Models & Structures

Examples of typical family governance structures, e.g., family constitutions, as well as emerging models.

Integrating Structural Family Therapy into Family Enterprise Advising

Family enterprise advisors are often trained through the lens of Bowen Family Systems Theory, which remains one of the most influential frameworks in the field.

The 360 Legacy Wheel Balances What Needs to be Preserved and What Needs to be Shared: A Model for Philanthropic Advising

Thank you to Dennis Oteng, member of the 2025 Conference Program Committee, for this article about the 360 Legacy Wheel, a model that can help client families consider which resources to share outside of the family and which to protect within the family.

Crafting a Sustainable Legacy Plan Using the Enneagram

In this week’s FFI Practitioner, FFI Asian Circle Virtual Study Group member Aik-Ping Ng discusses how family enterprise advisors can use the Enneagram, a personality assessment tool, to help guide their clients through conflict and improve communication.

Balancing Representation with Qualification on Family Business Boards

In this week’s FFI Practitioner, contributors Omar Romman and Ben Francois explore the topic of how to balance family member and independent director participation on the board.

The ZOPA Model: An approach for navigating emotional negotiations in family enterprises

Thank you to this week’s contributor, Doug Gray, for providing an overview of a model that can help your family enterprise clients negotiate emotional topics.

Iceberg Analysis of Family Systems

In this week’s FFI Practitioner, FFI Fellow and 2022 FFI International Award recipient Rodolfo Paiz, introduces the “Iceberg Analysis,” a framework that practitioners can use with their family enterprise clients to analyze the entire family enterprise system.

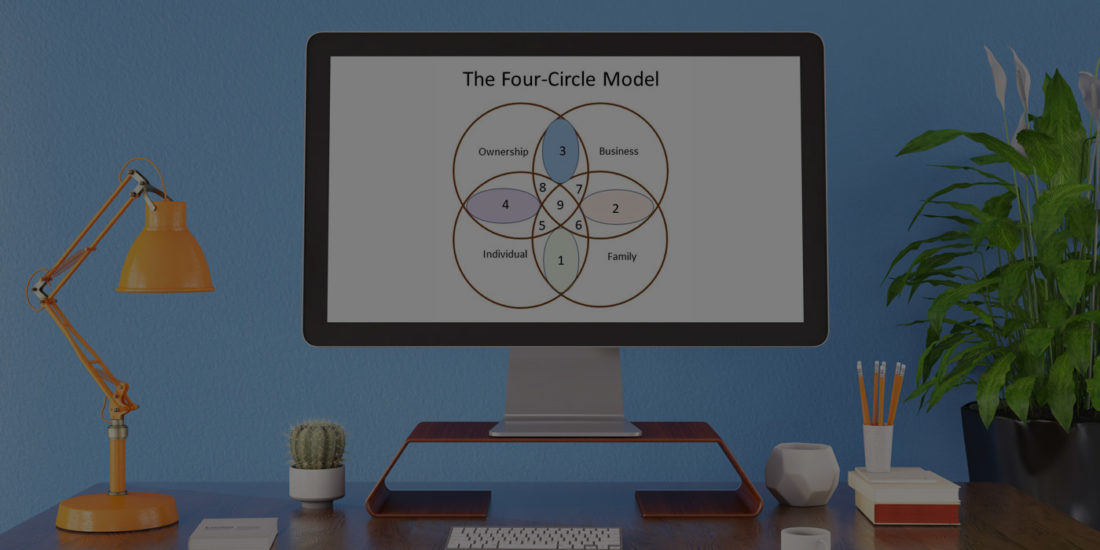

The Four-Circle Model

Thanks to this week’s contributor and FFI Fellow, Dean Fowler, for providing an overview of his Four-Circle Model.

The B Corp: A global values framework for the family enterprise

Thanks to Brett Coffman for this week’s edition discussing “B Corps” and how related assessments may provide your family enterprise clients a framework to codify family values around a set of corporate principles that relate to discussions of social responsibility.

Change, DNA, and Family Legacy

Thank you to this week’s contributors, Doug Gray and Natalie McVeigh, for their article that challenges practitioners’ reliance on bi-directional models that force “either-or” approaches to the complex issues confronting family enterprises.

The Two Pillars of Governance in Family Enterprises: A straightforward understanding of complex systems

This week’s edition kicks off a series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

A Few Thoughts on Family Constitutions: An Indian perspective

This week, FFI Practitioner is pleased to share an article by Ashvini Chopra in which he discusses family constitutions from an Indian perspective.

Launching the Parallel Planning Process: Aligning family and business systems

Thank you to this week’s contributors, Randel Carlock and Keng-Fun Loh, for this examination of the enhanced Parallel Planning Process (PPP), a tool that can help advisors to professionalize the family and business planning process.

An Interview with Dr. Salvatore Tomaselli: The Family-in-Business Model Canvas

This week, FFI Practitioner is pleased to share an interview with Dr. Salvatore Tomaselli, where he explains the development of his Family-in-Business Model Canvas, an adaptation of the Business Model Canvas, that Dr. Tomaselli has applied to his work with family enterprises.

The Exercise of Power in the Family Business

This week’s FFI Practitioner continues a series of articles written by members of the FFI IberoAmerican Virtual Study Group that are available in both English and Spanish. Thanks to Miguel Angel Gallo and Begoña Pereira-Otero for their examination of what constitutes an appropriate exercise of power by family business owners. We hope you enjoy this article in either (or both) languages!

The Future of the Three-Circle Model: A conversation between Pramodita Sharma and John Davis

This week’s FFI Practitioner concludes our two-part series commemorating the 40th anniversary of the influential Three-Circle Model. Thank you to FFI Fellows Pramodita Sharma and John Davis for sharing their insightful conversation about future the future of the model, research, and the field.

Celebrating the 40th Anniversary of the Three-Circle Model: An interview with John Davis

To celebrate the 40th anniversary of the legendary Three-Circle Model, FFI Practitioner is excited to share two editions about the model during the month of June. For the first edition, we’d like to thank Pramodita Sharma for her interview about the inception and impact of the model on the field with one of its two creators, John Davis.

Lessons on Governance: Pruning the Tree or Inclusion

For family businesses, there is no one-size-fits-all approach to governance and advisers need to understand each family’s unique values and ownership philosophies before attempting to implement specific governance structures. Thanks to Marta Widz and Benoît Leleux from IMD for illustrating this point by sharing two cases where the family businesses have divergent ownership philosophies but have both excelled in their governance practices.

Multi-Roles Model: Theory and Practice

What better way to start a new year than to look at some classic models in the family enterprise field and offer forward facing ideas. Thanks to FFI Fellow Paul Karofsky of Transition Consulting Group for refining some of his early work on a multi-roles model and providing examples from his client base for consideration by the readers of FFI Practitioner.

Is It Better to Govern Managers via Agency or Stewardship? Examining Asymmetries by Family Versus Nonfamily Affiliation

The core question of the article is clear: Is agency or stewardship governance more effective for aligning the interests of (family or nonfamily) managers with those of family owners?

Family Firms and Compliance: Reconciling the Conflicting Predictions Within the Socioemotional Wealth Perspective

Corporate scandals and financial meltdowns have led to corporate governance reforms all around the world. In addition to the rules and laws that firms have to legally comply with, several self-regulatory codes or ‘soft-laws’ have been enacted in many countries.