FFI Practitioner: Featuring the most popular editions from our frequent contributors

For this week’s edition of FFI Practitioner, we’re diving into our archive to feature popular editions from frequent contributors over the past few years.

What to Do When a Client Inherits Artwork

Many enterprising families create unique collections of artwork, which ultimately may be passed from one generation to the next.

Year-End Tax Planning Considerations for Families with Property Interests in the US

As the end of the year is quickly approaching, this week’s contributor, Matthew Erskine, provides a checklist of tax planning items for family enterprise clients to consider.

Using AI to Draft Estate Plans: Some caveats for family enterprises and their advisors

With the growing popularity and continued evolution of AI platforms, such as ChatGPT, increased questions have been raised about their ability to complete more complex functions.

Planning for the Sudden Death of a Family Business Leader

In this week’s edition of FFI Practitioner, FFI Fellow Patricia Annino explores the impact that the sudden death of a family business leader can have on the entire enterprise.

Estate Planning for Digital Wealth

In this week’s edition of FFI Practitioner, Matthew Erskine discusses the unique qualities and risks of crypto-asset wealth and provides an introduction to the special considerations to be addressed in the transfer of digital assets.

Can NFTs Save a NASCAR ARCA Career?

Recently, NFTs have become a popular topic for enterprising families considering whether to invest in the digital collectibles as a way to diversify their assets.

Flexibility is Key to Succession Planning for LGBTQ, Blended Families, Cohabitation, and other Nontraditional Families

Thanks to this week’s contributor, Matthew Erskine, for his article that explores the importance of building flexibility into the estate planning process for advisors working with nontraditional families.

Five Sisters and Two Executors: A case study

Thanks to Vijay Sathe, Alfredo Enrione, Donna Finley for this week’s edition, which is a case study about how five sisters, who suddenly and unexpectedly inherited their father’s businesses, and how they dealt with the influence of two executors to reach harmonious ownership of the family enterprise.

Family Offices and Artwork: Mitigating the Risks

Thanks to Matthew Erskine for this week’s issue discussing the most important steps that family offices and their clients can take to mitigate risk to clients’ collections of art and other collectibles.

Ownership Strategy: The foundation of every family business

Thank you to FFI Fellow Ed van de Vijver for this week’s article on the importance of developing a family enterprise ownership strategy that is aligned with the family financiers’ objectives.

Understanding the Complexities of Mental Incapacity When Advising Family Business Owners

Thank you to this week’s contributors, Patricia Annino and Jim Grubman, for concluding our series of articles by presenters at the virtual 2020 FFI Global Conference, October 26-28.

Preparing for a Trust Beneficiary’s Addiction Issues

n this week’s issue, contributor Matthew Erskine discusses estate planning measures that can be taken to prepare for the eventuality of a beneficiary’s substance abuse issues.

Family Businesses in Germany – total lack of trust(s)?

For advisors working with family business clients operating across multiple countries, it is important to keep informed about jurisdictional differences and how they could impact your clients.

Family Business Sanity Check

In today’s world, family business owners have a lot to worry about – from rising taxes to developing future leadership.

