View this edition in our enhanced digital edition format with supporting visual insight and information.

The number of family offices established in Singapore has increased considerably over the past several years. In this week’s FFI Practitioner, Maya Prabhu and Karen Tan explore several factors that have made Singapore an appealing location for family offices and identify topics for advisors to consider as they work with their clients to establish family offices.

Singapore has seen a marked increase in the number of families establishing their family offices in the country.

This growth has largely been driven by the increasing number of Asian families preparing for intergenerational wealth transfer, together with significant wealth growth in Asia and their need to professionalize the management of their private wealth.

At the same time, established family offices from the US and Europe—including those of UK billionaire James Dyson, Google’s Co-Founder Sergey Brin, and Hedge Fund Founder Ray Dalio—have also set up their Asian satellite or alternative bases in Singapore, seeking stronger and deeper access across investment opportunities in Asia. In this article, we delve into what makes Singapore appealing to these families. We also highlight three focus areas for advisors and their clients to consider as each family steers its journey with a newly-established family office to serve the family’s specific needs.

Singapore’s Appeal

Stable economic and political environment and strong rule of law

Singapore enjoys a reputation for its economic and political stability. The country is underpinned by a strong rule of law (based on the common law legal system) and the Westminster system of parliamentary democracy. These attributes make it a safe harbor for families who are not only seeking shelter from geopolitical and global economic turbulence, but also want to access attractive investment opportunities in Asia Pacific.

Comprehensive financial center offerings to access global investment opportunities

Singapore’s developed capital markets, coupled with the breadth and depth of its institutions, offer investors ready access to global and regional financial markets, while supporting them with a full suite of wealth management services. As such, Singapore-based investors can easily access early-stage investment opportunities in Asia Pacific—the world’s fastest-growing region.

Professionals with strong expertise

Singapore provides infrastructure and access to a pool of highly skilled finance professionals and experienced professional advisors that can service families’ multi-faceted needs. Its workforce is also culturally diverse; while English is the main language used in business, government, law and education, Singapore’s workforce is made up of professionals with multiple language proficiencies.

Concurrently, the government ensures that the workforce is also constantly improving its capabilities in addressing the needs of family offices. In August 2020, the regulator, Monetary Authority of Singapore (MAS), supported the launch of the Family Office Advisor Skills Map program, aimed at deepening the skill sets of professionals serving and advising families and focusing on core competencies that professionals advising family offices should possess, including wealth-planning administration and governance.

Continued enhancements in Singapore

Singapore’s willingness to evolve in the face of disruption and change are reflective of the government’s pro-business stance. One such example was the formation of the Family Office Development Team, jointly helmed by the Economic Development Board (EDB) and the MAS to align various development initiatives targeted at families, family businesses, and family offices.

Setting up a family office in Singapore

The process and mechanics of establishing a family office in Singapore are fairly straightforward.

Case-by-case exemptions from the MAS for single family offices (SFOs) will be granted to facilitate their investment management activities in the fund when they fall within the defined scope of “family” under current regulations.1

