Change, DNA, and Family Legacy

Thank you to this week’s contributors, Doug Gray and Natalie McVeigh, for their article that challenges practitioners’ reliance on bi-directional models that force “either-or” approaches to the complex issues confronting family enterprises.

The Value of Family Business Peer Groups during a Global Crisis

Thank you to this week’s contributors, Kurstyn Loeffler and Jenell Wittmer, for their article on the potential benefits of family business leader peer groups, especially during times of crisis.

Research Applied: FBR Précis for FFI Practitioner

Thank you to this week’s contributor, Navneet Bhatnagar of the FBR Research Applied Board, for sharing his précis of “Community Socioemotional Wealth: Preservation, Succession, and Farming in Lancaster County, Pennsylvania” – an article that appears in the September 2020 issue of FBR.

Understanding the Complexities of Mental Incapacity When Advising Family Business Owners

Thank you to this week’s contributors, Patricia Annino and Jim Grubman, for concluding our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

The Reality of Relevancy in the Family Office System: Exploring forces and key drivers that can affect relevancy

Thank you to this week’s contributor, Jim Coutré, for continuing our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

The Value of Learning About Families as Emotional Systems

This week, FFI Practitioner is pleased to continue our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

How to Preserve Wealth? The Answer is Infrastructure

Thank you to this week’s contributor, Natasha Pearl, for continuing our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28. In her article, Natasha outlines the importance of developing an effective infrastructure as an important element in wealth preservation for family enterprises.

From Safety, Through Sustainability to Stewardship: The Triple-S journey of Jebsen & Jessen Family Enterprise

Thanks to Marta Widz and Sameh Abadir from IMD for this article based on the Jebsen & Jessen Family Enterprise story, which illustrates how responsible leadership and early awareness can coalesce to pioneer safety, environmental sustainability, and stewardship strategies and thus lead to impactful social innovation.

How Corporate Governance Helps in Decision Making: A case study

This week, we are pleased to share a case study that demonstrates how effective corporate and family governance can help clarify decision-making protocols in family enterprises. Thanks to Roberto Vainrub for sharing this case with practical implications for advisors.

Preparing for a Trust Beneficiary’s Addiction Issues

n this week’s issue, contributor Matthew Erskine discusses estate planning measures that can be taken to prepare for the eventuality of a beneficiary’s substance abuse issues.

Commentary #6 on Professionalizing the Business Family: A research report sponsored by the FFI 2086 Society

This week, we conclude our series of commentaries about the report sponsored by the FFI 2086 Society titled, “Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership.”

Education and the Rules for Engagement: A case study on ways to encourage young entrepreneurs

Thanks to Ricardo Mejia for this case study discussing how education and clear rules of engagement may still be the best strategy for developing young entrepreneurs in family enterprises.

What is WYSIATI in Our Profession? Some observations and a suggestion

Thanks to Doug Gray for his article on VIA Classification assessment tools, which can help family enterprise practitioners think differently about their clients’ family system.

Commentary #5 on Professionalizing the Business Family: A research report sponsored by the FFI 2086 Society

This week, we are pleased to continue the series of commentaries on the 2086 Society sponsored research “Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership.”