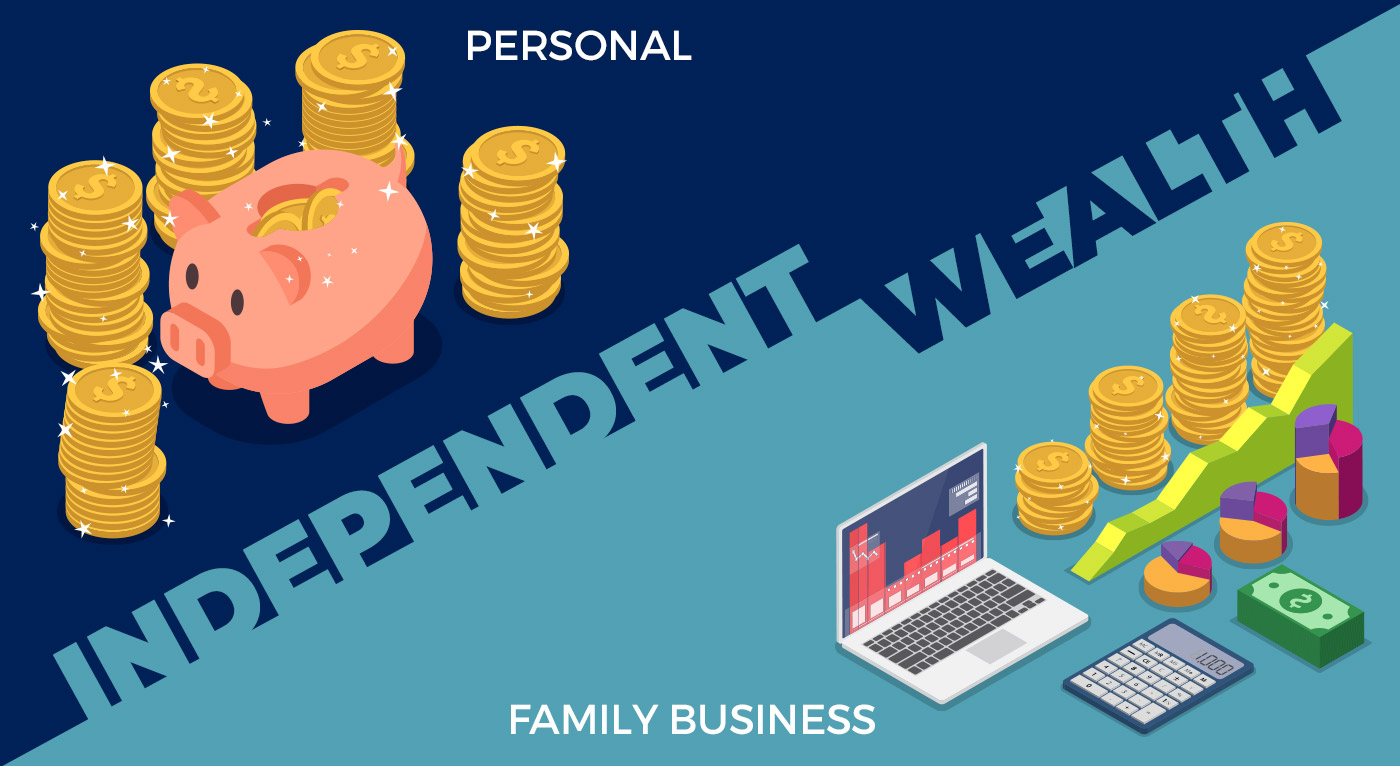

Financial Independence – A Critical Factor in Ownership and Management Succession

Thank you to this week’s contributor, Randy Waesche, for this thought-provoking examination of the influence that money and financial independence can have in the succession process.

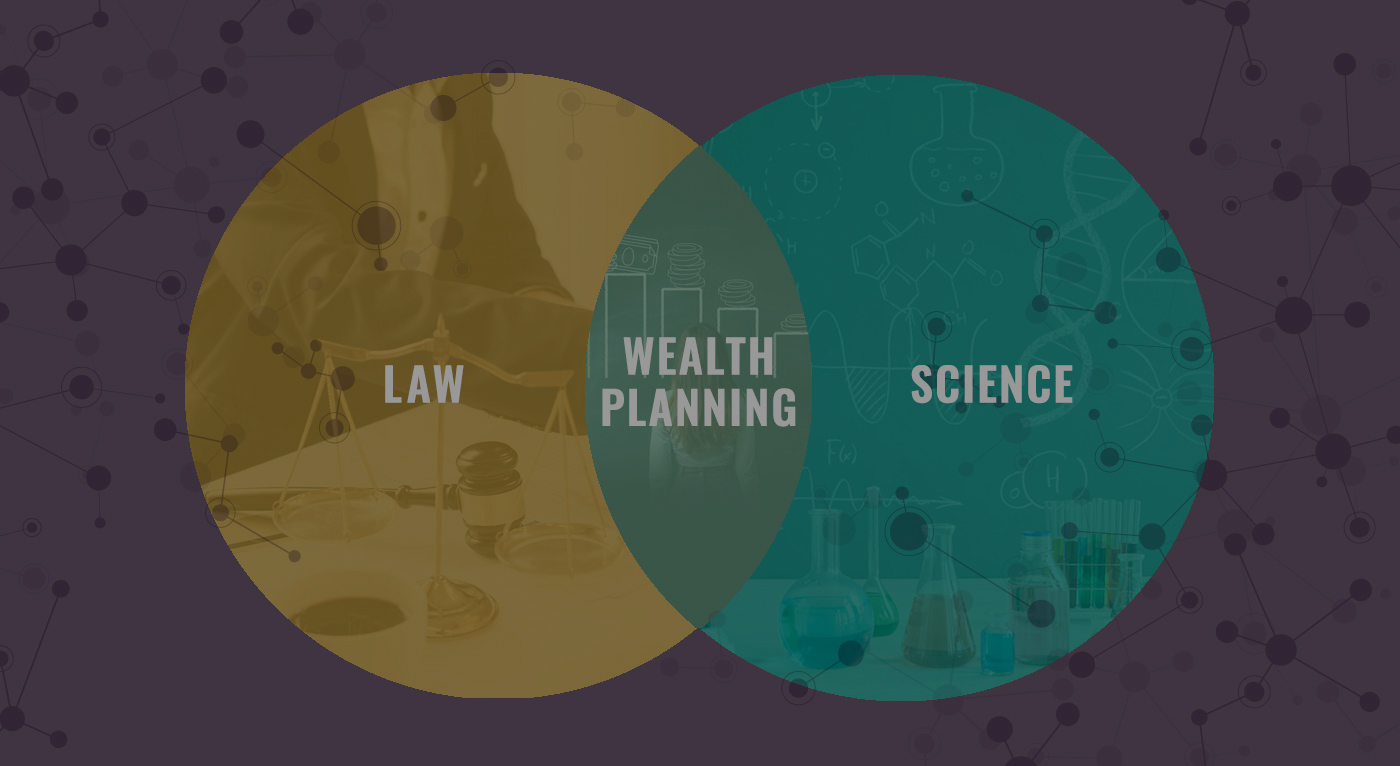

When Science and Law Intersect: Preparing for a new age of wealth transition planning

This week’s FFI Practitioner examines how advances in science can impact multidisciplinary approaches to family business consulting.

The Utility of Buy-Sell Agreements for Family Enterprises

This week’s FFI Practitioner focuses on buy-sell agreements and their role in protecting family enterprise from potential future ownership issues. Thanks to Dan Frosh, this week’s author, for providing an examination of the numerous benefits and features of effective buy-sell agreements within the family enterprise context.

Cases for Clients

Family business cases can serve as powerful tools to integrate into consulting and educational work with clients. Cases provide an engaging way for family enterprise members to recognize issues similar to the ones they face, helping evaluate potential, less emotionally-charged solutions. To further this publication’s mission to provide readers with practical materials that support their work with multi-generational family enterprises, we are pleased to feature a selection of family business cases previously published in FFI Practitioner.

Celebrate Halloween with these Scary Articles from the Archives

In many parts of the world, October 31 is Halloween, so we couldn’t resist featuring some topics that might seem scary to approach with your clients. In the spirit of Halloween, here are some spooky editions.