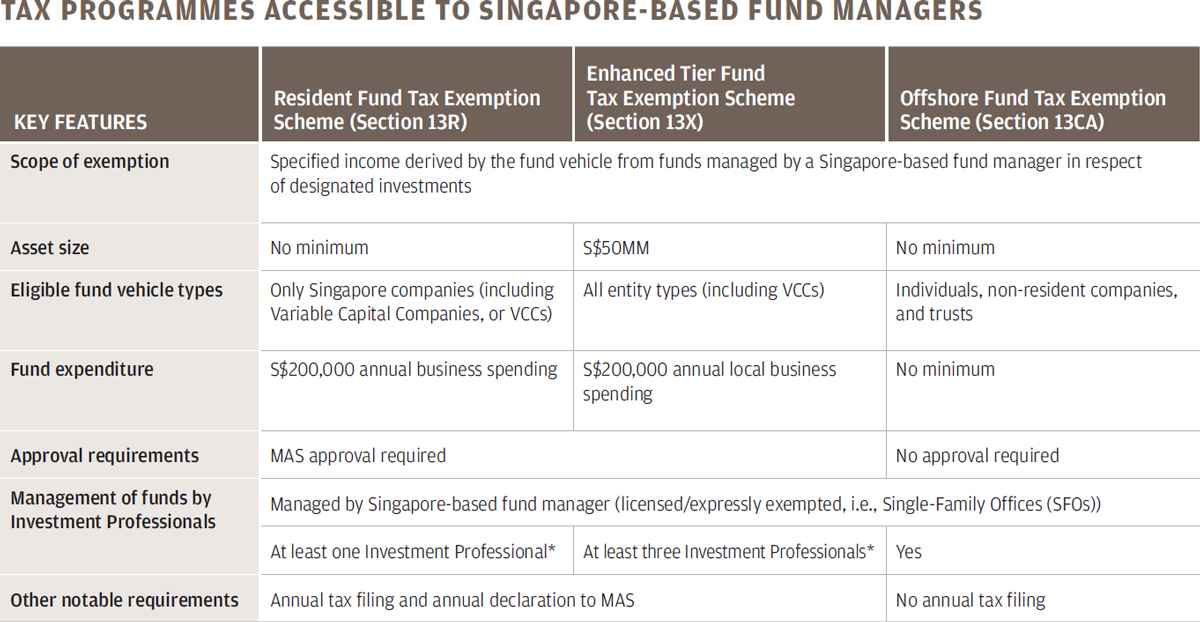

Furthermore, the family can enjoy clarity and certainty of tax treatment on specified income, derived from the fund’s designated investments, through tax programs commonly referred to as Section 13X, or 13R tax exemptions. In order to qualify for these programs, these funds have to be managed by exempted SFOs or licensed managers. The table below details an overview of program requirements, depending on the family’s choice of legal entity:

*SFOs in Singapore may employ suitable family members as investment Professionals.

J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any financial transactions.

With structural and macro factors in Singapore’s favor, aided by its government’s efforts to streamline and ease the processes to set up base in the country, Singapore has become increasingly popular as a choice for families to establish their family offices.

How a family office can add value

One of the key roles for a family office, particularly SFOs, is to manage and invest the family’s assets or financial capital. However, other equally important aspects of the family office’s function may often be overlooked.

It is critical to recognize that a family office is first and foremost a structure that primarily serves the goals and needs of the particular family. The family office’s ethos and values must truly reflect that of the family and ensure that they evolve over time to meet changing needs and circumstances.

Below, we outline three important considerations for advisors and their clients that we distilled from our observations and experience in working with families and their family offices:

1. Articulate your “North Star”

Just as Polaris serves as a fixed celestial presence in the northern hemisphere, families should always try to seek out their “North Star.”

Simply put, the question to ask is this: “Where are we heading as a family?”

We suggest that the following questions be raised and discussed from the family’s perspective:

- What is our vision and goals for our wealth and our family?

- Why do we want a family office and what will be the family’s relationship with the family office?

- What services do we need it to fulfill, and will we deliver them in-house or outsource them?

- Who in the family will the family office serve—both now and in the future—and who will be involved in decision-making?

- Who else in the family does the family office need to share information with, and how will it do so?

- How long do we want the family office to be operational?

- What are the internal and external risks faced by the family and the family office?

- What conflict-resolution strategies (including an exit strategy) are in place?

- Which aspect of governance should the family address (i.e., business vertical governance, family office governance, and/or family governance)?

2. Invest in people: Does your family office team have the IQ AND the EQ?

In order for the family to succeed in the long term, the family office needs to support the learning and development of the wider family, including the next generation, and needs to share information appropriately. The family office team should be well-equipped with a good blend of skills—the intellectual know-how and the emotional sensitivity, or the IQ and the EQ—in anticipating the family’s evolving needs.

The team also should appreciate the family’s governance framework and its role in helping the family to develop and refine their own governance strategy over time.

3. Are family offices leveraging available resources and investing to reduce the administrative load?

Family-office representatives should develop a thorough understanding of their service providers’ capabilities and leverage them thoughtfully to complement their work without needing to hire additional staff. One way is to tap into the array of services that banks and other service providers offer; these can include learning opportunities for the next generation, philanthropy advice, access to a wider network to source investment opportunities, and useful takeaways on cybersecurity.

Family offices should also consider the benefits that digital solutions offer, especially if the family office is established to serve across generations. It is certainly worth investigating and investing in such capabilities, as it can help streamline data management and save time and costs. At the same time, it is becoming increasingly crucial to have robust cybersecurity measures and frameworks to prevent family offices and their principals from being targets and victims of cybercrime, identity theft, and fraud risks.

Conclusion

In recent years, Singapore has been seen as offering a conducive environment—the “hardware” if you like—for establishing family offices. Given that the family office plays a central role in addressing the needs and objectives of the families they serve, enhancing this collaboration with “softer” aspects thoughtfully embedded in the hardware will, no doubt, serve families well in their journeys ahead across generations.

References

1 The term ‘family’ in this context may refer to individuals who are lineal descendants from a single ancestor, as well as the spouses, ex-spouses, adopted children and stepchildren of these individuals. https://www.mas.gov.sg/development/wealth-management

About the Contributors

Maya Prabhu, FFI Fellow, is Managing Director and Head of Wealth Advisory for J.P. Morgan Private Bank. Maya is a member of the FFI board of directors and the 2086 Society. Maya teaches GEN 504: Philanthropy, Investing, and the Enterprise: Advising families in pursuit of impact. She can be reached at maya.am.prabhu@jpmorgan.com.

Karen Tan is the Head of Southeast Asia Wealth Advisory for J.P. Morgan Private Bank. She can be reached at karen.tan@jpmorgan.com.

View this edition in our enhanced digital edition format with supporting visual insight and information.