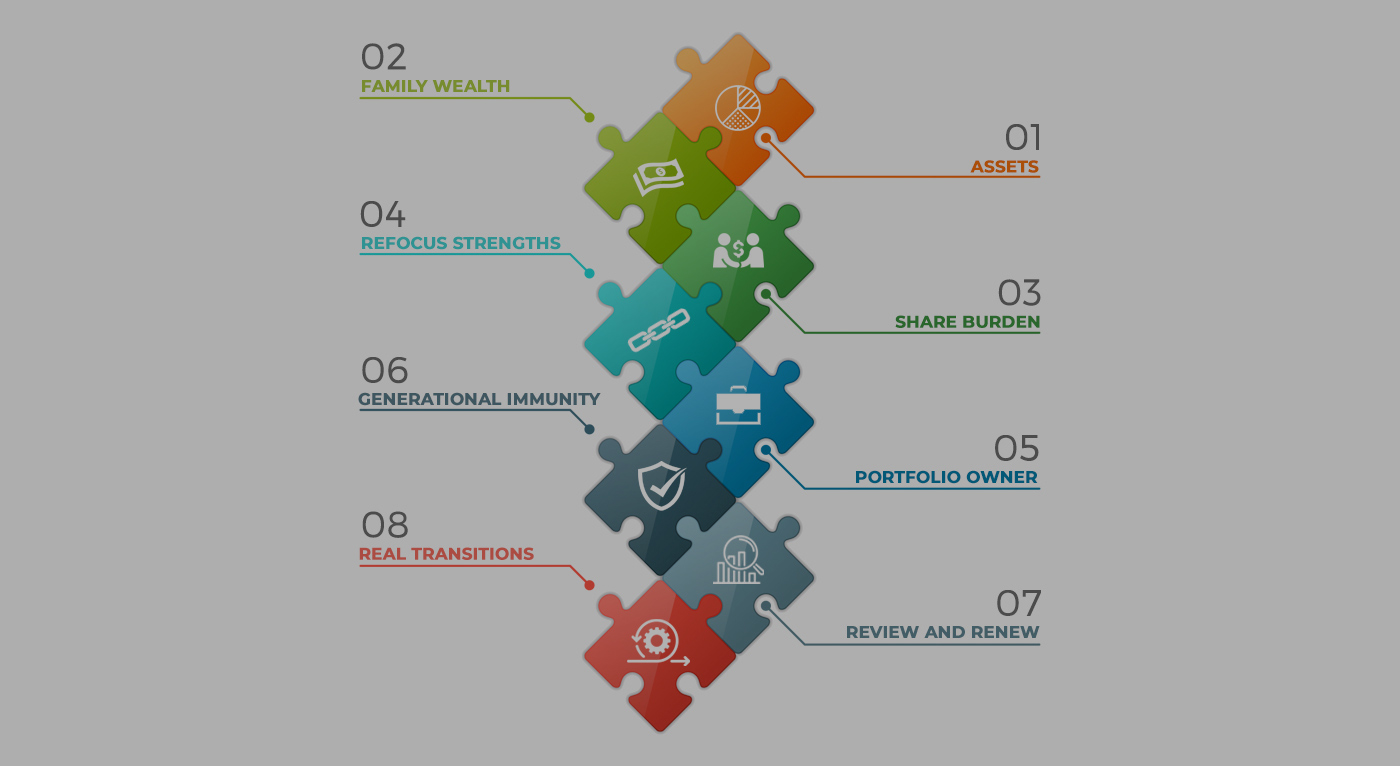

Disruption-in-Disruptions: Eight actions advisors should bring to their client families

During times of disruption, how can family enterprise advisors help their clients navigate unchartered waters to survive turbulence and prepare for an unpredictable future?

The Benefits of Coaching for Family Enterprise Leaders and Practitioners

Thanks to Greg McCann for this week’s article discussing some widely held notions about professional coaching and how family enterprise leaders and advisors can maximize their leadership development through effective coaching.

The Impact of a Global Crisis on Family Business Transitions: Some scenarios

Thanks to this week’s contributor, Ken McCracken, for his article exploring the impact of the Covid-19 pandemic on family business succession planning.

Commentary #4 on Professionalizing the Business Family: A research report sponsored by the FFI 2086 Society

This week, we are pleased to continue our series of commentaries on “Professionalizing the Business Family: The Five Pillars of Competent, Committed and Sustainable Ownership” – a research report supported by the FFI 2086 Society.

Family Businesses in the Times of Crisis and Global Recession: A story of resilience and sustainability

This week, we are pleased to share a family business case illustrating how Firmenich, the world’s largest privately-owned perfume and taste company, has utilized their concentrated family ownership and governance model to navigate worldwide crises.

Conducting Effective Virtual Meetings: An interview with Greg Owen-Boger

In the midst of the Covid-19 pandemic, family enterprise advisors have been forced to evolve their practices to adapt to working remotely with their clients.