI Fellow, is a Founder and Principal at CFAR’s five founders and a member of the firm’s Board of Directors. Nancy leads CFAR’s Family and Owner-led Business practice and has been instrumental in crafting CFAR’s approach to strategy. Nancy is a founding member of FFI, a former member of the FFI board of directors, and a current member of the FFI 2086 Society. She received the 2012 Richard Beckhard Practice Award, which annually honors a founding member and distinguished practitioner in the family enterprise field. Her ideas have been published in Sloan Management Review, Business Week, CEO Magazine, Family Business Magazine, the Journal of Management Consulting, Family Business Review, the New York Times and other publications. Nancy can be reached at ndrozdow@cfar.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.